Pre-Open Market Analysis

The Emini S&P 500 sold off 85 points and reversed back up last week. I said throughout November that a 50 – 100 point pullback was likely, and last week probably was it. The bulls want a resumption of the bull trend through the rest of the year. However, the bears want a double top with the high of 2 weeks ago.

Since the Emini raced up to that high and not far above, it might pause here for a few days. This is especially true with the uncertainty over Wednesday’s FOMC announcement. However, the odds still favor higher prices over the next month or two.

Overnight Emini Globex Trading

The Emini is down 3 points in the Globex session. The 4-day rally was not especially strong. Traders wonder if it was simply a buy vacuum test of the all-time high from 2 weeks ago. The bears want a double top and then a reversal down.However, the bulls see last week’s selloff as a bear trap. They want a break to a new all-time high. Furthermore, they want the year to close on its high.The momentum up on the daily, weekly, and monthly charts gives the bulls a slight advantage over the remaining weeks of 2019. But Wednesday’s FOMC announcement and next week’s announcement on China tariffs are catalysts. They have the potential to create a big move up or down.With last week racing up to the high from 2 weeks ago but unable to break above that resistance, and with upcoming catalysts, there is an increased chance of trading range price action for a few days.

Friday’s Setups

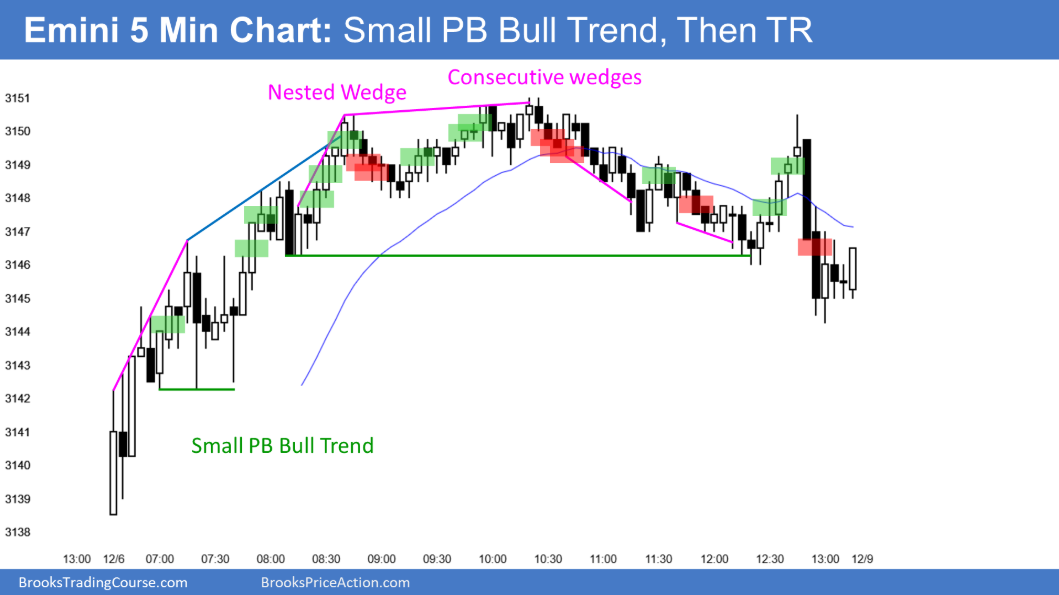

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.