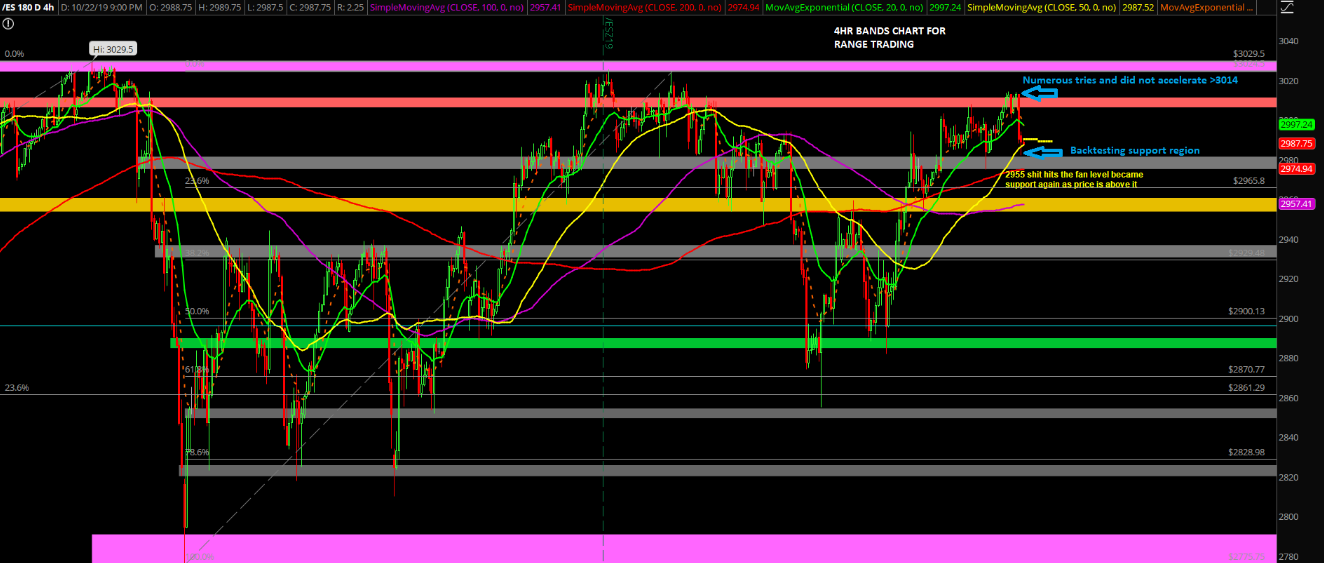

Tuesday’s session showcased a textbook rangebound grind and backtest as the price action could not break above the overnight 3014.25 high on the Emini S&P 500 (ES) to force a trend day.

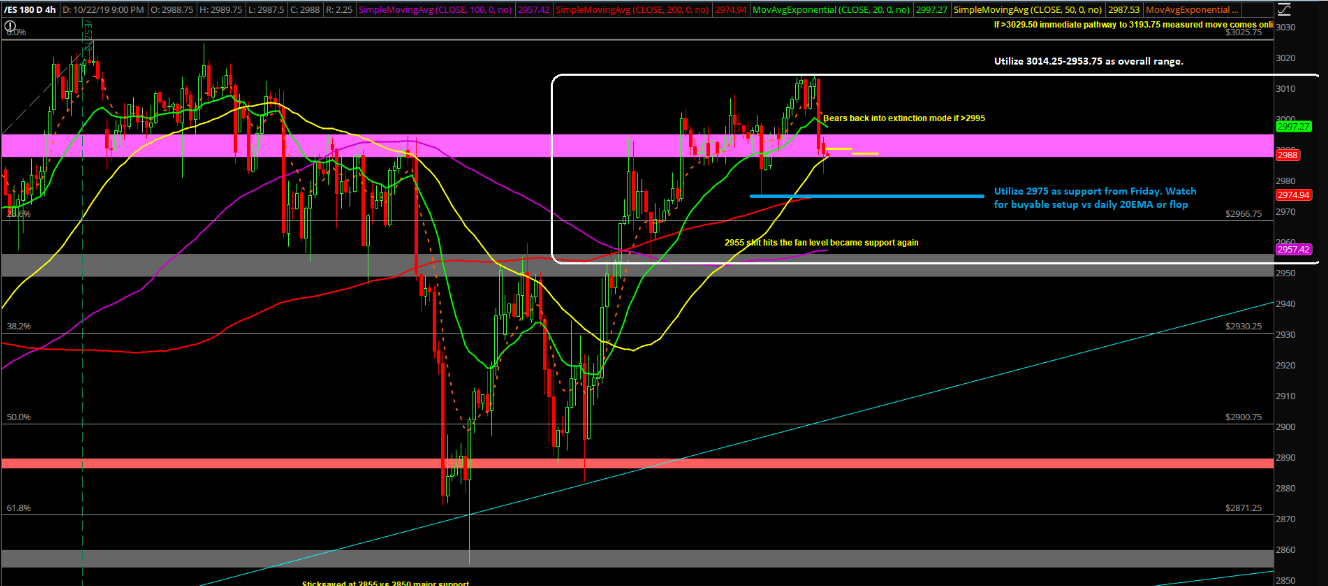

Essentially, the market had to work out all the negative divergence on all four of the equity indices. As discussed in our trading room, it was prudent for short-term traders to bail and take profits in the morning given the numerous attempts that failed to break above 3014 indicating no immediate trend day setup. We had to bail immediately after the regular trading hours (RTH) open as bulls kept failing to break above the 3014.25 overnight high. It is what it is.

