Pre-Open Market Analysis

Yesterday was a trading range day. On the daily chart, it is a High 1 bull flag and therefore a buy signal bar. Every pullback this year ended after 1 or 2 bars. The bulls hope the bull trend will resume today.

However, the Emini is at strong resistance at 2800 and the triple top on the daily chart. In addition, yesterday was a doji day and not a strong bull trend day. Furthermore, there is a parabolic wedge buy climax.

Monday might be the start of 2 – 3 weeks of profit taking. Consequently, yesterday is not a strong buy setup. There may be sellers above yesterday’s high and above Monday’s high.

How will traders know that a pullback is underway? They will begin to see 2 or more especially big bear bars closing on their lows on the 5 minute chart. In addition, there will be bear trends. Also, there will often be selling in the final 30 minutes.

Finally, the pullback on the daily chart will last 3 or more days. Until then, traders will assume that the 2 month Small Pullback Bull Trend is still in effect.

Overnight Emini Globex Trading

The Emini is down 4 points in the Globex session. Since yesterday was a doji bar on the daily chart, it was neutral. Consequently, there will probably be buyers around its low and sellers around its high.

The bears see yesterday as the entry bar for the selloff from resistance above 2800. A doji bar is a weak entry. When that is the case, the bears usually need a micro double top. Therefore, there will probably be a test up this week.

Furthermore, the open of the week is important this week. After 9 bull weeks on the weekly chart, the bulls will try for a 10th. That is another reason for a test up to 2808 today or tomorrow.

Because the 2 day selloff has been weak, the daily chart is in a strong bull trend, and the open of the week is a magnet above, the odds favor sideways to up for at least a day or two.

Yesterday’s Setups

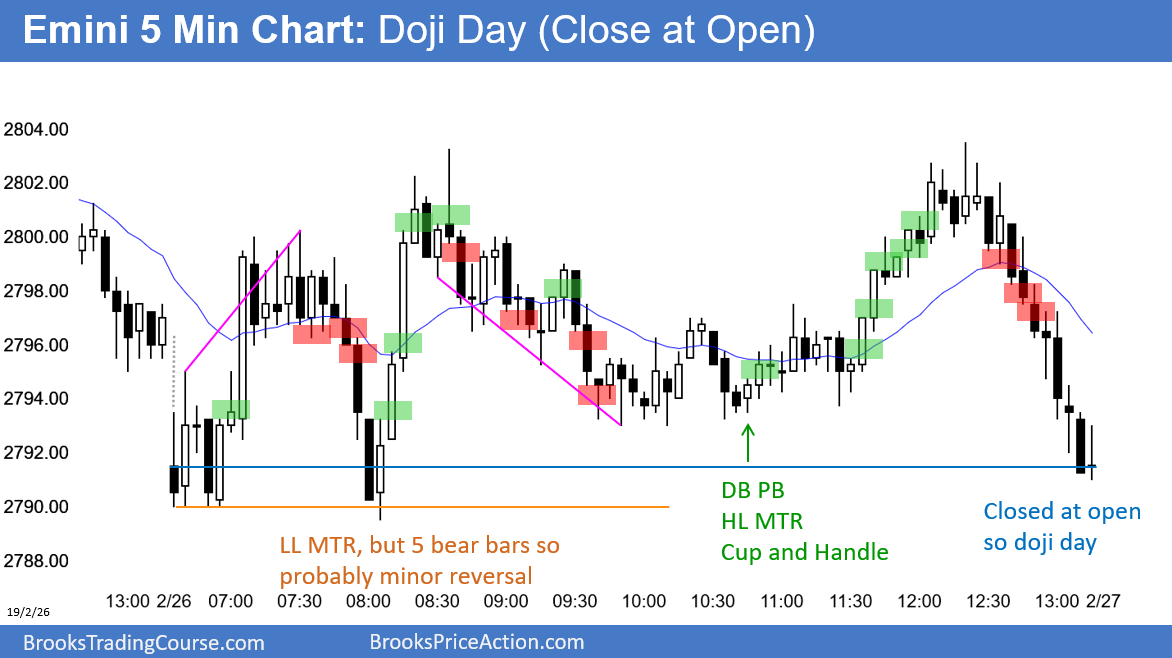

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.