Emini bull flag in buy climax after FOMC Fed rate hike

I will update around 6:55 a.m.

Pre-Open market analysis

The Emini is in a bull trend on all higher time frames. Furthermore, Thursday was a strong bull trend bar on the daily chart that reversed up from the daily moving average. In addition, it was a double bottom with the low from the week earlier. It is therefore a buy signal bar in a bull trend.

Yet, because the weekly chart is so exceptionally overbought, the odds are against a big breakout above the all-time high. In addition, there is a nested wedge top on the daily chart. Hence, the Emini will probably begin to trade down to the March low soon. That will probably become the bottom of a trading range that lasts for several months. However, there is no top yet. In addition, the Emini might make one more new high before reversing down.

Overnight Emini Globex trading

The Emini is up 8 points in the Globex market. Today will therefore probably gap up. The reversal up from the daily moving average on Thursday was strong. Furthermore, the momentum up in May was strong. The all-time high is only a few points above the current price. Consequently, the Emini will probably test and break above the all-time high today or tomorrow.

Yet, because the weekly chart is so unusually overbought, the bull breakout will probably fail. The June trading range will therefore likely be the final bull flag.

If there is a reversal down from a new high, the 1st target is the bottom of the final flag, which is the June 9 low. Since the March – April trading range will probably be a larger final flag, the next target would be the March 27 bottom of that trading range.

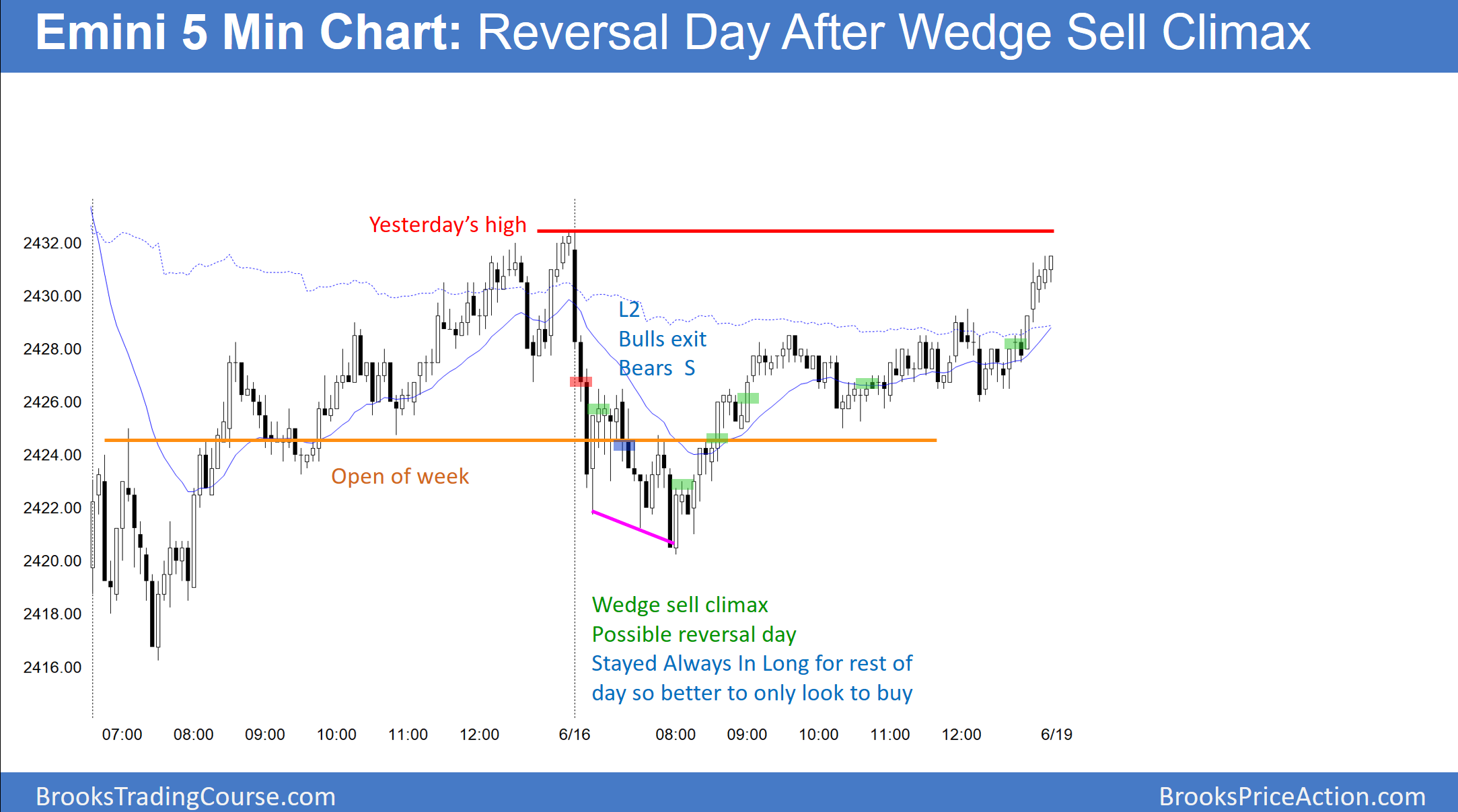

Here are several reasonable stop entry setups from Friday. The Emini reversed down strongly from a test of Thursday’s high. It then rallied from a wedge bottom to form a reversal day.