Market Overview: Weekend Market Update

The Emini finally broke above the tops of the bull channels on the daily, weekly, and monthly charts. The bulls want the year to close on its high after opening on its low. Because there is no credible top, the Emini will probably be sideways to up through December.

The bond futures market has been in a tight trading range for 9 weeks and a bigger trading range for 4 months. It is in Breakout Mode. More sideways price action is likely.

The EUR/USD weekly Forex chart reversed down on profit-taking on Friday. The bulls achieved their goal of 2 legs up to the bear trend line after the October 1 nested wedge bottom. It might pull back a little next week, but the 5 month trading range is likely to continue.

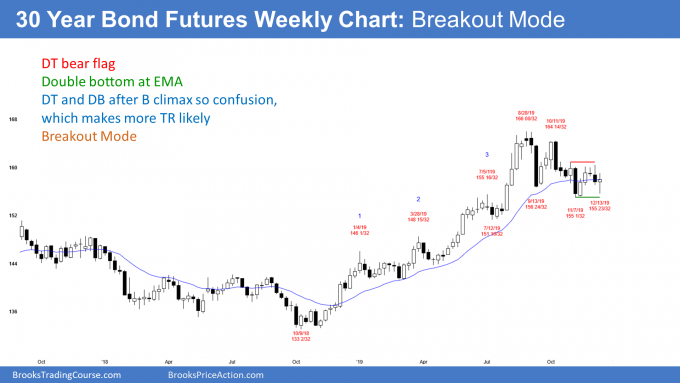

30 year Treasury bond Futures market: 9 week tight trading range on weekly chart

The 30 year Treasury bond futures weekly chart turned down last week with an outside down bar. This week went below that low of that bar and therefore triggered a minor sell signal.

However, the week reversed up on Friday and the weekly candlestick had a small bull body. This week is therefore just another bar in a 9 bar tight trading range. Because the body is small and there is a prominent tail on top, this week is a weak buy signal bar. There will probably be sellers not far above this week’s high. This is therefore probably not be the start of a major move up.

There is no sign on the weekly chart that the bond market is about to break out up or down. However, Friday was a big bull bar on the daily chart. There will probably be some follow-through buying next week.

9 week tight trading range so Breakout Mode

A 9 week tight trading range is a Breakout Mode pattern. There is always both a credible buy and sell signal. Most often, there is both a small double bottom and double top. This is the case now.

It is important to understand that there is no breakout until there is a breakout. Continued reversals every couple of weeks are more likely than a successful breakout.

Since the trading range is about 7 points tall, traders expect a 7 point move either above or below the range. Traders should understand that the probability is about the same for the bulls and bears. Furthermore, the 1st breakout up or down has a 50% chance of reversing.

Do not forget the monthly chart. I have mentioned many times that it has been making a major top over the past several years. There is no strong reversal down yet. Also, the bulls might get another minor new high. However, bonds will go down and interest rates will go up over the next 20 years. The nested wedge top on the monthly chart is clear and strong.

Weak selloff usually results in trading range

Even though the weekly chart has been drifting lower for 4 months, the selloff is weak. It lacks consecutive big bear bars closing near their lows. Furthermore, there have been several bull bars closing near their highs on the weekly chart since the August top. Also, many bars have prominent tails and overlap the prior one or two bars. Finally, there are reversals every 1 – 2 weeks.

When a selloff has these characteristics, it typically does not go far. This type of price action is more common when the selloff is a bear leg in what will become a trading range.

A trading range also has bull legs. Therefore, traders will continue to look for minor reversals every 2 – 3 weeks.

Since there is not sustained buying or selling, traders are taking quick profits. While the weekly chart is in an early bear trend, the trend is a fairly broad bear channel. It is also a bull flag. Traders trade it more like a trading range than a bear trend. They buy low, sell, high, and take quick profits.

