Pre-Open Market Analysis

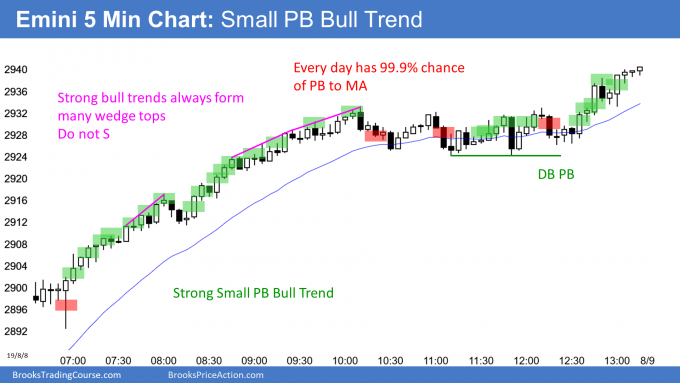

Yesterday was an exceptionally strong Small Pullback Bull Trend day. It reversed up from a one-bar selloff on the open that tested Wednesday’s high. The Emini bears could not close the gap above Wednesday’s high. The rally continued up to above last week’s low, closing the gap on the weekly chart.

I said over the past few days that the week might close around the open. After yesterday’s strong rally to far above the open, that is now unlikely. The bulls want the week to close near its high so that this week will be a stronger buy signal bar on the weekly chart. At a minimum, they want the week to close above last week’s 2913.50 low. That will therefore be a magnet in the final hour.

Because yesterday was extremely strong on the 5 minute chart, the rally is unsustainable. It is therefore a buy climax. Day traders expect at least a couple hours of sideways to down trading to begin by the end of the 2nd hour. There is only a 25% chance of another relentless bull trend today.

Will the bull trend on the daily chart resume from Wednesday’s micro double bottom? The selloff was strong enough to probably lead to a trading range 1st for a couple weeks. The daily chart over the next 2 weeks will more likely resemble early and late 2018 than early 2019.

Overnight Emini Globex Trading

The Emini is down 15 points in the Globex session. After 2 huge days of trending up, the bulls are exhausted. Today therefore will probably not be another big bull trend day. More likely it will have mostly trading range price action.

Today is Friday so weekly support and resistance can be important. This is especially true in the final hour. The bulls want the week to close on its high. Also, they would like it to close above last week’s low of 2913.50. At a minimum, they want it to close above the 2885.50 open of the week. That is below yesterday’s low and an unlikely target.

The goal for the bears is to have the week be a less strong buy signal bar for next week. They want to put as big a tail on the top of this week’s candlestick as they possibly can.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.