Pre-Open Market Analysis

The Emini has been in a Small Pullback Bull Trend for 3 weeks. Yesterday was a 1 day pullback. It is High 1 bull flag buy signal bar for today.

However, the Emini has stalled below the 3400 Big Round Number for 6 days. Also, yesterday was not a big bull bar closing on its high. In addition, the 3 week rally is forming a small wedge and that will likely lead to a pullback soon.

While the Emini might get a brief break above 3400 within a couple weeks, it will probably test the February 10 buy climax low by mid-March. Also, there is a 50% chance of a test of the January low by the end of March.

Emini Stalling At The 3400 Big Round Number

The bulls want a strong break above the 3400 Big Round Number. However, the parabolic wedge rally on the daily chart and the 4% selloff in January make it equally likely that the 3-week rally is just a bull leg in a trading range that began around Christmas.The Emini stalled for 4 days just below 3300 last month. It then broke above, but could not hold above. January then had a 4% selloff.The current behavior is similar. At a minimum, the Emini will probably fall to the February 10 buy climax low within a couple weeks. But will it first break above 3400? We should find out over the next few days.Overnight Emini Trading

The Emini is up 9 points in the Globex session. It has been in a tight range for 5 days. Most days have had at least one reversal. Since markets tend to continue what they have been doing, traders will expect at least one reversal today as well.

A tight trading range is a breakout mode pattern. The probability of the bull breakout is about the same as for a bear breakout. Traders are looking for a breakout. Therefore, there is an increased chance of a strong trend within the next few days. However, until one is clearly underway, day traders will continue to look for reversals.

Yesterday’s Setups

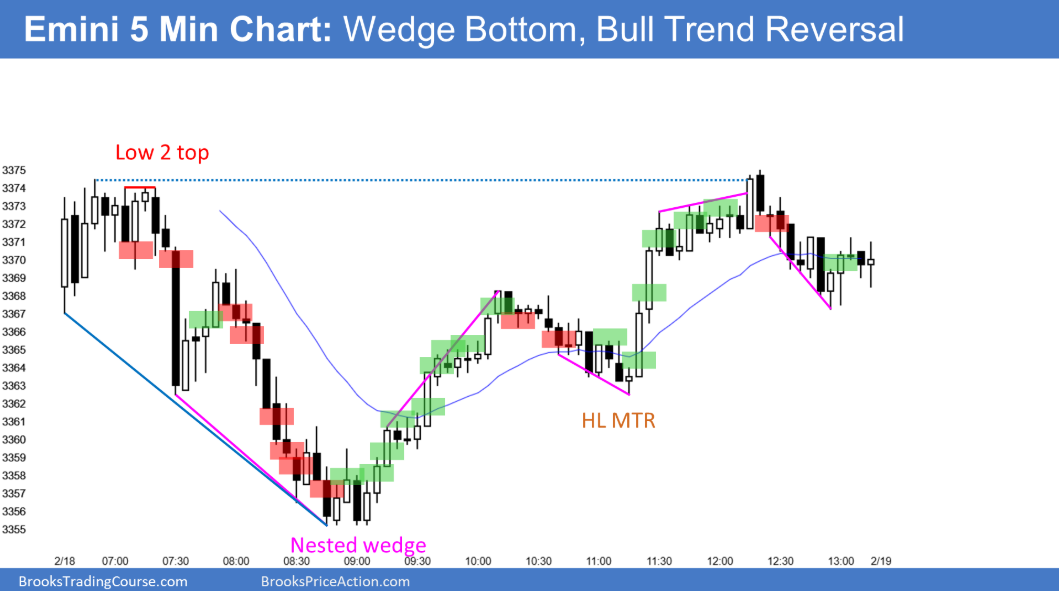

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.