Pre-Open Market Analysis

While yesterday gapped up, it was still below Friday’s high. Therefore the bears can create a lower high. Furthermore, it was the 7th consecutive doji day on the daily chart. The Emini is therefore neutral going into today’s FOMC meeting. Traders do not care if the Fed raises interest rates. All they care about is whether there will be a trend up or down after the announcement.

Prior to a couple of years ago, the FOMC announcement usually led to strong trends. Recently, they have led to trading ranges. However, the trading ranges usually had at least a brief breakout by the end of the day. A trading range is more likely tomorrow because of 7 consecutive dojis on the daily chart. But, traders will trade what is there, not what is most likely.

Overnight Emini

The Emini is up 3 points in the Globex market. If it opens here, it will be within a point of last week’s 2343.50 all-time high. While the momentum up on all higher time frames is strong enough to make higher prices likely, the extreme buy climax on the weekly chart makes a 100 point correction likely at any time. The bears want a reversal down from around the all-time high. Yet, until there is a reversal, the odds favor higher prices.

Because today is an FOMC announcement day, the Emini will probably enter a tight trading range for an hour or two before the 11 a.m. announcement. Traders should stop trading before the report.

Since the breakout on the announcement has a 50% chance of reversing within 2 bars, traders should wait to trade for at least 10 minutes after the report. If there is a strong breakout up or down, traders should look to swing trade. However, over the past two years, the Emini has been mostly sideways with many sharp reversals after FOMC announcements. Traders need to be careful to trade what is on the chart in front of them and not what they hope the chart will become. If there is not a clear strong trend, most traders should wait.

Yesterday’s Setups

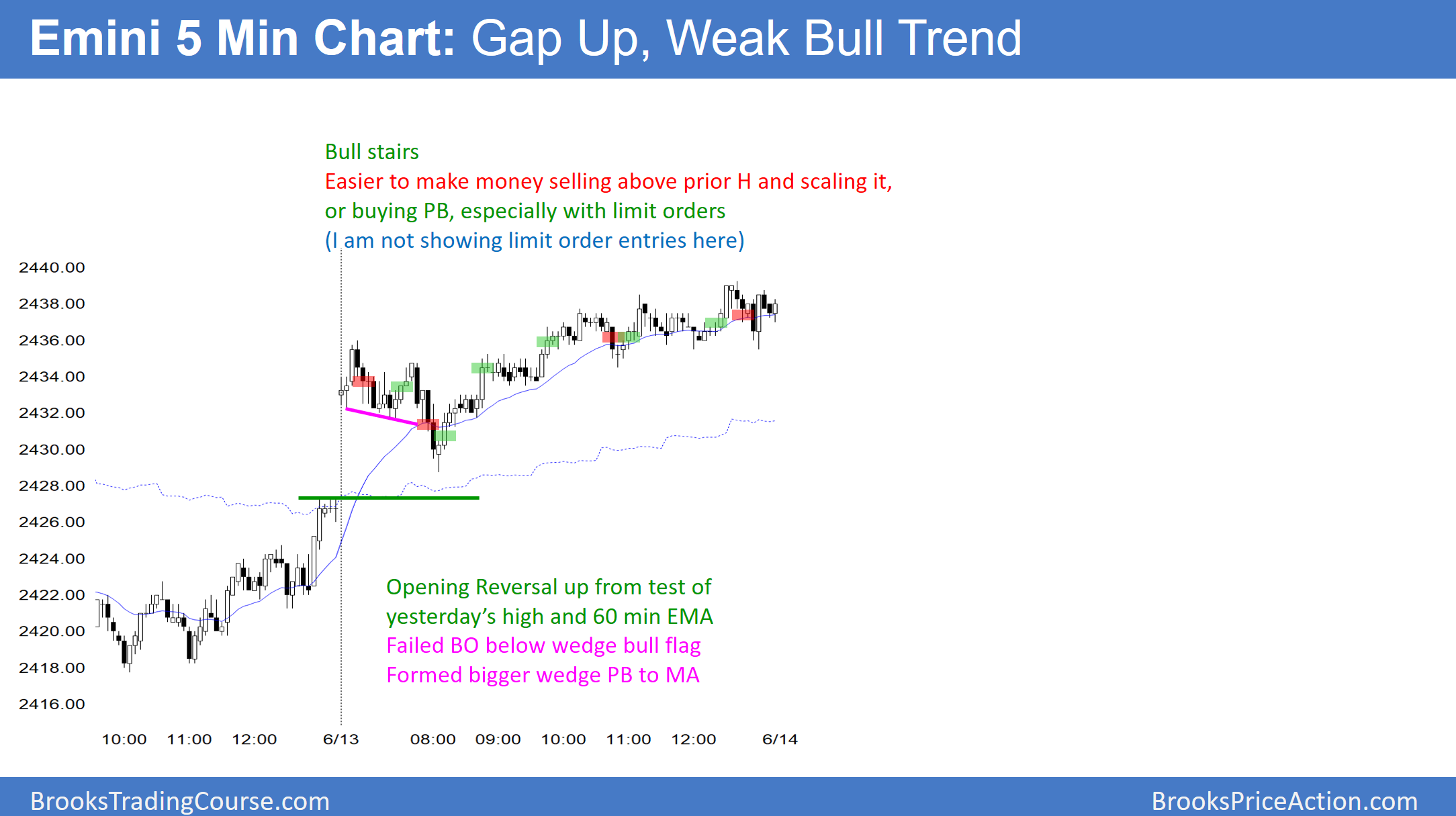

Here are several reasonable stop entry setups from yesterday.