Pre-Open market analysis

The Emini reversed up on Friday. Yet, the daily chart has had 10 bear bars in the past 13 bars. Hence, this is increasing selling pressure. It therefore increases the chances of a bear breakout below the month long trading range. Since the weekly chart now has 3 consecutive bear bars, the odds are that the Emini has begun its pullback to the weekly moving average.

June is a sell signal bar on the monthly chart. Therefore the bulls want a break above the June high instead of below the June low. In addition, the Emini has mad several minor lower highs since the June 19 all-time high. This is therefore an early bear trend on the daily chart. Consequently, the bulls want a strong break above one or more of those lower highs to erase some of the bear argument.

The most recent is the July 3 high of 2436.50. That is the neck line of a double bottom bull flag on the 60 minute chart. If the bulls can break strongly above it, they then will probably make a new all-time high. Furthermore, the rally would probably continue to the next major resistance, which is the 2,500 Big Round Number.

Overnight Emini Globex trading

The Emini is unchanged in the Globex market. In addition, it is in the middle of a month-long trading range. Therefore day traders expect reversals every day or two.

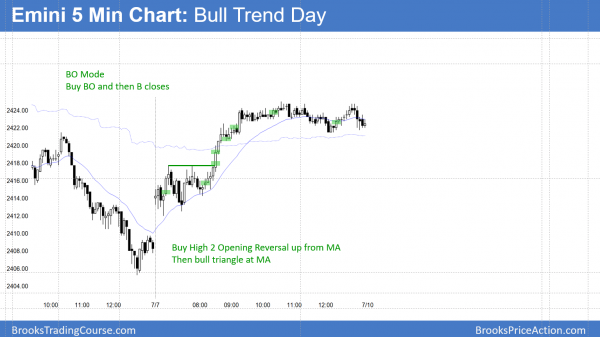

Since Friday was a bull trend day, there is a 50% chance of follow-through buying in the 1st 2 hours. Yet, there is also a 75% chance of at least a couple of hours of sideways to down trading that begins by the end of the 2nd hour. Furthermore, Friday was in a tight range for 4 hours. That increases the odds of more trading range trading today.

In addition, if there is a bull breakout, that trading range will probably be the final bull flag. Hence, the bull breakout will probably reverse back down before the rally goes above either they July 3 minor lower high or the all-time high.

Last Friday’s setups