Pre-Open Market Analysis

The Emini collapsed last week. It is now down in the March to October trading range. Traders looked at that as a fair price. They probably will again. Consequently, the Emini S&P 500 might begin to go sideways this week. It could be sideways for a month or more. That is what often happens after a very big move.

When there is a huge selloff like last week, the bears have big profits. Also, their stops are now far above. That means their risk is getting too big. They can reduce their risk by buying back (covering) some of their shorts.

Traders should expect a strong short covering rally to begin today or tomorrow. Friday is a good buy signal bar for today. However, the 1st reversal up will form a lower high. This is true even if it is very strong and lasts several days.

February was a huge outside down bar on the monthly chart. It is therefore a monthly sell signal. March will probably trigger the sell signal by trading below the February low at some point. If you read my weekend blog, you know that there is a potentially huge problem with the coronavirus.

However, when there is a very big outside bar, there is an increased chance that the next bar will be an inside bar. If today opens above Friday’s low, there might an early rally as the bulls try to create an inside bar in March.

Did The Market Fully Adjust For Coronavirus?

Traders are deciding if they have fully priced in the consequences of the corona virus. If the rate of new cases slows this week, traders will wonder if worldwide containment will be successful and it they lowered the price too much. That could result in a big rally over the next week or two. But probably not to a new high.After a Bear Major Surprise, the best the bulls typically can get is a bull leg in a trading range. Then, after 20 or more bars, if they can create some type of a double bottom or wedge bottom, they would have a better chance of resuming the bull trend.However, if there is a steady increase in the number of new cases, and especially if here is a dramatic increase, the odds of a 30 – 50% correction will go up. There is currently only a 30% chance.Most likely, the news will become less bearish and the Emini will be sideways over the next month. With it as oversold as it is, no news should result in a rally, maybe starting today.

Overnight Emini Globex Trading

The Emini rallied strongly overnight but then fell back. Much of the price action is being driven by coronavirus news. There was an increase in cases in the US overnight.

But as long as the news is not terrible, the Emini will begin to enter a trading range. Traders suspect that last week might have adequately repriced the market. The bulls therefore are willing to begin to buy and the bears will start to take profits if the news stabilizes. Both expect a trading range once they feel that containment might be successful.

The daily ranges and the bars on the 5-minute chart have been huge. Unless a day trader has at least a $50,000 account, he should probably not be trading Emini contracts until the ranges become much smaller.

One alternative is to trade micro Emini contracts. They have only 10% of the value of Emini contracts. If the daily range is 10 times bigger than normal, trading a single micro Emini is comparable to trading one Emini contract during normal market conditions. Day traders can also trade big volume stocks or options as alternatives.

Since the overnight news was not terrible and the Emini traded mostly sideways Friday, day traders expect legs up and down again today. There is an increased chance of one or more big bull trend days starting early this week.

Friday’s Setups

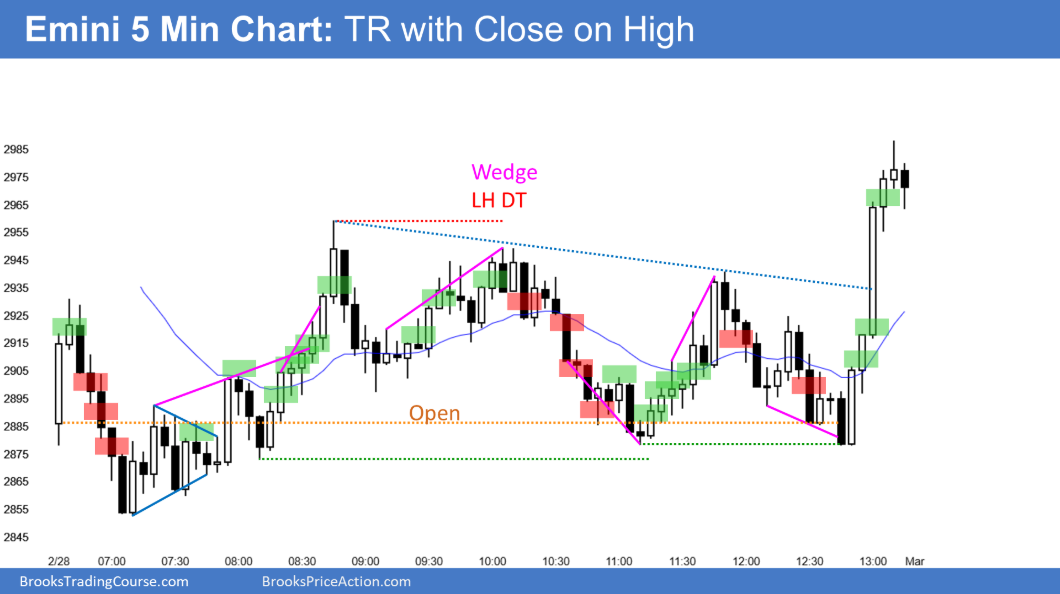

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.