E-mini pre-open market analysisYesterday’s E-mini setups

E-mini rallied yesterday, as I said was likely. The E-mini turned up from a double bottom with the Sept. 20 low and from the bottom of a 2-month tight trading range. It is also reversing up from the 100-day MA and a micro double bottom with Friday’s low.

The bears want either a micro double top with Friday’s high or a double top with the Sept. 23 lower high, which is just above the resistance of the 50-day MA and the big gap above the Sept. 28 high. I have been saying that the big rally in August and the big selloff in September created big confusion. Confusion typically leads to a trading range. So far, the E-mini has been in a tight trading range for 4 days.

Traders are deciding if the E-mini will reverse up from the bottom of the 3-month range or continue down to below 4,000. If there is a strong break above the Sept. 23 high, the E-mini will probably make a new all-time high. However, since the E-mini has been in a trading range since July, it would probably not get much above the September high before reversing down again.

There is a 50% chance that a 15% correction is underway. If the E-mini breaks strongly below Monday’s low, which is the neckline of the micro double bottom, the odds of a test of 4,000 will be more than 50%.

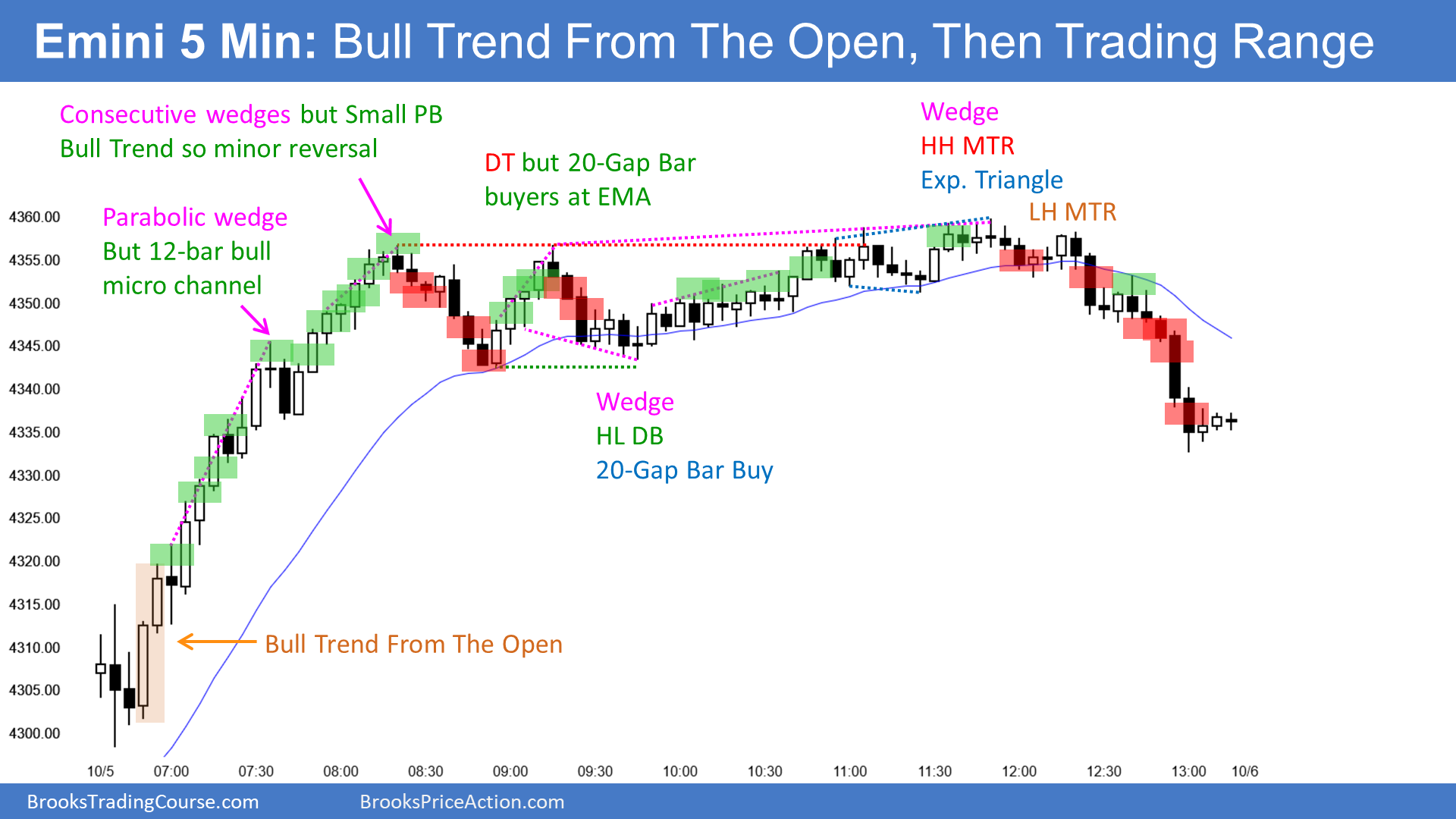

E-mini 5-minute chart and what to expect today

E-mini was down 35 points in the overnight Globex session. It will therefore open near the bottom of its 4-day tight trading range. The bears see today’s gap down from yesterday’s close as a reversal down from a double top with Monday’s high. That would be a micro double top on the daily chart. The bulls hope that the gap down will simply be another test of the bottom of the 4-day range. A reversal up would form a 3-day triangle.

The 4-day trading range is 100 points tall. Traders expect a 100-point measured move up or down. Trading ranges resist breaking out. Therefore, it is more likely that today will form the 5th sideways day in the tight trading range.

If the E-mini is early in a bear trend on the daily chart (as I said, there is currently a 50% chance), then there is an increased risk of big bear surprises. That means a big bear day breaking far below support.