Emini Gapped Up But Need Follow-Through Buying

I will update around 6:55 a.m.

Pre-Open Market Analysis

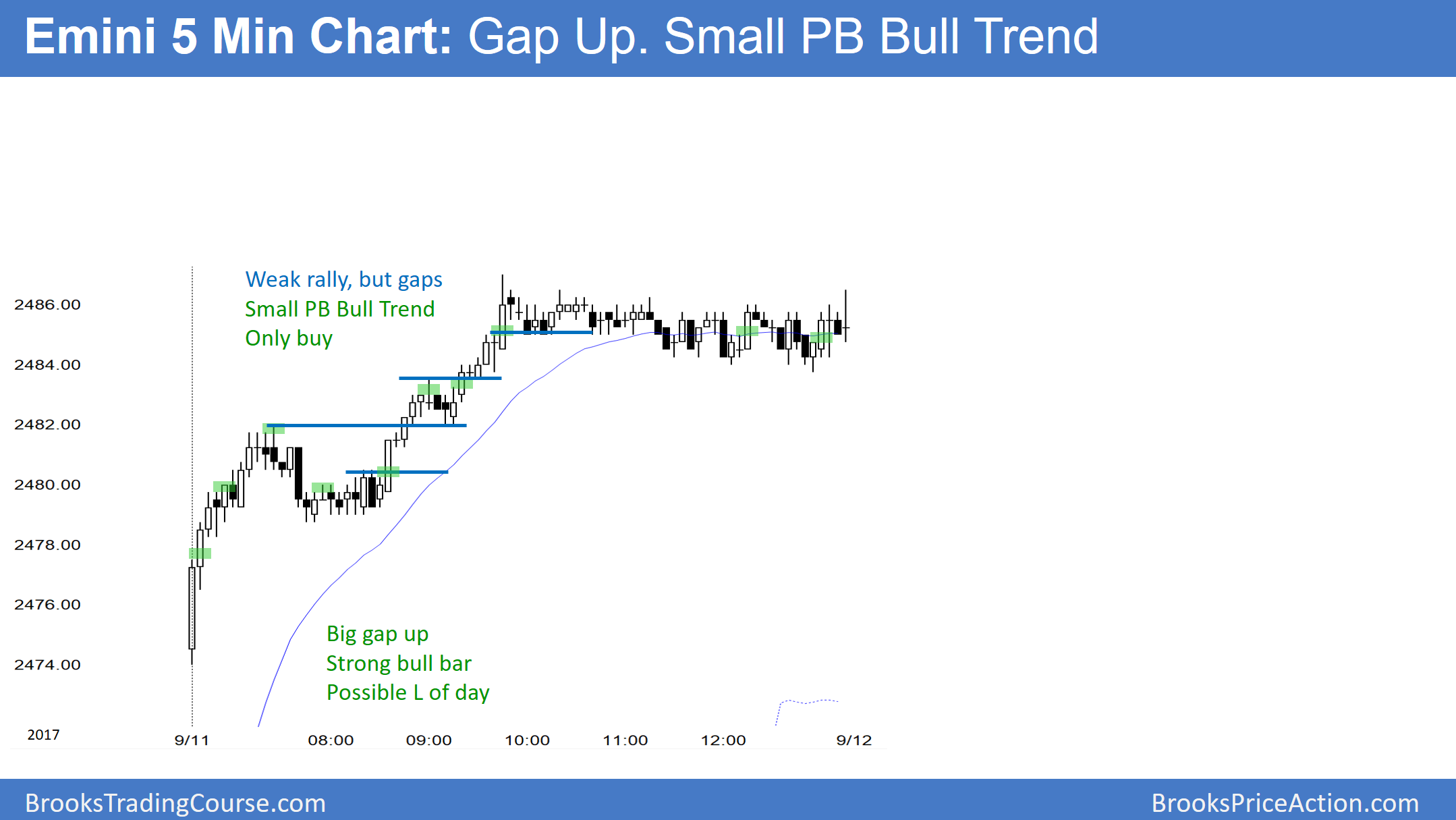

Yesterday's Emini gapped up and it rallied in a small pullback bull trend day to a new all-time high. Since that is a type of buy climax, there is a 75% chance of at least 2 hours of sideways to down trading beginning by the end of the 2nd hour. While there is a 50% chance of follow-through buying in the 1st 2 hours, there is only a 25% chance of another strong bull trend day.

The bears want a reversal down from the new high. If they get it, there will be an expanding triangle top, which is always a higher high major trend reversal. However, they will probably need at least a micro double top after yesterday’s strong rally. Therefore the odds are against a strong bear day today.

Financial markets often go sideways into catalysts, like next week’s FOMC announcement. In addition, the bull breakouts in the 7 month bull channel have been brief. They led to trading ranges within a couple of bars. While today might be another bull trend day, the odds are that the Emini will begin to have trading range days starting either today or tomorrow.

Overnight Emini Globex

The Emini is up 4 points in the Globex market, and it therefore might gap up again today. The next magnet is the 2500 Big Round Number. Since yesterday was a buy climax, the odds are that today will be more two-sided. However, since yesterday was a strong bull trend day, there is an increased chance of another bull trend day today. In addition, there is a reduced chance of a bear trend day.

Yesterday’s Setups