Pre-Open Market Analysis

Traders hope that January is a barometer for the year. However, this is an unreliable indicator. A more important indicator is the strong bull trend in 2017. The odds favor higher prices, even if there is a 10 – 20% correction in 2018. More likely, the biggest correction will be 5 – 10%.

There are 2 days left to the month and the month has been exceptionally strong. Consequently, the bulls might take some profits. If so, today and tomorrow might be sideways to down. Yesterday was a bear inside day in a parabolic wedge top. Furthermore, the buy climaxes on the daily, weekly, and monthly charts have never been this extreme. Therefore, the odds favor a 5% correction beginning within the next few weeks. With the January rally being so extreme, the environment is good for a pullback.

Can this rally continue up to 3,000 without a 5% pullback? Of course. However, it is already more overbought than any other time in the history of the stock market. That increases the odds of a 5% pullback in February or March. Yet, the bull trend is so strong that the bulls will buy the reversal down even if it is dramatic. For example, if there is a 100 point selloff over 2 – 3 days, the bulls will buy. This is because they know the odds are that the selloff will be followed by a new high.

Overnight Emini Globex

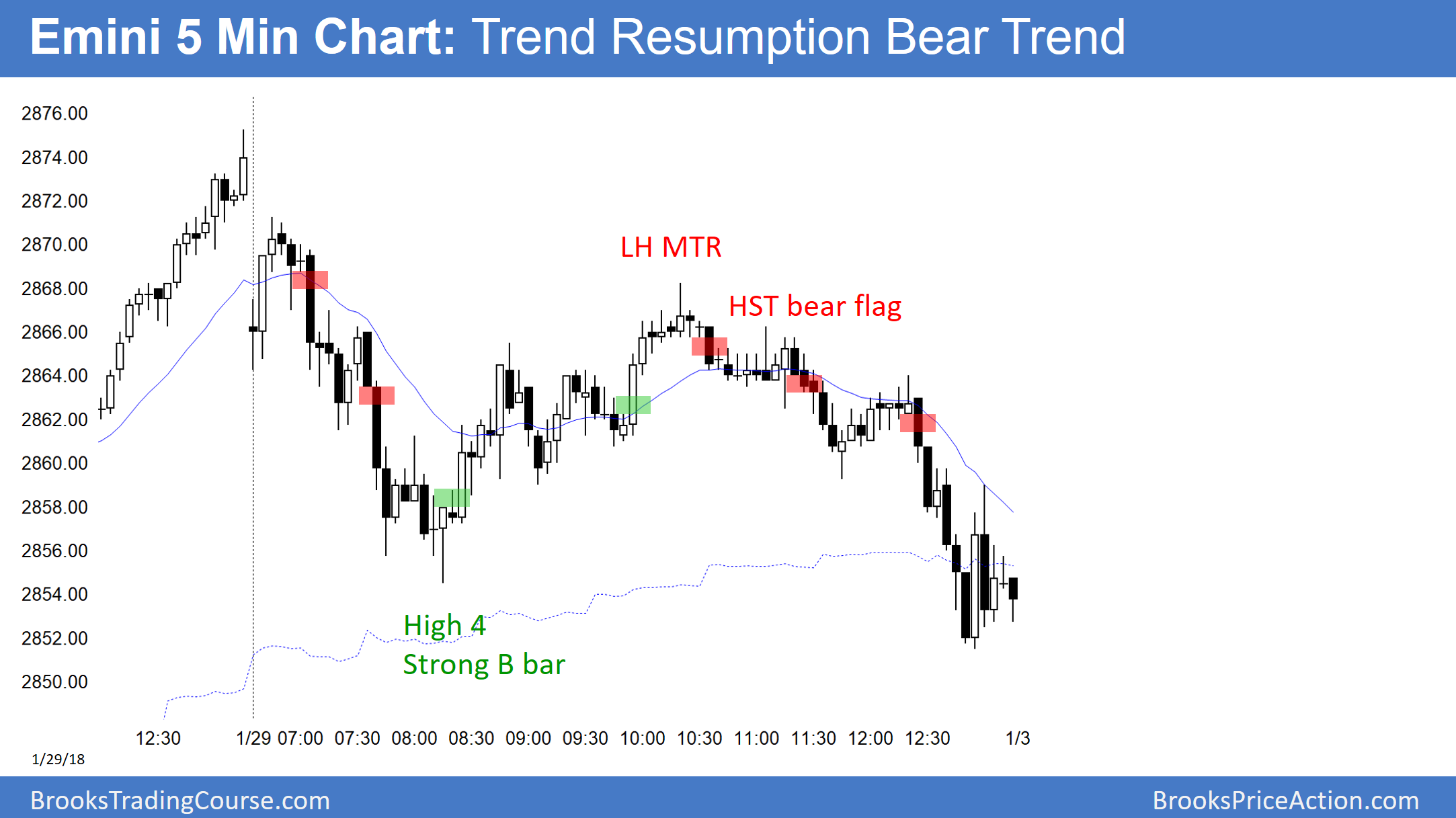

The Emini is down 14 points in the Globex session. It will therefore probably open below yesterday’s low. Since yesterday is a sell signal bar, the open will trigger the sell signal. However, the bull trend is exceptionally strong on the daily, weekly, and monthly charts. Therefore, the bulls will be eager to buy a selloff, even if it is deep and fast, like 100 points over a week.

Because there is an increased chance of a quick pullback, the bears will look for signs of a bear trend day, and then swing trade at least part of their short trades.

The bulls know that no matter how strong any selloff is, there are buyers below. This increases the odds of sharp reversals up from even strong selloffs. However, if these strong rallies start to form lower highs, they will begin to believe that a 5% correction is unfolding. They will then take profits on rallies and only look to buy reversals up from selloffs.

Support Here Down To 2750

Even if the Emini opens 10 points below yesterday’s low, it would still be at the bottom of a 6 day tight trading range. Hence, it would be at support. The bulls will therefore look for a rally up from this level.

The bears need a strong break below 2825 before the bulls will believe that the selloff will test the next support at 2769.25, which is the January 16 major higher low. That is also around a 50% pullback from the January rally. That would only be a 3.7% correction. A 5% correction is likely in the 1st several months this year. If the 5% pullback has begun, 2750 is 5% down from the high.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.