Pre-Open market analysis

The Emini formed an outside down week last week. Because of the extreme buy climax on the weekly chart, last week has a reasonable chance of starting a 2 – 3 month correction. At the moment, the odds favor sideways to down over the next couple of weeks. However, the bears need follow-through selling. Consequently, this week is important. If the weekly chart closes on Friday with a bear body this week, it will increase the odds that the correction has begun. On the other hand, if it has a bull body, especially a big bull body, it could completely undo what the bears accomplished last week.

Thursday was a big bear breakout day on the daily chart. Friday was a small bull inside day. Because that is bad follow-through, it lowers the probability that the correction has begun. The odds are still better than 50% that a rally this week will form a lower high. However, one or two strong bull days will increase the odds for the bulls. Consequently, they could make one more new all-time high likely.

Overnight Emini Globex trading

The Emini is up 13 points in the Globex market. It will therefore probably gap up today. This will reverse more of Thursday’s bear breakout. Sometimes when there is a strong breakout at the start of a bear trend, the bulls reverse back up to above the top of the bear breakout. Then, the bears sell aggressively and take control. The bad follow-through selling on Friday and again today increase the chances that the 2 day rally will continue up to test Thursday’s sell climax high.

Because the Emini will open today at around a 50% pullback, the bears need a reversal down from this resistance. If they fail to reverse the rally back down, the odds will favor a test of Thursday’s high. If they fail to get a reversal down within few days of that test, the bulls will have completely erased Thursday’s selloff. The odds then would favor either a new high or a continued trading range.

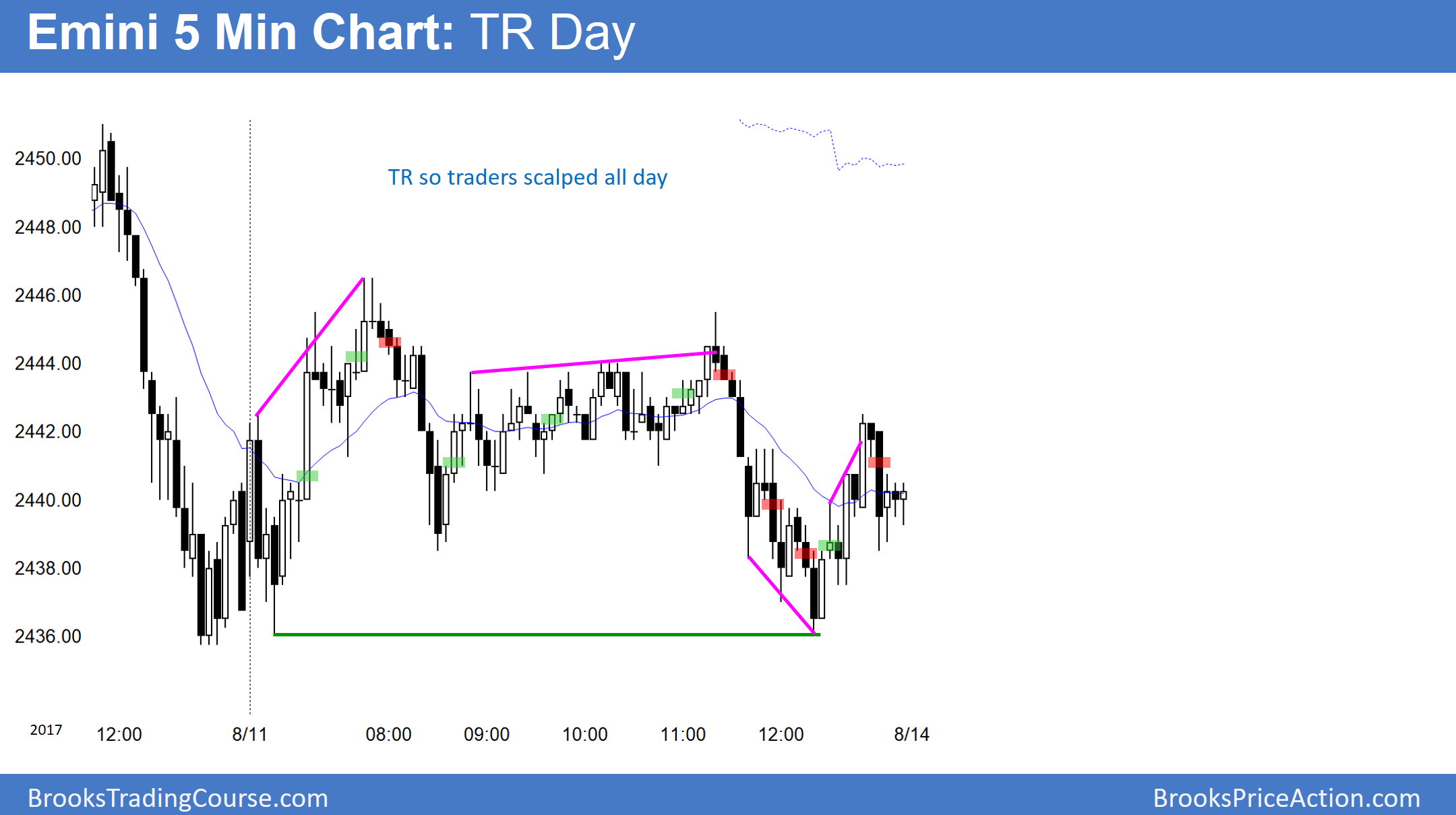

Friday’s setups

Here are several reasonable stop entry setups from Friday. I sometimes also show limit order entries and entries on the close of bars.