Pre-Open Market Analysis

The Emini triggered a High 1 bull-flag buy signal yesterday by going above Friday’s high. The bulls want a strong breakout above the 3400 Big Round Number.

Yesterday got near that target. Traders expect it to get closer within a few days. Furthermore, they expect at least a small breakout above. If there is a big breakout with follow-through over the following days, the rally will probably continue up to the Leg 1 = Leg 2 target at 3468.

More likely, the Emini will begin to pull back to the February 10 low within a week. That is the bottom of the most recent leg up and therefore a magnet below.

Also, there is a 50% chance of a selloff down to the January low by the end of March. This 3-week rally looks more like it will end up as a bull leg in a trading range that began around Christmas than a resumption of last year’s bull trend.

Most recent days have had predominantly trading range price action. Traders will expect that again today and will look for at least one swing up and one swing down.

Overnight Emini Globex Trading

The Emini is down 10 points in the Globex session. The Emini is overbought on the daily chart and there is also a parabolic wedge buy climax top on that chart. There is therefore an increased chance of several bear trend days within the next couple of weeks.However, there is no reversal down yet and the Emini has been working higher. Can the bulls get a strong rally from here? While it is possible, if there is going to be several trend days, down is slightly more likely. But with the past 6 days having mostly trading range price action, traders will continue to bet on reversals until there is a strong breakout up or down.

Yesterday’s Setups

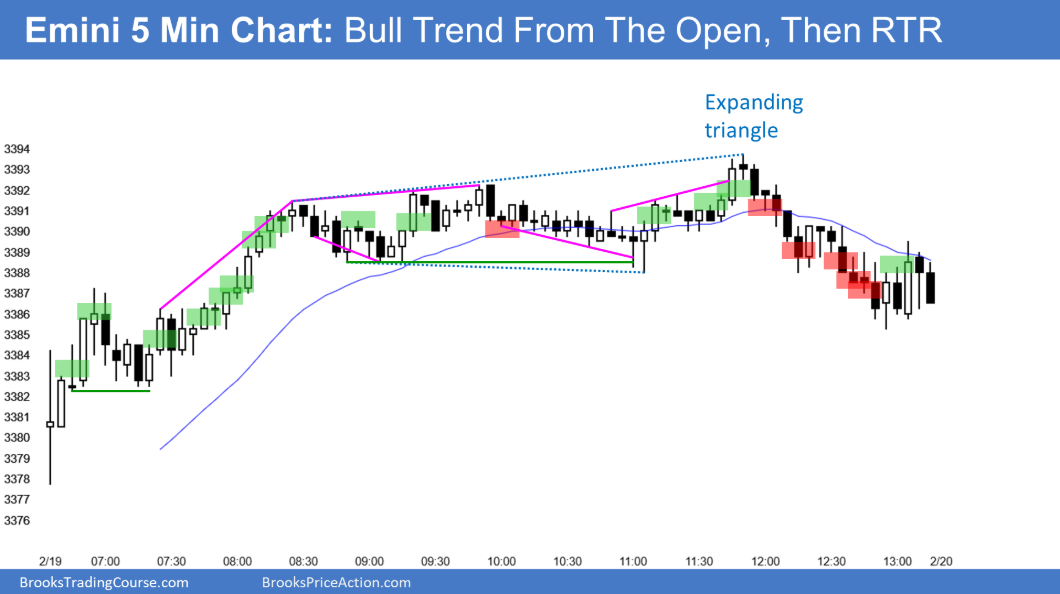

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.