Pre-Open Market Analysis

Yesterday reversed up sharply from below Monday’s low and exactly at a 10% correction from the all-time high. After rallying back up above the December close and to the January low, it reversed back down again. However, it rallied strongly at the end of the day, and the day closed near its high. It is therefore a good buy signal bar for the bulls today.

At the moment, the odds still slightly favor at least a small 2nd leg down within a month. But, a big bull day today will shift the odds in favor of the bulls. They see this selloff as a 2nd leg bear trap in a bull trend on the daily chart. The 1st leg was small and the 2nd leg was huge, which often happens.

Yesterday met all of the objectives that I have been discussing for the past few months. The Emini had its 5% correction (in fact, it was 10%). In addition, it fell below the 20-week EMA and below last month’s low. Therefore, the bulls might buy aggressively here. We’ll know within a few days if the bulls will rally back up to a new high. The big rally in January, Monday’s big selloff, and now Tuesday’s big reversal up create confusion. Confusion usually means a trading range. Consequently, the odds favor a few sideways days.

The swings up or down today will probably be big again. If the bars are about 10 – 20 points tall, most day traders should wait because that is too much risk for a small account.

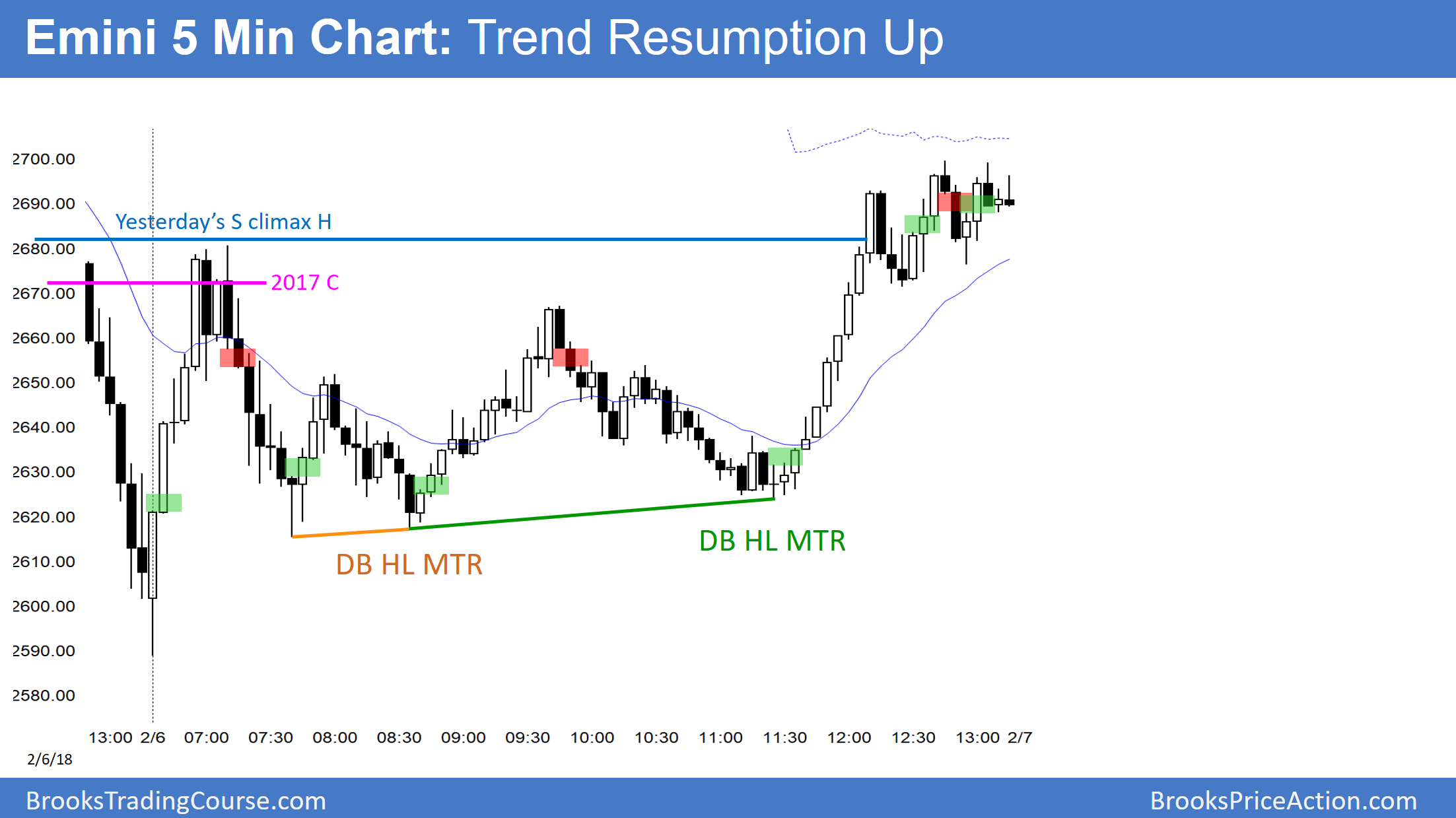

Overnight Emini Globex Trading

The Emini is down 14 points in the Globex session. Most reversals lead to trading ranges. Monday reversed down and Tuesday reversed up. This make a trading range likely for a few days. As a result, traders will look for reversals after a swing up or down lasts 2 – 3 hours.

The bulls want today to be a huge bull trend day. That would make it likely that the bull trend is resuming. More likely, any 2 – 3 hour rally will reverse and the day will be a trading range day.

After yesterday’s strong rally, today will probably not reach yesterday’s low. If there is a selloff, it will either form a trading range with yesterday or reverse up after a few hours.

Traders always have to be ready for trends, but today will more likely be confused after 2 big reversals. This means trends up or down will probably reverse. The result will then be a trading range day.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.