Pre-Open Market Analysis

The Emini had bear trend resumption late Friday. They need strong follow-through selling this week if this is the start of a 3 – 10% correction. Most reversal attempts become bull flags and therefore this 2-week selloff will probably be another bull flag. However, from the weekend blog, you can see that the odds are 70% that at least a 3 – 5% correction will begin early this year. The bears need consecutive big bear bars on the daily chart, or 3 – 5 smaller bear bars. Because the January 19 congressional vote to avoid a government shutdown is a major catalyst, the Emini might stay mostly sideways until then.

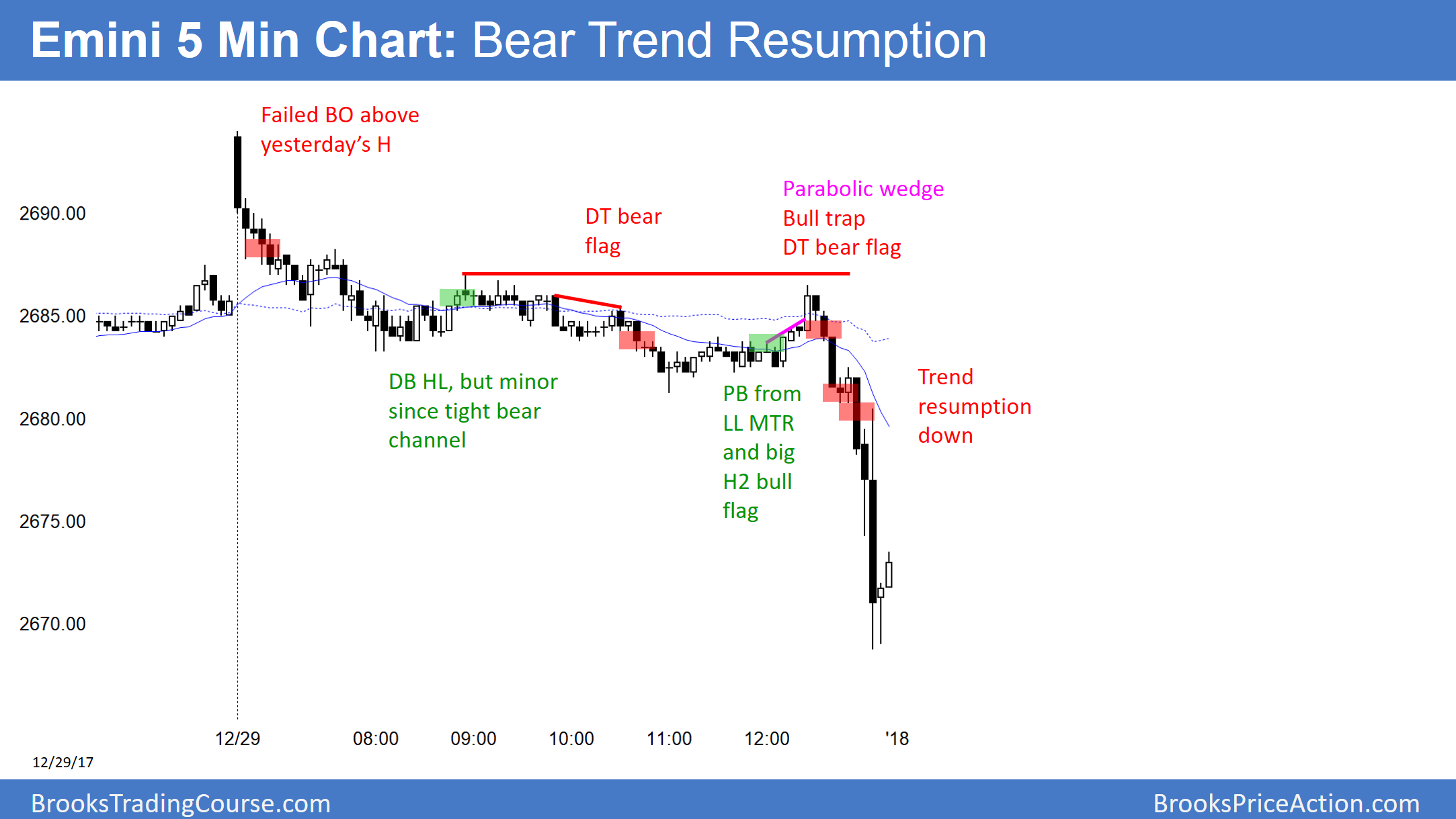

Friday’s trend resumption down is similar to the trend resumption down on New Year’s Eve on the 5 minute chart in 2009. The Emini immediately reversed up on the daily chart for a week or two, and then fell 10%. Since the Emini is still in a bull trend on the daily chart, a continued rally is likely. Because of the buy climaxes on the daily, weekly, and monthly charts, a 5% pullback is likely as well. If the next few days are up, traders should look for a 1 – 2 week rally and then at least a 5% pullback.

Overnight Emini Globex Trading

The Emini is up 9 points in the Globex market. That means it will probably open around the top of Friday’s late sell climax. The bears want a double top with that high. The bulls want a breakout above, and then a measured move up.

The Emini will probably open with a big gap up. That increases the odds of a trend day. If there is a trend day, a bull trend is more likely when there is a big gap up. However, because the open will probably be in Friday’s tight trading range and at the 60-minute moving average, the odds favor an opening trading range. The big gap up would be a reversal of Friday’s big selloff. This increases the chance of a bull trend day today.

Friday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.