Pre-Open market analysis

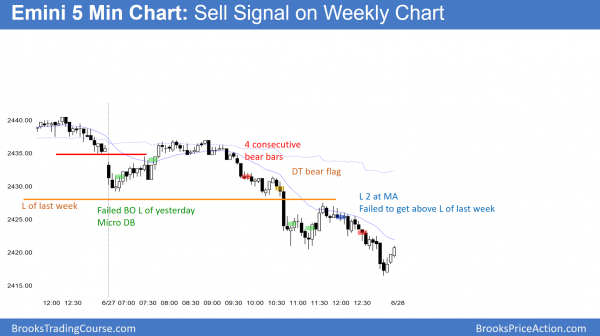

By trading below yesterday’s low, the Emini triggered a small double top sell signal. Furthermore, it fell below last week’s low. It therefore also triggered a sell signal on the weekly chart. The bears have about a 50% chance that this is the start of a 100 point pullback to below the weekly moving average. Yet, they need strong follow-through selling. Bear trends usually begin with a big bear trend bar. Day traders will be ready to swing trade if one unfolds this week.

Since yesterday was a bear channel, it was a bull flag. Furthermore, it was a wedge. While today could have strong follow-through selling, it will more likely break above the channel and test one or both of yesterday’s lower highs. A channel usually evolves into a trading range. Hence, today will probably be a bull leg in that developing range.

Friday is the end of the month. The Emini is just above the open of the month. If the Emini closes below the open, it would have a sell signal bar on the monthly chart as well.

Overnight Emini Globex trading

The Emini is up 6 points in the Globex market. The bulls want to rally above the bear channel and back above last week’s low. The bears want Friday to close below the open of the month. Their goal is to create a bear reversal bar on the monthly chart. Since both prices are important this week, the odds are that the Emini will stay in this area until Friday.

While there is a 50% chance of follow-through selling in the 1st 2 hours, there is a 75% chance of a trading range forming by the end of the 2nd hour. After yesterday’s wedge bottom, the odds are that today will have at least 2 legs sideways to up, lasting about half as many bars as yesterday’s selloff.

Yesterday’s setups