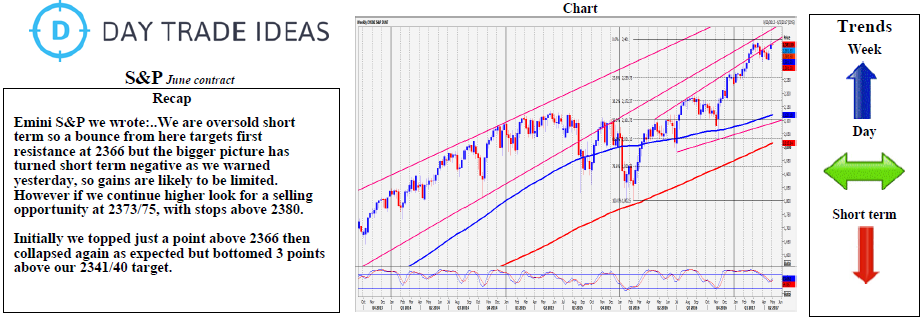

Emini S&P strong bounce from 2345 reached our selling opportunity at 2373/75 and this trade worked perfectly as we topped exactly here. We have dipped so far to 2362 but below here meets quite good support at 2355/53. A break below 2348 is more negative and we may then break yesterday's low at 2345/44 for 2341/40 and perhaps as far as 100 day moving average support at 2335/34. Just be aware that any further losses in to next week target the April low at 2323 then better support at 2318/16.

A weekly close below 2348 would be a short term sell signal for the start of next week.

Resistance at 2374/75 could hold again but shorts need stops above 2380. We then meet minor resistance at 2385/86. Above here clears a path to 2394/96 before the all time high at 2403/2404.50