Pre-Open Market Analysis

The Emini gapped down yesterday, but then traded sideways. The 2-day pullback was probably profit-taking after a very strong month. Today is the last day of the month and there might be more profit-taking.

However, yesterday was not a strong bear trend day, despite the big gap down. The bulls want a rally today to make the month close on its high. If today gaps above yesterday’s high, yesterday will be a 1-day island bottom.

The 2-day selloff is only about 2%. Many bulls will buy it since the bull trend is so strong on the daily, weekly, and monthly charts. Yet, the buy climaxes have never been this extreme. Consequently, the odds favor a 3 – 5% correction over the next 2 months. Therefore, even if today reverses up, the odds are that traders will sell the test of last week’s all-time high.

If the selloff continues for a week or two and reaches 5%, the odds are that the bulls will buy it. This would then probably lead to a new high.

Overnight Emini

The Emini is up 10 points in the Globex market. It might therefore gap above yesterday’s high. If so, yesterday would be a 1-day island bottom. While slightly bullish, the gap up will be small. This makes it likely to close shortly after forming. Furthermore, the odds are that the Emini is in the process of pulling back to 2725 (a 5% correction). This means that there will be sellers above yesterday’s high and above the all-time high.

The bulls need a strong breakout above the all-time high to convince traders that the bull trend on the daily chart is intact. Since the 2-day selloff was deep, the odds are that there will be sellers above and at least a small 2nd leg down. Consequently, the bulls will sell rallies to take profits and the bears will sell rallies, expecting at least a small 2nd leg down. Even if there is a strong bull trend today or tomorrow, the bulls and bears will likely see it as an opportunity the sell. The odds favor sideways to down for at least a week or two, even if there is a new high first.

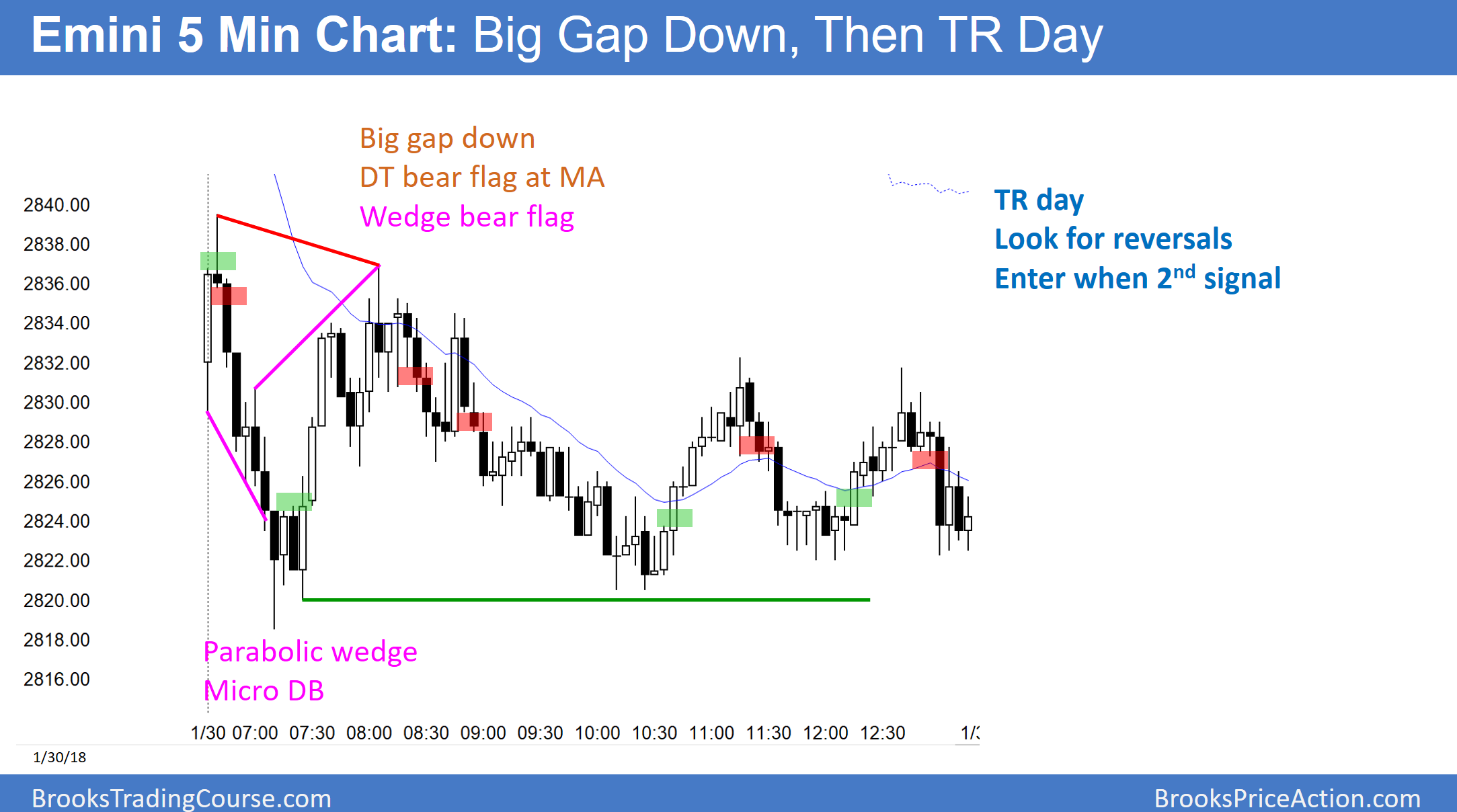

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.