The E-mini has been trading around the February high for 2 months. Traders are deciding between a new high and a test of 3000. I talked about the President’s COVID-19 infection over the weekend. I believe that technical factors are more important.

The bears want a reversal down from a double top with the Sept. 16 lower high. The bulls hope that last week’s small wedge bottom will lead to a new high.

I keep talking about that streak of 9 consecutive bull bars that started in late July. While traders can argue that the market is neutral, that streak is important. When there is a reversal down after a bull streak, the market typically falls below the streak. Therefore, the odds still favor a test below the July 29 bottom of that streak. And that means a break below the Sept. 24 wedge bottom.

The biggest problem that the bears have is that the Emini has not quite reached the Sept. 16 lower high. Traders expect the Emini to get there. Therefore, the Emini will probably go at least a little above 3400 before the bears can get a 2nd leg down from the September high.

The bulls currently have a 40% chance that this rally will make a new high. Their odds will go up if the Emini breaks strongly above the September 16 lower high.

Overnight Emini Globex Trading

The Emini is up 21 points in the Globex session. It has been sideways for 4 days after a strong reversal up from a wedge bottom on Sept. 24. Traders are deciding if the rally will continue up to the Sept. 16 lower high.

Because the overnight range has been small and the Emini has been sideways for 5 days, day traders will expect more trading range price action again today. That means at least one leg up and one leg down.

But since the Emini is in Breakout Mode on the daily chart, there can be a surprisingly strong trend day in either direction at any time. At the moment, it is likely that there will be a test above 3400 this week. But, it is also likely that there will be a reversal down from the top of the month-long trading range some time in October.

Friday’s Setups

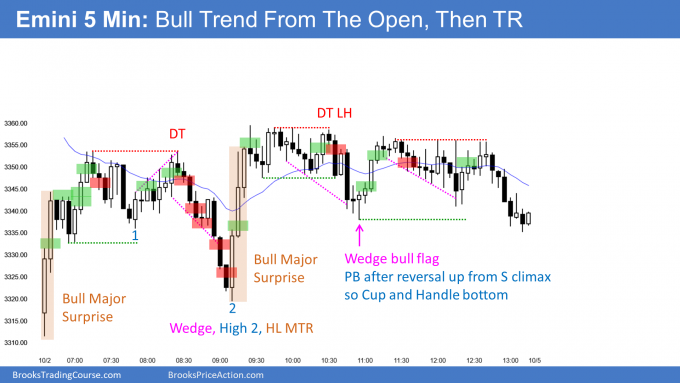

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. I do not want the lines to be distracting. If they are longer, I make them dotted. But, they have to be visible, so I make the shorter ones solid. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.