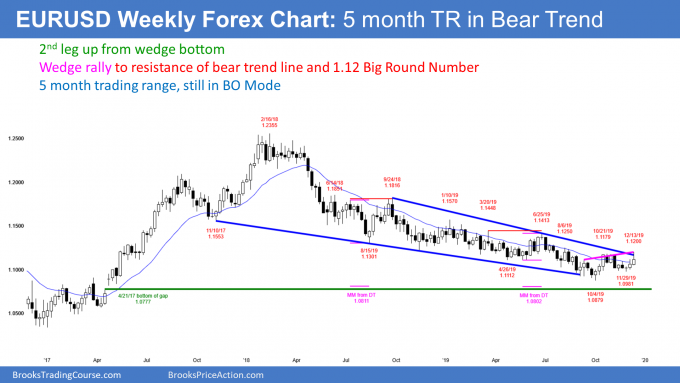

EUR/USD weekly Forex chart:

Profit-taking after 2nd leg up from nested wedge bottom

The EUR/USD weekly Forex chart reversed up from a nested wedge bottom on October 1. The 3 week rally in October was the strongest rally in 2 years on the weekly chart. Consequently, the bulls were likely to get at least a small 2nd leg sideways to up. The rally over the past 3 weeks fulfilled that minimum expectation.

The next important target for the bulls is the October 21 high. If the bulls can get 2 closes above it, they will then try to break above the June 25 high. That is a major lower high. When a bear rally breaks above a major lower high, traders conclude that the bear trend has evolved into a trading range or a bull trend.

The bears know the implications. They therefore will try hard to prevent consecutive closes above resistance. This is especially true of major resistance.

Profit-taking at resistance

For more than a month, I have been saying that the rally would test the 14 month bear trend line and probably the October high. It broke above both on Friday. I also said that it would test the 1.12 Big Round Number. Friday’s high was exactly 1.12.

The EUR/USD reversed down on the daily chart (not shown) on Friday, indicating that the bulls took profits. The bulls were not buying at the high, betting on a successful breakout. There will probably be some follow-through selling next week.

In addition, the bears sold, betting that the bulls would sell out of longs. Friday is now a sell signal bar on the daily chart. However, the chart is still in a 5 month trading range. If there is a selloff, it will probably last 2 – 3 weeks and test the November low.

Even if the bears break below the October low, the bulls will buy a reversal up. That has been a profitable strategy for 2 years and the odds are it would work again.

Trading range likely for many months

While the bulls have not done enough to create a bull trend, the weekly bear channel has never been strong. The bulls continue to buy reversals up from new lows, like they have been doing over the past year.

But what about the upside potential? The 2 month rally has not been especially strong. The daily chart has been in a trading range for 5 months. Traders expect a continuation of the 5 month trading range rather than a strong breakout up or down. They will continue to look for reversals ever 2 – 3 weeks.

This is true whether the bear channel continues or if the EUR/USD is in the early stages of a bull trend. The bulls need a strong, relentless breakout before they will buy high and hold for months. That is not likely after the 1st breakout above a tight bear channel.

The EUR/USD will probably be in a trading range for at least several more months. It is now in search of the top of the range.

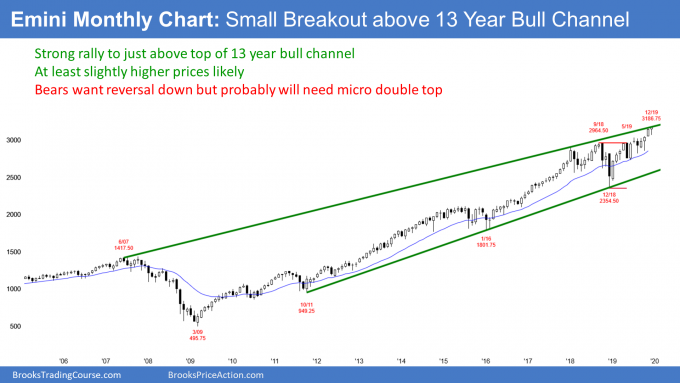

Monthly S&P500 Emini futures chart:

Small breakout above top of 13 year bull channel

The monthly S&P500 Emini futures chart finally broke above the top of its 13 year bull channel on Thursday. The breakout is small so far, but there are many days left to the month.

I had been saying for a couple months that the breakout was likely. But I also have been saying that there is only a 25% chance of a successful breakout above the top of a bull channel. By that, I mean an acceleration up into a stronger bull trend. The most dramatic example was the monthly chart in 1995. That breakout above a bull channel led to a huge bull trend.

In 75% of cases, there is a reversal down back into the channel within about 5 bars. An example of a reversal from a failed bull breakout above a bull channel happened in January 2018 on the weekly chart. The Emini eventually sold off 20% and went sideways for almost 2 years.

Five bars on the monthly chart is almost half a year. Therefore, the Emini could continue up for several more months before reversing down.

