Pre-Open Market Analysis

Yesterday opened almost exactly at a 10% correction from the high. It rallied early but then sold off to close on its low and well below 3000.

Yes, the selling is climactic and at support, but it is unusually strong. There will probably be a violent short covering rally within the next few days. However, the Emini S&P 500 will probably be sideways to down for at least another month. It may have seen the high for the year. Remember, I have been saying that the Emini would probably be sideways all year between 2900 and 3500. It is now at the bottom of that range.

I also said several times that a recession is likely in the fall. The stock market usually sells off 6 months before a recession. This is a good candidate for the start of a 20% that could lead to a recession later this year.

Can today collapse? The daily chart is in a bear trend. If there is going to be a big surprise, down is more likely than up. However, because there is an extreme sell climax at a cluster of support, the chance of another huge bear day is less than otherwise in a bear trend. More likely, the Emini will have one or two big bull days within the next few days.

But it may be just neutral today. It often has to stop going down for a day or so before it can go up.

Monthly Chart Is Important Today

Today is the final day of the week and month. February is a huge outside down month. If it closes near the low, there will be an increased chance of lower prices in March.But, if today rallies strongly, there will be a big tail on the bottom of the February candlestick. It would be less bearish going into March. There would be an increased chance of more short covering next week.

Overnight Emini Globex Trading

The Emini is down 45 points in the Globex session. It will probably gap down today.

When there is a big gap down, the Emini is far below the EMA on the 5-minute chart. Traders are hesitant to sell far below the average price, especially in an oversold market. That reduces the chance of a big bear trend day from the open.

However, there might be bargain hunters and then bears might cover some of their shorts. Therefore, there is an increased chance of a bull trend day. But with the uncertainty over the weekend, it is more likely that a sharp short covering rally will come next week and not today.

A big gap down usually leads to a trading range for the 1st hour or two. The Emini gets closer to the EMA by going sideways to up. Once near the EMA, the bears will look for a double top or wedge top to sell. The bulls want a double bottom or wedge bottom. Both are looking for a swing trade to begin in the opening trading range.

If there is a trading range open, it reduces the chance of a big trend day. That early trading range trading is a sign that the market is getting neutral. That increases the chance of more trading range trading later in the day and reduces the chance of a relentless trend day.

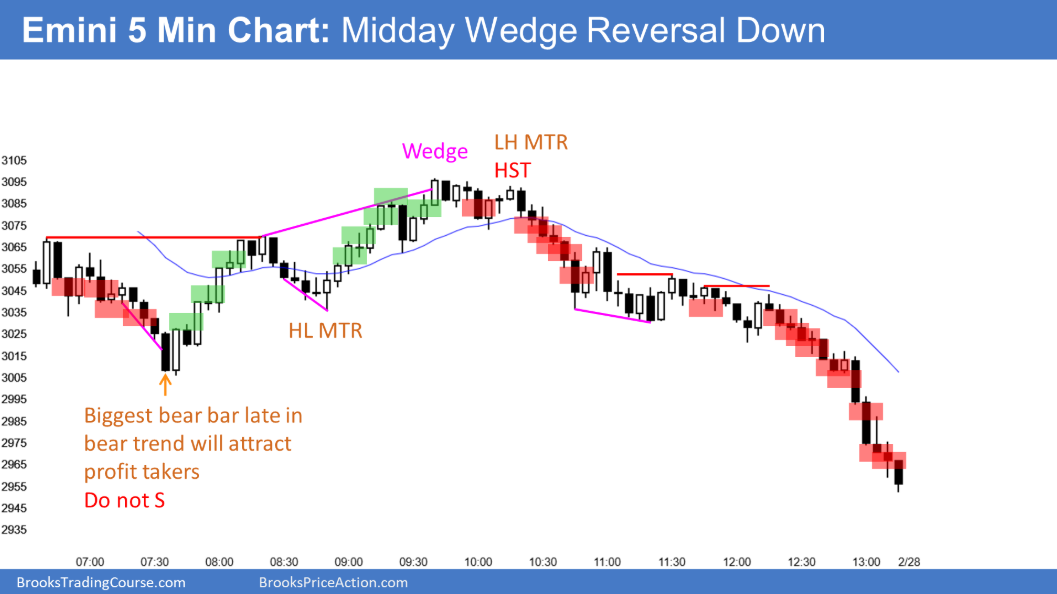

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.