Street Calls of the Week

Pre-Open market analysis

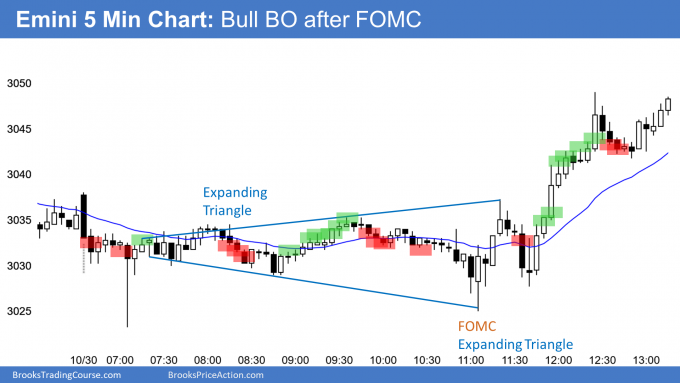

Yesterday sold off on the open and closed the gap above Friday’s high and last week’s high. The Emini was in a trading range day until the FOMC announcement.

After the 11 am PST report, the bulls rallied to a new high of the day. Furthermore, the rally went above Tuesday’s high. That means there are consecutive outside bars on the daily chart. Yesterday is, therefore, a buy signal bar for an oo bull flag. If today goes above yesterday’s high, it would trigger the buy signal. Traders would then expect sideways to up trading for several more days.

The bears want today to be a bear inside day. Today would then be an ioi (inside-outside-inside) sell signal bar for tomorrow. Traders would wonder if this week’s breakout to a new all-time high might fail.

Overnight Emini Globex trading

The Emini is down 5 points in the Globex session. Since yesterday was a buy climax day, there will probably be some profit-taking today. Traders expect at least a couple hours of sideways to down trading to begin by the end of the 2nd hour. It might begin on the open.

Today is the last day in October. October is now an outside up month. The bulls would like October to close above the September high. That would be a sign of strong bulls and increase the chance of higher prices next month. In addition, they would like the month to close above the July high as a further sign of buying pressure.

The Emini is now about 11 points above the July old all-time high. That former all-time high is close enough to be a magnet today. That increases the chance of at least a small bear trend day today.

Since the bulls have already accomplished their goals, they do not need another big bull day today. Therefore, today will probably not be a strong follow-through buying day, despite yesterday’s late rally.

Yesterday’s setups