Pre-Open market analysis

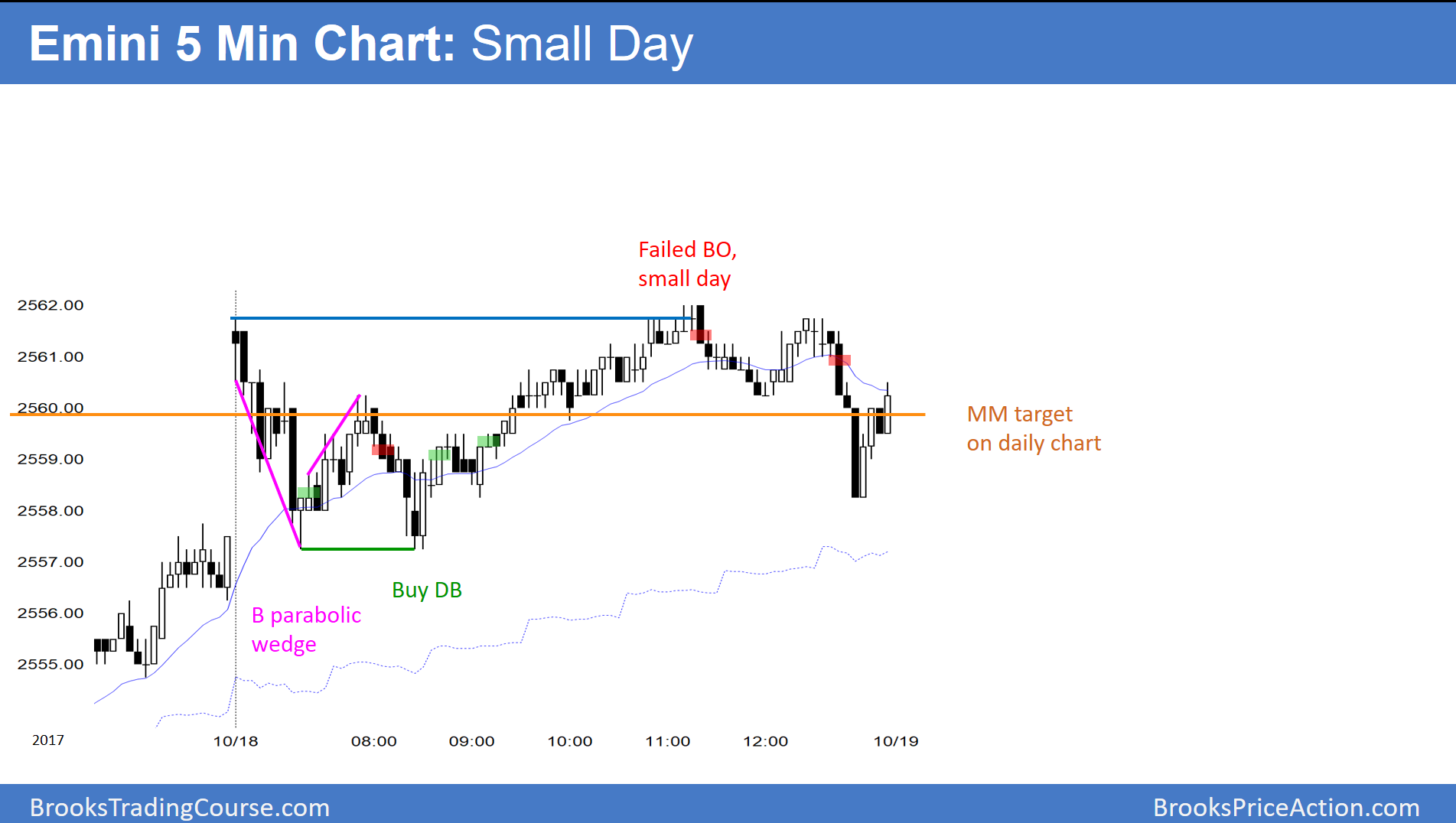

Yesterday broke above the measured move target on the daily chart. Yet, the breakout was small. It was the 9th day in the wedge bull channel. While a small wedge top is usually a minor reversal, this one has a higher chance of a major reversal. This is because the buy climaxes on the weekly and monthly charts are the biggest in the past 50 years. That increases the chances of a 1 – 3 bar pullback on the monthly chart, which would be a major reversal on the daily chart. There is an increased chance of a reversal within the next couple of weeks.

However, even once the bears get a 100 – 200 point pullback, it will still only be a small bull flag on the monthly chart. There are buyers below.

Overnight Emini Globex trading

The Emini is down 11 points in the Globex market. Since last week was small, there is a chance that the Emini could trade below last week’s low. That would create an outside down week this week and increase the chance that a 100 – 200 point pullback has begun. However, until there is a strong bear breakout with strong follow-through, the odds are that every selloff will be brief. Since the weekly and monthly charts are so extreme, the odds of a successful reversal are going up. Day traders should be ready to swing trade their shorts if today becomes a big bear day.

Big gap down?

A big gap increases the chances of a big trend day. When the gap is down, if there is a trend day, it is slightly more likely to be a bear day. Traders will be ready to swing trade on the open. They will buy for a possible low of the day if there are big bull bars on the open, hoping for a failed break below yesterday’s low and a reversal up.. Likewise, they will sell if there are big bear bars on the open, hoping for a trend from the open bear trend.

When there is a big gap down, instead of an immediate trend up or down, the Emini often goes sideways for an hour or so. The bulls will try to create a wedge bottom or a double bottom, and the bears will try to create a double top or wedge top near the moving average.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.