Trump Rally Continuing Into January 19 Government Shutdown Vote

I will update around 6:55 a.m.

Pre-Open Market Analysis

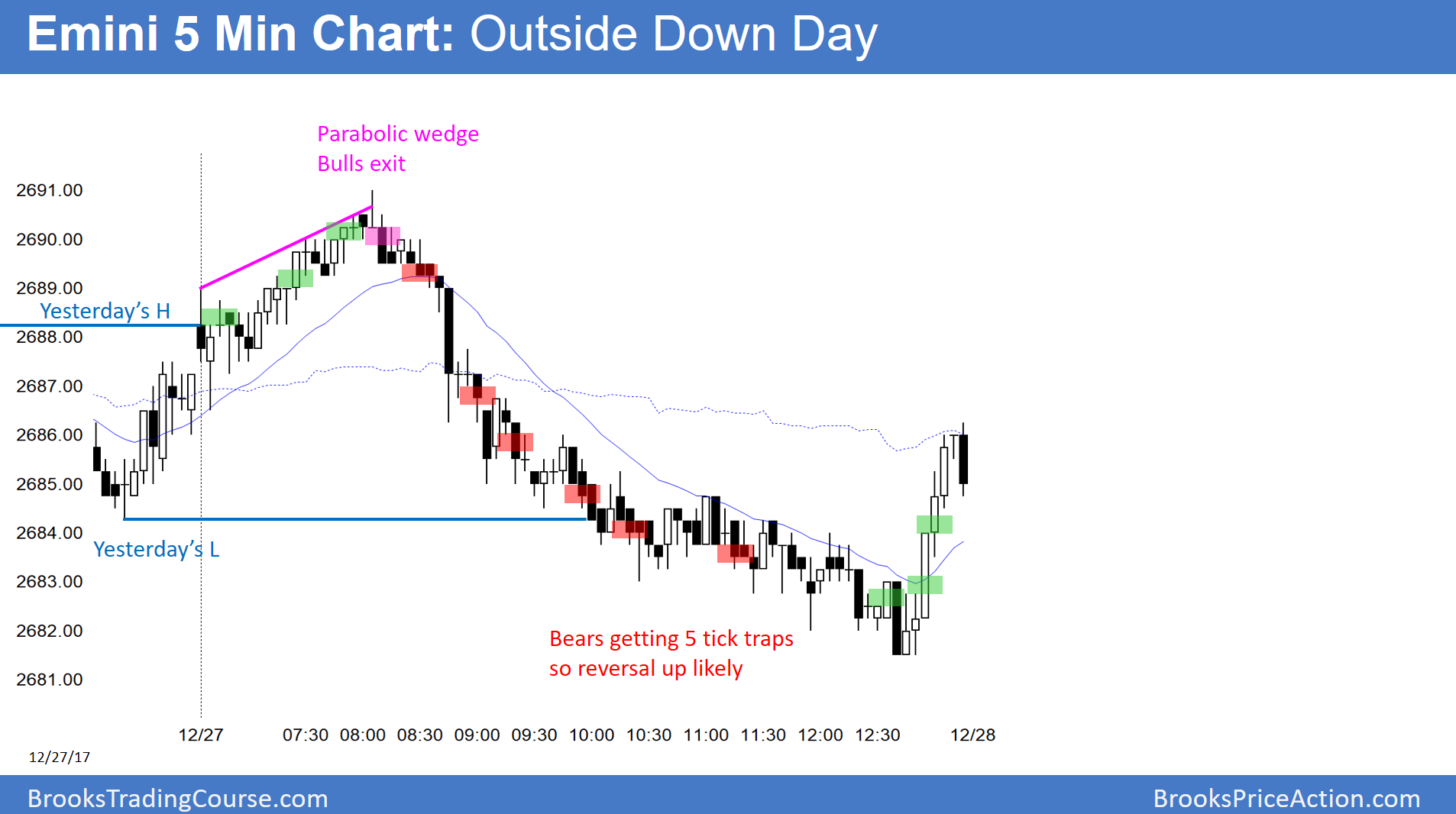

The Emini formed an outside down day yesterday on the daily chart. Yet, it was the 7th day in a tight trading range, and it tested the bottom of that range. In addition, it did not have a huge bear body closing on its low. Therefore, it does not significantly increase the odds of a reversal down. Instead, it was just another day in the tight range. The strong rally into the close increases the odds of a rally today and into tomorrow, which is the final trading day of the year.

Overnight Emini Globex Trading

The Emini is up about 3 points in the Globex market. Since yesterday’s late reversal up was strong, the bulls will try for follow-through buying today. In addition, the Emini has been at the bottom of a bull flag on the daily chart for 8 days. Yesterday’s reversal therefore might be the start of another leg up on the daily chart. Consequently, there is an increased chance of a bull trend day today.

Furthermore, since there has been no yearend profit taking, the bulls will try to have the year close at a new all-time high tomorrow. This also increases the chance of a bull trend day today and tomorrow.

There is always a bear argument. However, the Emini is at the bottom of an 8 day trading range in a bull trend on the daily chart. Unless the bears break strongly below yesterday’s low, the best they will probably get today is a bear leg in a trading range today. Since most trading range breakout attempts fail, the odds are against a bear trend day today.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.