Pre-Open Market Analysis

Yesterday gapped up to a new all-time high, but sold off in a trend resumption down day. It is a sell signal bar for a micro double top with Thursday’s high. Yet, the Emini will probably go mostly sideways into Friday’s vote on the continuing budget resolution. However, if there is a big bear trend day tomorrow, the odds that a 5% correction has begun would be 40 – 50%.

As strong as last month’s rally was on the daily chart, bear bars and dojis followed big bull bars. This usually results in a trading range, which might now be forming.

Overnight Emini Globex Trading

The Emini is up 4 points in the Globex session. That is close enough to yesterday’s low so that the odds favor a test below yesterday’s low. Yesterday is a sell signal bar for a micro double top on the daily chart. Consequently, traders want to know if there are more buyers or sellers below its low.

Since most reversals fail, the odds are against a big bear trend day today. However, with the daily, weekly, and monthly charts all in buy climaxes, the Emini can form a huge bear trend day at any time. More likely, the 3-day tight trading range will continue. This is especially true since Friday’s vote on the continuing budget resolution is a major catalyst. The Emini will probably wait for the vote before having a big move up or down.

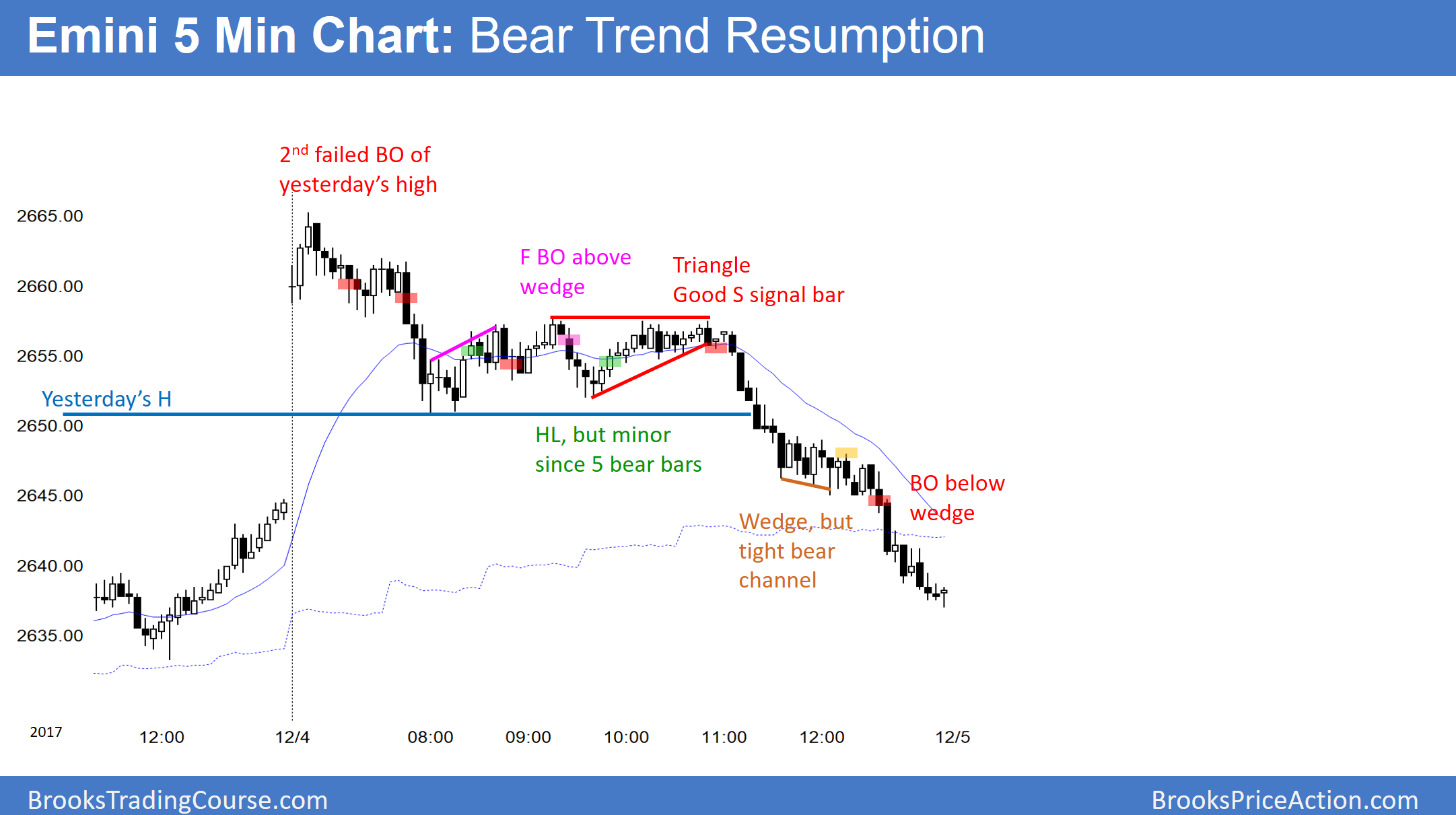

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.