Pre-Open market analysis

Yesterday sold off from just below last week’s high. Since last week was a big doji bar, the odds of an inside bar on the weekly chart are higher.

While yesterday sold off, it found support at about a 50% pullback and the 60 minute 20 bar exponential moving average. Yesterday had mostly trading range trading and it was an inside day. The odds are that today will also me mostly an inside day. This is in part because of yesterday’s trading range and because of Wednesday’s FOMC Fed interest rate announcement.

Because yesterday was a bear inside day after Friday’s new high, it is a sell signal bar for a failed breakout. However, there have been many reversal attempts this year. Since most reversal attempts fail, the odds are that this one will as well. Yet, with the daily, weekly, and monthly buy climaxes now being the most extreme in history, the odds favor a 5% correction beginning before the end of the year.

Breakout Mode likely going into tomorrow’s FOMC announcement

Breakout mode means a trading range. All trading ranges have both a reasonably buy setup and a reasonable sell setup. The probability of a successful bull breakout is about the same as for a bear breakout.

Since tomorrow’s FOMC announcement is an important catalyst, the odds are that the Emini will begin to enter Breakout Mode going into the event. This increases the chances of more trading range trading after yesterday’s 4 hour range. Because the daily chart is in a strong bull trend, the odds continue to favor higher prices. But, since the daily, weekly, and monthly charts have never all been this overbought before, the odds are that the Emini will soon pullback about 5%.

Overnight Emini Globex trading

The Emini is up 4 points in the Globex market. The bulls see yesterday’s selloff as a bull flag after last week’s rally. The bears do not yet have a clear topping pattern, but will get one if yesterday’s 4 hour trading range continues today.

Yesterday’s setups

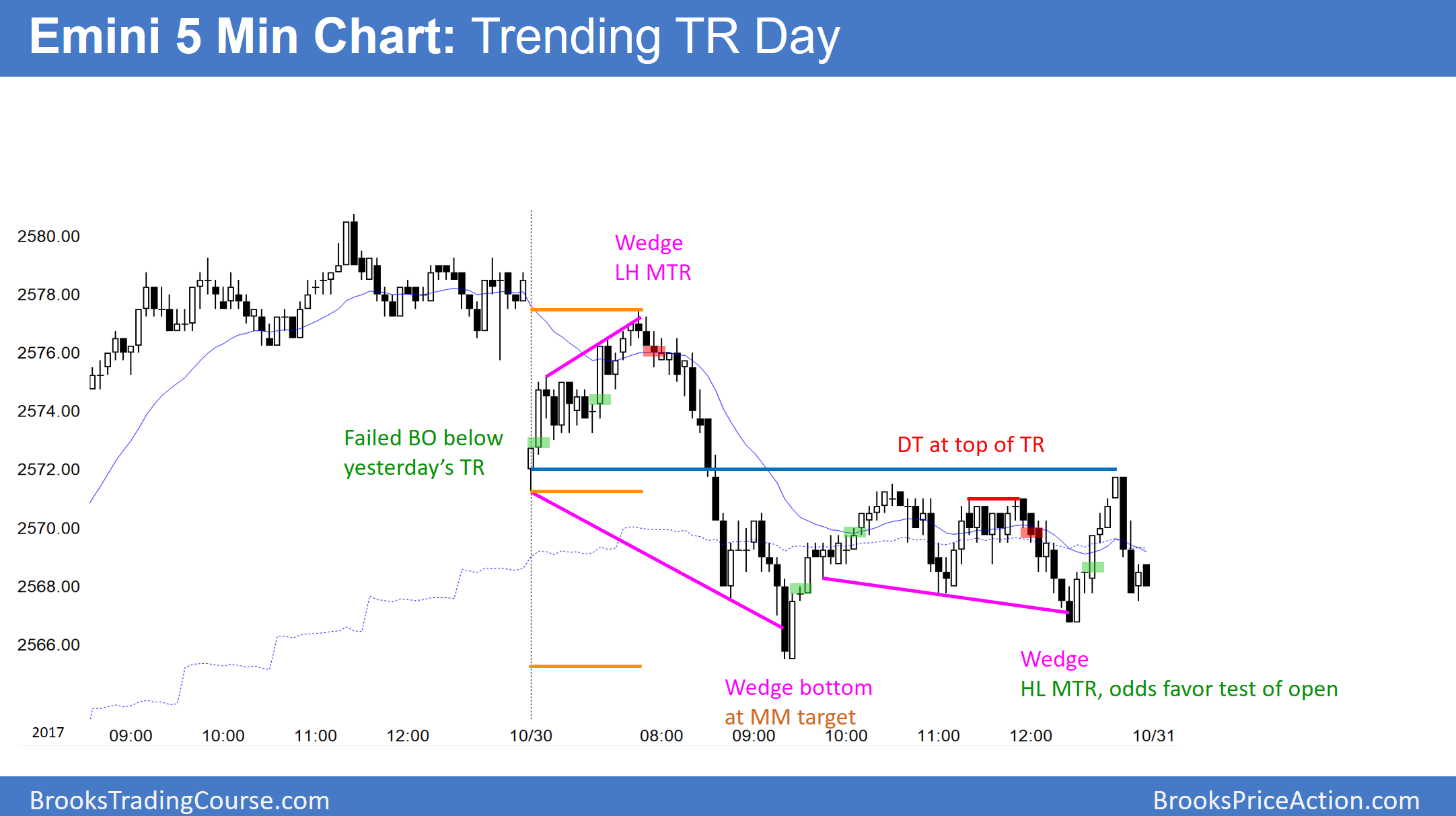

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.