Pre-Open market analysis

Yesterday traded below Friday’s low and therefore triggered a sell signal on the daily chart. The bears saw last week as a 4 day bear flag.Since Friday was a bear doji, it was a weak sell signal bar. Also, after 2 big bull bars, the context is bad as well for the bears. There will likely be more buyers than sellers below Friday’s low either today or tomorrow.The 2 week selloff in early August was surprisingly big. That makes at least a couple more weeks of sideways to down trading likely. The Emini is deciding whether last week ended the 2 week selloff. It might take several more days until that is clear.Confusion usually results in a trading range. The Emini will probably be mostly sideways for a couple weeks. This is true even it it tests above last week’s high or below last week’s low and 2800.

Overnight Emini Globex trading

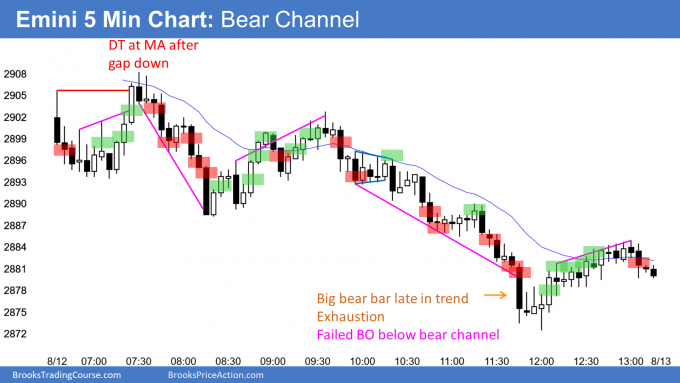

The Emini is down 8 points in the Globex session. There might be a small gap down opening. But small gaps typically close in the 1st hour. Also, even though the Emini has sold off for 2 days and yesterday was a bear Surprise Day on the daily chart, the odds are that there will be a test back up starting at some point this week.

Because the daily chart is probably forming a trading range, day traders will look for reversals every few days. Furthermore, day traders know that a trading range on the daily chart increases the amount of trading range price action on the 5 minute chart. As a result, traders will expect at least one reversal every day.

While yesterday reversed up in the final hour, the rally followed a 6 hour tight bear channel. It was therefore likely to be minor. But it was strong enough so that a reversal up this morning would have a 40% chance of being major.

A major reversal in a bear trend means a conversion into a bull trend. Consequently, day traders will look for a reversal up from around yesterday’s low.

But is important to understand that 60% of major trend reversal setups lead to small profits or losses and not bull trends. Therefore, the odds still favor trading range price action again today.

Yesterday’s setups