Pre-Open market analysis

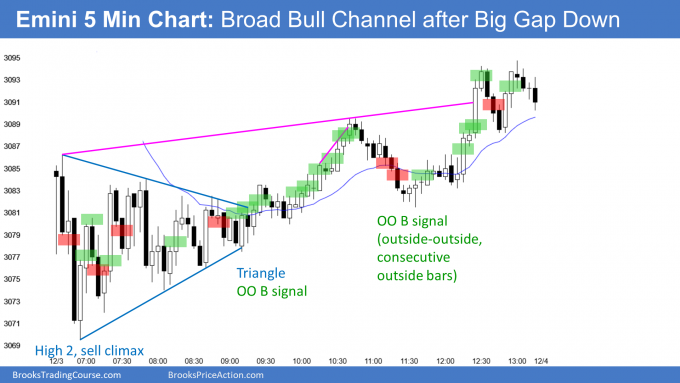

Yesterday opened with a big gap down and sold off on the open. It then rallied in a broad bull channel for the rest of the day. Yesterday is buy signal bar for today on the daily chart. The bulls are hoping that the 2 day selloff will be just a bear trap in a strong bull trend.

It is important to remember what I said throughout November. Traders needed to expect a 50 – 100 point, 1 – 2 week correction to begin by the end of November. This was because the buy climax on the daily and weekly charts was extreme. Well, it began on November 27. Yesterday’s low was 85.5 points below the high. This selloff, therefore, met my minimum goal.

It is also important to understand that the weekly chart had been in a 9 bar bull microchannel. That means that this pullback was likely to only last a week or two. It might have ended yesterday, but it probably has a little more sideways to down to go. Can the Emini fall 5 – 8%, like the other pullbacks in 2019? I think the weekly microchannel will result in a smaller pullback.

Because many bulls believe the pullback will be brief and the current pullback has been extreme, these bulls are eager to buy. If the Emini begins to reverse up strongly today or this week, everyone might buy in a panic. That could quickly end the selloff.

Overnight Emini Globex trading

The Emini is up 13 points in the Globex session. If today gaps up, yesterday would be a one day island bottom. Just like the 5 day island top was not a major sell signal, an island bottom is not a major buy signal.

The 2 day selloff was extreme. Many bears began to take profits yesterday after a surprising big selloff. Traders are deciding if the profit-taking will be enough to resume the bull trend on the daily chart, or if the bears will take control again around 50% up, near Monday’s low.

Although yesterday reversed up on the 5 minute, the reversal was not surprisingly strong. That hesitation results in confusion. This adds to he confusion caused by the sharp drop on the daily chart after a strong 2 month rally.

Confusion typically takes time before the path becomes clear. Therefore, the Emini will probably soon go sideways for a few days. If it does, the 5 minute chart will have a lot of trading range price action.

Less likely, yesterday will be a one day bear flag and the bear trend will resume. Or, yesterday will be the start of a climactic reversal up, like what happened at the end of December last year.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.