Pre-Open Market Analysis

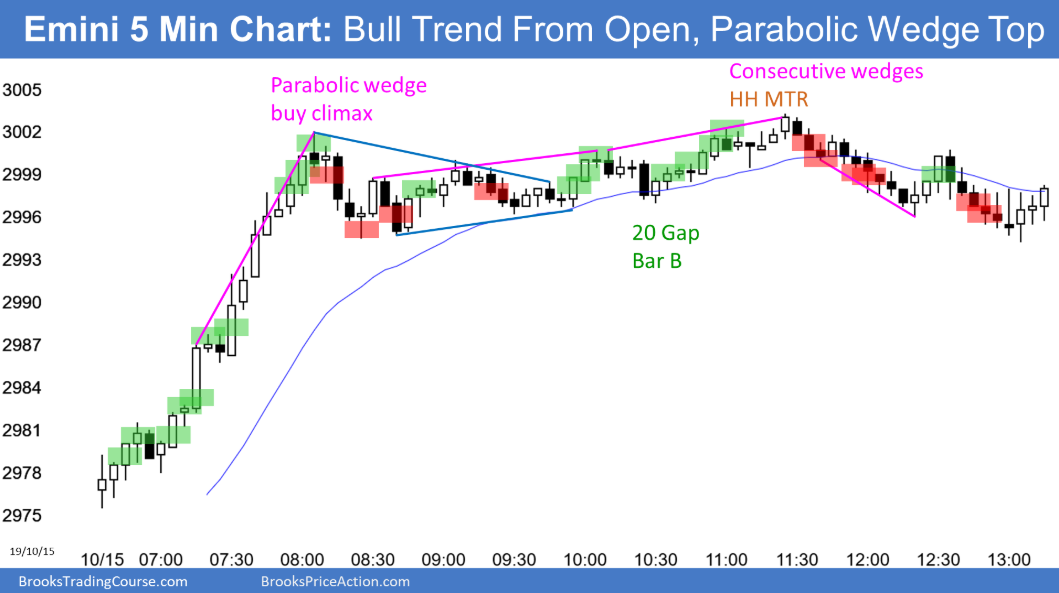

The Emini S&P 500 began yesterday with a bull trend from the open. This then evolved into a trading range after testing above 3,000, last week’s high, and the open of the month.

By going above last week’s high, the Emini triggered a weekly buy signal. However, there were 3 bear bars and then a tail on top of last week’s bar. This is a weak buy setup. Since the Emini is at the top of a 4-month range, the context is not strong either. Therefore, the upside will probably be limited over the next week.

Nothing has changed from what I have been saying since June. The odds still favor a new high, but it might not come in October. Currently, the Emini is stuck in a trading range and the bulls on the daily chart need several bull bars before traders will conclude that the bull trend is resuming.

Overnight Emini Globex trading

The Emini is down 6 points on the Globex chart. By going above last week’s high, the Emini triggered a buy signal on the weekly chart.Since the signal was weak, traders expect a pullback below last week’s high. If the Emini opens where it is currently trading, it will open very close to last week’s high. It might oscillate here today as traders decide whether the weekly buy signal will succeed or fail.Yesterday was the 1st strong trend day in 7 days. Yet, the Emini spent most of yesterday in a trading range. Today will likely open within yesterday’s range. If so, day traders will expect at least some continuation of that range.The 60 minute chart has not touched its 20 bar EMA in more than 20 bars and its 3-day rally is not particularly strong. That is somewhat unusual and it makes a touch likely today or tomorrow. That will probably limit the upside today.Yesterday’s early rally was strong enough to make a big bear day unlikely today. That leaves trading range price action. Day traders will expect at least one swing up and one swing down today, like the Emini has been creating for the 6 days prior to yesterday.Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.