Pre-Open Market Analysis

The Emini reversed up strongly last week and the selloff has probably ended. Yet, the rally is now in the middle of the collapse. This increases the chances of a 2 – 5 day pullback. There is only a 30% chance of a double top bear flag with the February 7 high on the daily chart.

More likely, the odds are that bulls will buy the selloff and create a higher low. Since a trading range is likely, the pullback might be deeper than what the bulls were expecting. A 50% retracement down to the February 14 low is a reasonable target if the Emini is in a trading range. If it is still in a bear trend, it will break strongly below the February 9 low. This is not likely at the moment. If the 9 year bull trend is resuming, the rally will have only a 1 – 3 day pullback before it continues up to the all-time high.

Trading Range Likely

Big Up, Big, Down, Big Up creates Big Confusion. Therefore, a trading range for at least another month is most likely. This means that most days will have a lot of trading range trading.

Finally, after 6 consecutive bull bars on the daily chart, the odd are that there will be buyers below Friday’s low. This means that the best the bears will probably get over the next couple of days is a pullback. They will probably have to wait for a test of Friday’s high and a micro double top before they can get a 50% retracement of the 6 day rally.

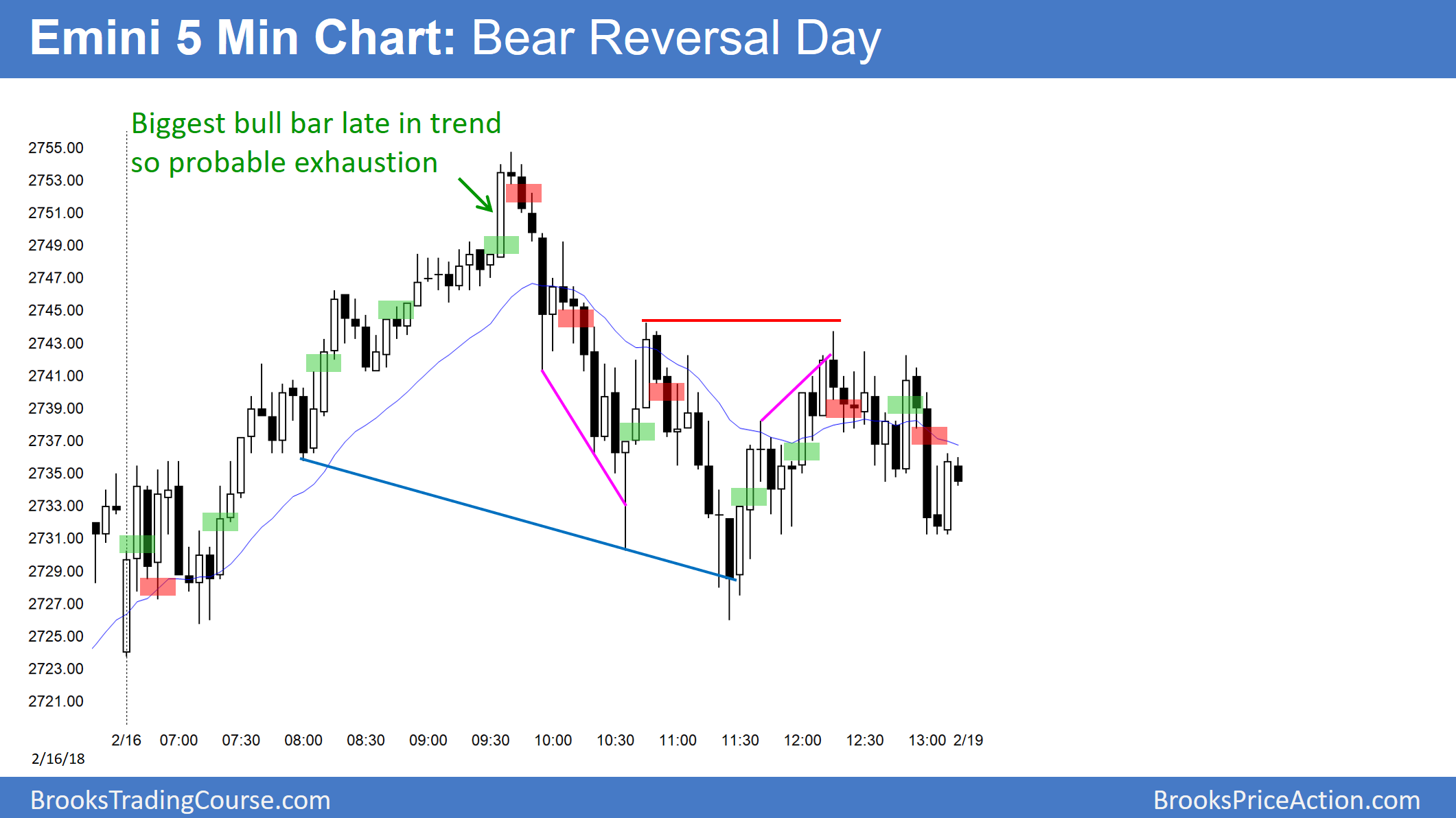

After 6 days in a tight bull channel, the Emini reversed down on Friday. The rally is stalling around the February lower high, the daily EMA, and a 50% bounce. This increases the odds for a few days of sideways trading.

Last week was a strong buy signal bar on the weekly chart. The odds are that this week will trade above last week’s high and trigger the buy signal. Alternatively, it could be another inside bar.

While the weekly and monthly charts are in bull trends, the 2 week selloff was very strong. This increases the odds that this week will not be a strong entry bar for the bulls if it trades above last week’s high. This means that it will either have a small bull body on the weekly chart, or a prominent tail on top. Consequently, there will probably not be relentless buying again this week. The Emini will likely begin to go sideways.

Overnight Emini Globex Trading

The Emini is down 9 points in the Globex session. It is around Friday’s low. Friday was the 6th consecutive bull trend bar on the daily chart in a 6 day bull micro channel. This represents strong buying. Hence, the bulls will probably buy the 1st 1 – 3 day reversal. Consequently, there will probably be more buyers than sellers below Friday’s low. As a result, today will probably not be a big bear day.

Furthermore, the 60-minute chart has not tested its 20-bar EMA in more than 20 bars. This means that the bulls have been willing to pay above an average price for a long time. They will therefore probably be happy to have an opportunity today to buy around the average price. This further limits today’s downside.

The 6-day strong bull channel transitioned into a bear channel on Friday. Bear channels often last a few days. Therefore, the 60-minute chart might go sideways for another couple of days.

Finally, as strong as the 6-day rally was, it was also a buy vacuum test of resistance. That resistance is the February 14 lower high and a 50% pullback from the selloff. This reduces the chances of a big bull day today. With neither a strong bull or bear day likely, today will probably mostly be sideways.

Friday’s Setups

Here are several reasonable stop entry setups from Friday. I sometimes also show limit order entries and entries on the close of bars.