Breakouts usually overshoot before reversing

A breakout of a trend line or channel line on the monthly chart often goes several percent beyond the line before reversing. Therefore, this rally could continue up for 100 or more points before there is a swing down.

A swing down does not mean a bear trend. More often, the reversal down from above a bull channel is the start of a trading range. A common target is the middle of the channel.

The monthly chart had been in a trading range for 2 years. There was a smaller range within that range for 7 months in 2019. The bottom of that smaller range is the June low around 2800. If there is a reversal down within the next 6 months, that would be another reasonable support level.

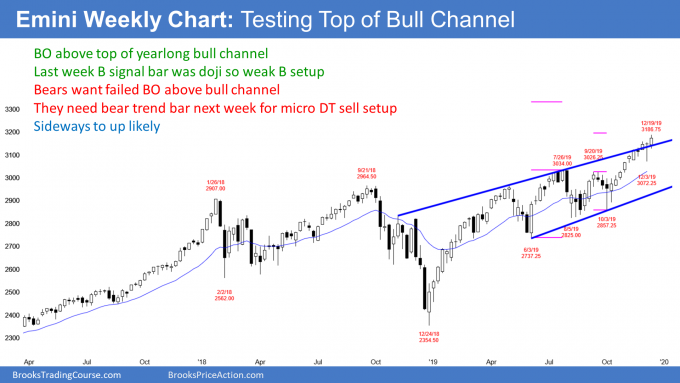

Weekly S&P500 Emini futures chart:

This week triggered High 1 bull flag buy signal

The weekly S&P500 Emini futures chart finally pulled back 2 weeks ago after 9 weeks without a pullback. I said that a 9 bar bull micro channel means that the bulls are very happy to buy for any reason.

That is why I have been saying for more than a month that the 1st pullback would only last 1 – 2 weeks and only fall 50 – 100 points. I said that the bulls would be eager to finally be able to buy below the low of the prior week. And the did. The Emini reversed up strongly from an 85 point selloff 2 weeks ago.

Since last week was a pullback in a strong bull trend, it was a High 1 buy signal bar. I said last week that this past week would probably go above last week’s high and trigger the buy signal. Furthermore, I said that the all-time high from 2 weeks ago was only a few points higher. That made it likely that a breakout above last week’s high would also break to a new all-time high. That is what happened on Thursday.

Higher time frame buy signal usually has a pullback

In the chat room on Thursday, I talked how the rally was very strong and it broke far above the prior week’s high. But I also said that when a higher time frame buy signal triggers, there is usually a pullback to below the top of the buy signal bar. Despite Thursday rallying about 25 points above the prior week’s high, the Emini then sold off briefly to below that high.

There was one other point that I made above last week. I said that when a buy signal bar has a small body and a big tail, the setup is weak. That often results in a weak entry bar. A weak entry bar either has a big tail on top or it has a bear body.

This week had a prominent tail on top, which was likely. However, the weekly chart is still in a strong bull trend. Therefore the odds still favor higher prices, even if the Emini goes sideways or pulls back for a week or two first.

Daily S&P500 Emini futures chart:

Small bull follow-through after Thursday’s big breakout

The daily S&P500 Emini futures chart had a big rally to above the top of a 13 year bull channel on Thursday. Friday had a bull body and it therefore confirmed the breakout. It increases the chance of at least slightly higher prices through December. However, Thursday was climactic and there might be a few days of sideways to down trading first.

The monthly chart is at the top of its bull channel, which is resistance. But, the next significant resistance on the daily chart is a measured move target based on the August 5/October 3 double bottom. The measured move projection is 3216.

If the Emini reverses down before reaching that target, traders would say that it formed an expanding triangle top. November 19 and November 27 are the other two highs in the pattern. Since the space between the 2nd 2 highs is much greater than that between the 1st 2, traders will conclude that the pattern is not reliable.

Probably any reversal down will be minor

What will happen if the Emini reverses down on the daily chart within the next month? The 1st targets are always the bull trend line, the EMA, and the most recent higher low, which came on December 3. When there is a reversal down from an expanding triangle top, the 1st target is the bottom of the triangle, which is that December 3 low.

Below that, support is the breakout point. That is the neck line of the double bottom, which is the September 19 high of 3027.25.

When a bull trend is as strong as the 2019 trend has been, traders expect reversals to be minor. That means that a trading range is more likely than a bear trend. Therefore, traders should expect sideways to up prices over the next month or more. Any reversal down will probably be minor.