I will update around 6:55 a.m.

Pre-Open Market Analysis

Congress shut the government down over the weekend, but the Emini is unchanged this morning. Friday broke above Thursday’s high. Since Thursday was a bear bar on the daily chart, it was a weak buy signal bar. That means that there are typically more sellers than buyers above its high. However, the bull trend is extremely strong and that is more important.

The weekly chart last week was a bull doji and it followed 2 big bull trend bars. It is weak follow-through buying, but a bad sell signal bar. Until there are consecutive big bear bars on the daily chart, the odds continue to favor higher prices.

Overnight Emini Globex Trading

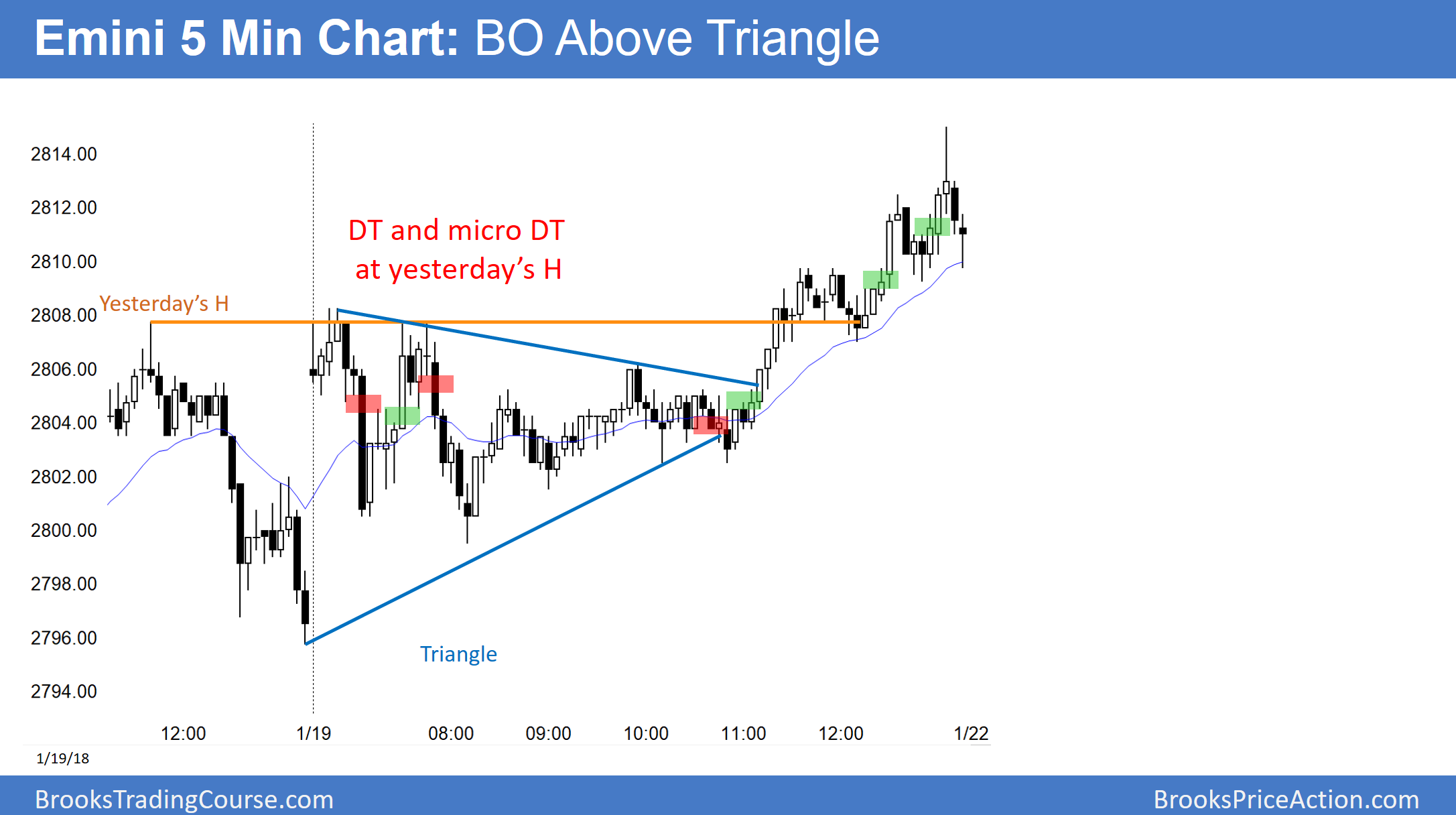

The Emini is down 1 point in the Globex market. Friday ended with a wedge top and a small leg down on the 5-minute chart. The odds are that there will be at least a small 2nd leg down today that tests the bottom of the wedge, which is around 2807.

The 60 minute chart also has a wedge rally. The bottom of the wedge is 2769.25, which is last week’s low. Since a wedge is a channel and channels usually evolve into trading ranges, the odds favor a reversal down on the 60 minute chart this week. Consequently, there is an increased chance of a bear trend day today or tomorrow.

However, the buy climaxes on the daily, weekly, and monthly charts have been stronger than any in the history of the stock market. Therefore, there is a 50% chance of a breakout above the wedge and then a measured move up to around 2860 over the next 2 weeks.

Friday’s Setups

Here are several reasonable stop entry setups from Friday. I sometimes also show limit order entries and entries on the close of bars.