Pre-Open Market Analysis

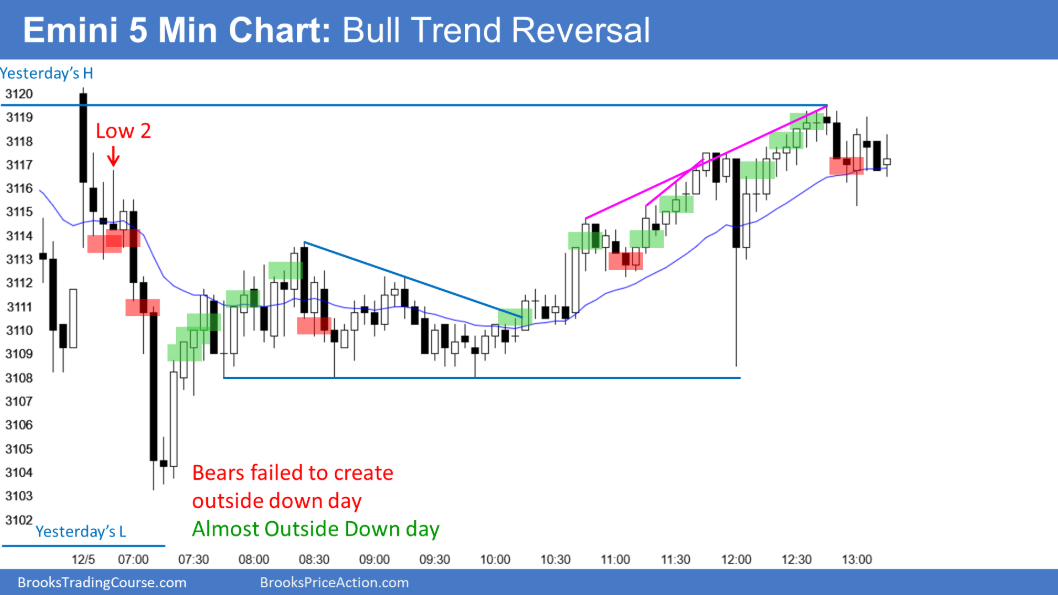

The Emini S&P 500 reversed down strongly yesterday from above Wednesday’s high. However, the bears were unable to break below Wednesday’s low to create an outside down day. Instead, the bulls got a reversal up and a rally that lasted the rest of the day.

I have been saying all week that last week’s low would be a magnet on Friday. Well, today is Friday. I said it because last week had a bull body. It was therefore a bad sell signal bar on the weekly chart, given a 9 week bull micro channel. That means there would probably be more buyers than sellers below.

This was true, despite the 2-day selloff. As a sign of strength, the bulls would try to get the week to close above last week’s low. They want a close above the entry price for the bears. Furthermore, they would like today to close above the open of the week, reversing the entire selloff.

The bears wanted a big bear bar closing on its low on the weekly chart. Now, they are desperate to simply get the week to close even slightly below last week’s low.

With last week’s low being important to both the bulls and the bears, it might be a magnet again today. This is especially true in the final hour of today. The other key price is the open of the week. The bulls want the week to close above the open.

Overnight Emini Globex Trading

The Emini is up 20 points in the Globex session. It therefore might gap up again today. Furthermore, it is now only 6 points below the open of the week. That is close enough to be a magnet today.The 4-day rally has reversed the 2-day selloff. A big gap up increases the chance of a trend day. If there is a trend, up is more likely than down.However, The bulls might be satisfied with a close around the open or high of the week. If so, there might not be much of a rally today.Their next objective would be to close the week above last week’s high. This week would then be an outside up week. But even if they achieved that, today would probably not close much above last week’s high. That high is only 18 points above the current Globex price. Therefore, if today is a bull trend day, it will probably not be a huge bull trend day.Can today trend down? Last week’s low is still a magnet below. With the surprisingly strong rally over the past 30 minutes, and the Emini now getting close to the open of the week, a bear trend day is unlikely. Consequently, today will probably be sideways to up. With most days spending a lot of time going sideways, today likely will as well, even if there is a trend.Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.