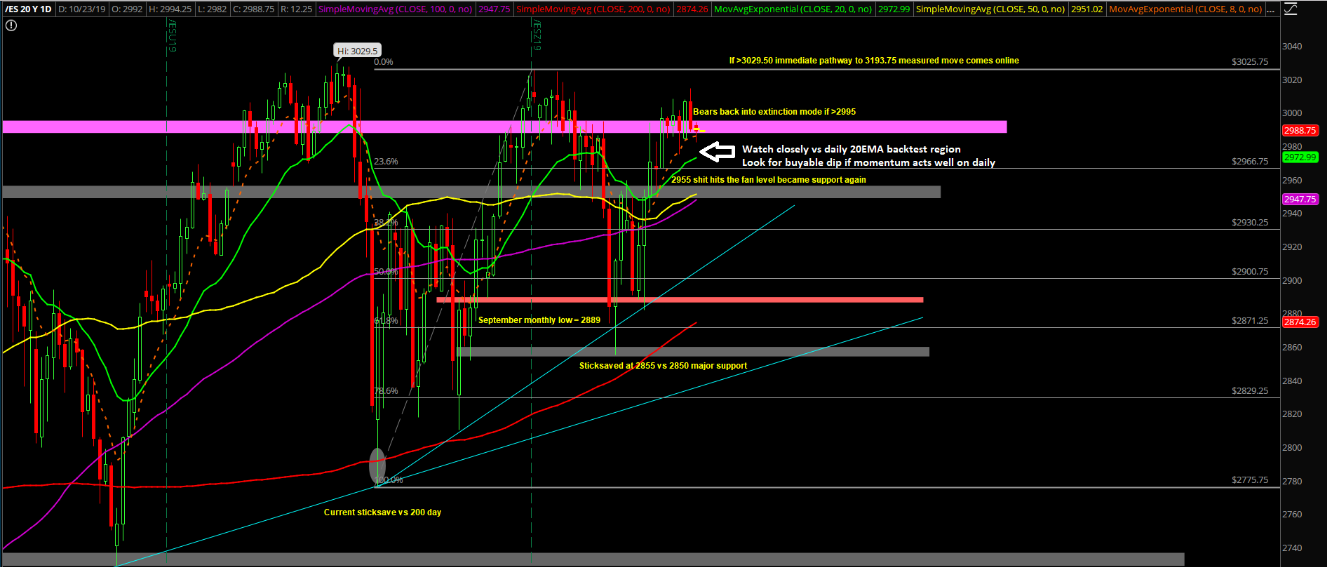

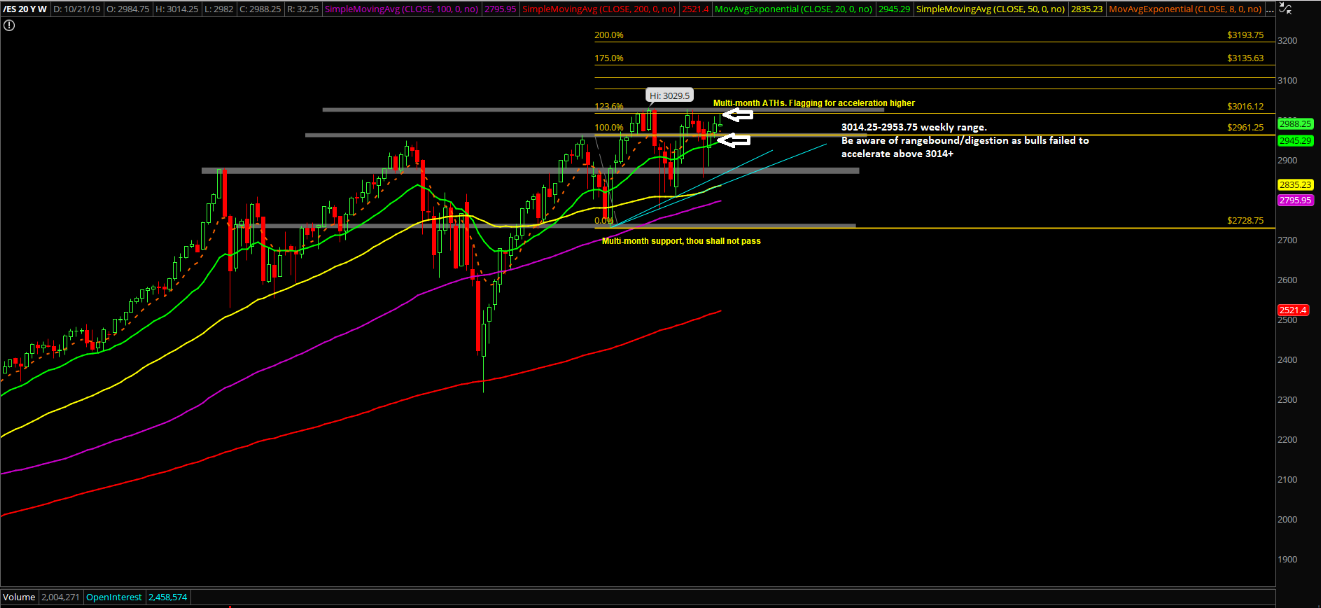

The main takeaway is the market continues doing the daily 8EMA grind and now the range could be expanded into 3014.25-2953.75 derived from Tuesday’s high and last week’s low. The immediate trend continuation setup into all-time highs (ATH's) has obviously been delayed/rejected given what occurred today with the backtest into support. The primary thing to focus on now would be the incoming backtest vs. the trending daily 20EMA 2970s -- that also matches with Friday’s low of 2975.

What’s Next?

Tuesday closed at 2988.25 on the ES, showcasing a rejection/bearish candlestick that closed just below the midpoint of Monday’s range. Price action is below the immediate trending supports signifying the immediate acceleration setup has been rejected or have been put on hold. Key points: