Emini Holiday Trading Before Budget Vote And Possible Government Shutdown

I will update around 6:55 a.m.

Pre-Open Market Analysis

The Emini has been in a tight trading range for 6 days. Since the daily chart is in a bull trend, the odds favor at least slightly higher prices. However, because the higher time frames are climactic, the odds are against much higher prices without a 5% pullback 1st.

This is the quietest week of the year. Most of the time, the Emini will probably be in tight trading ranges. However, there will be some breakouts that have follow-through. Swing traders will wait for the breakouts. Scalpers will trade with limit orders until there is a strong breakout. They then will be able to enter with stops when there are pullbacks.

Overnight Emini Globex Trading

The Emini is up 3 points in the Globex session. Yesterday was the 1st bull day in 5 days. Since the 6-day pullback is a bull flag on the daily chart, yesterday was a buy signal bar. The odds are that today will trade above yesterday’s high and trigger the buy signal.

While Christmas week typically spends most of its time in tight trading ranges, a small day like yesterday often leads to a big day. Therefore, today has an increased chance of being a strong bull trend day. If the bulls get an early rally, traders should look to swing trade at least part of their position. A bear trend day is less likely.

Because the Emini has been in a tight range for 6 days and this week is often quiet, most likely today will be another small day. Traders should watch the early bars to see if they are mostly big trend bars or small sideways dojis. That is often a sign of what will follow.

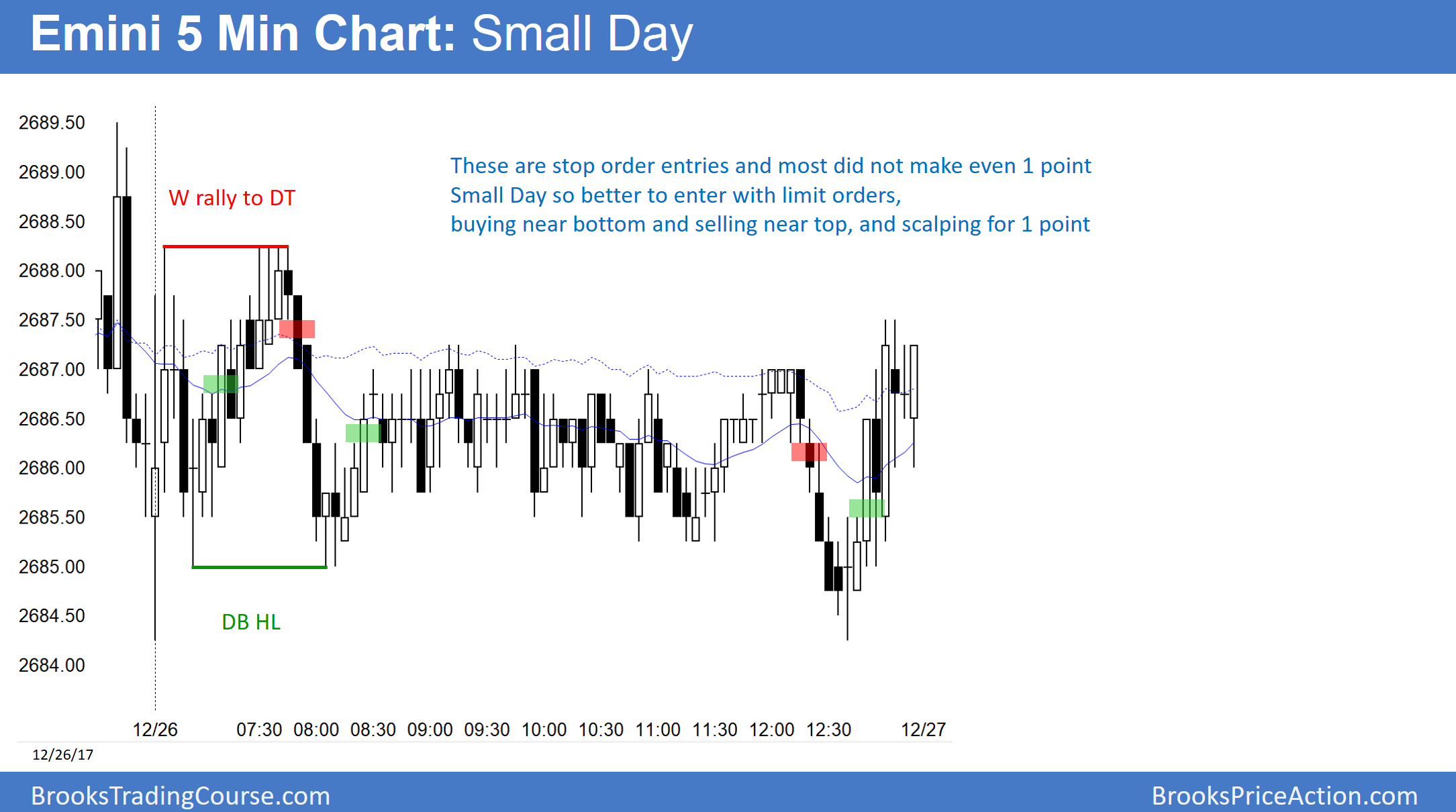

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.