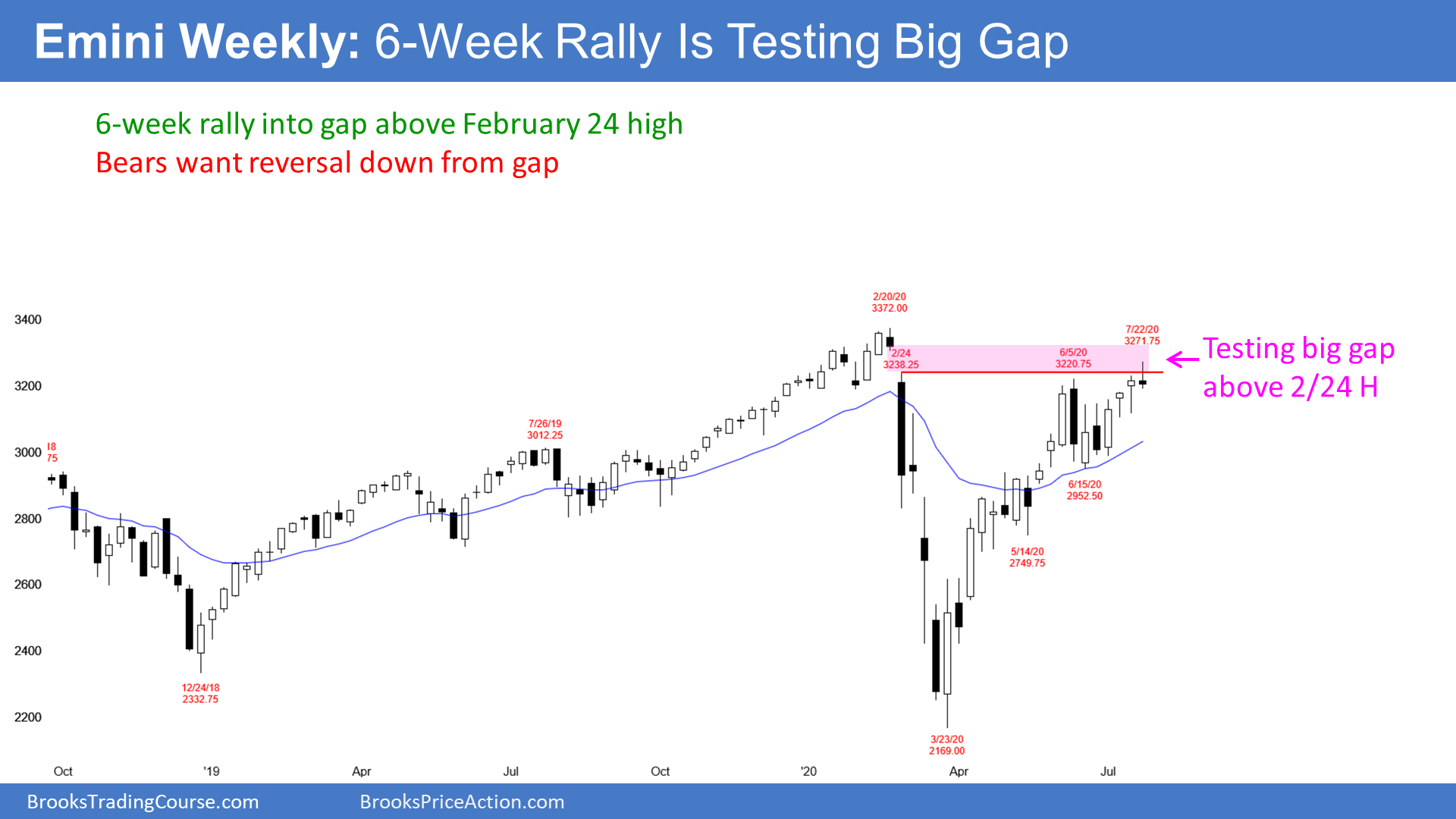

The Emini is stalling in the gap above the February 24 high, as I said was likely. There is a 50% chance of a reversal down to the middle 3rd of the 3 year trading range beginning within a few weeks before there is a new high.

Bond futures have worked higher relentlessly for 8 weeks. Even though the price is not much higher, the persistence increases the chance of a bull breakout. Small but relentless trends sometimes accelerate into clear, strong trends.

The EUR/USD Forex market broke to a new 52 week high and it is no longer in a bear trend. It should soon test 1.18, but it then might evolve into a big trading range.

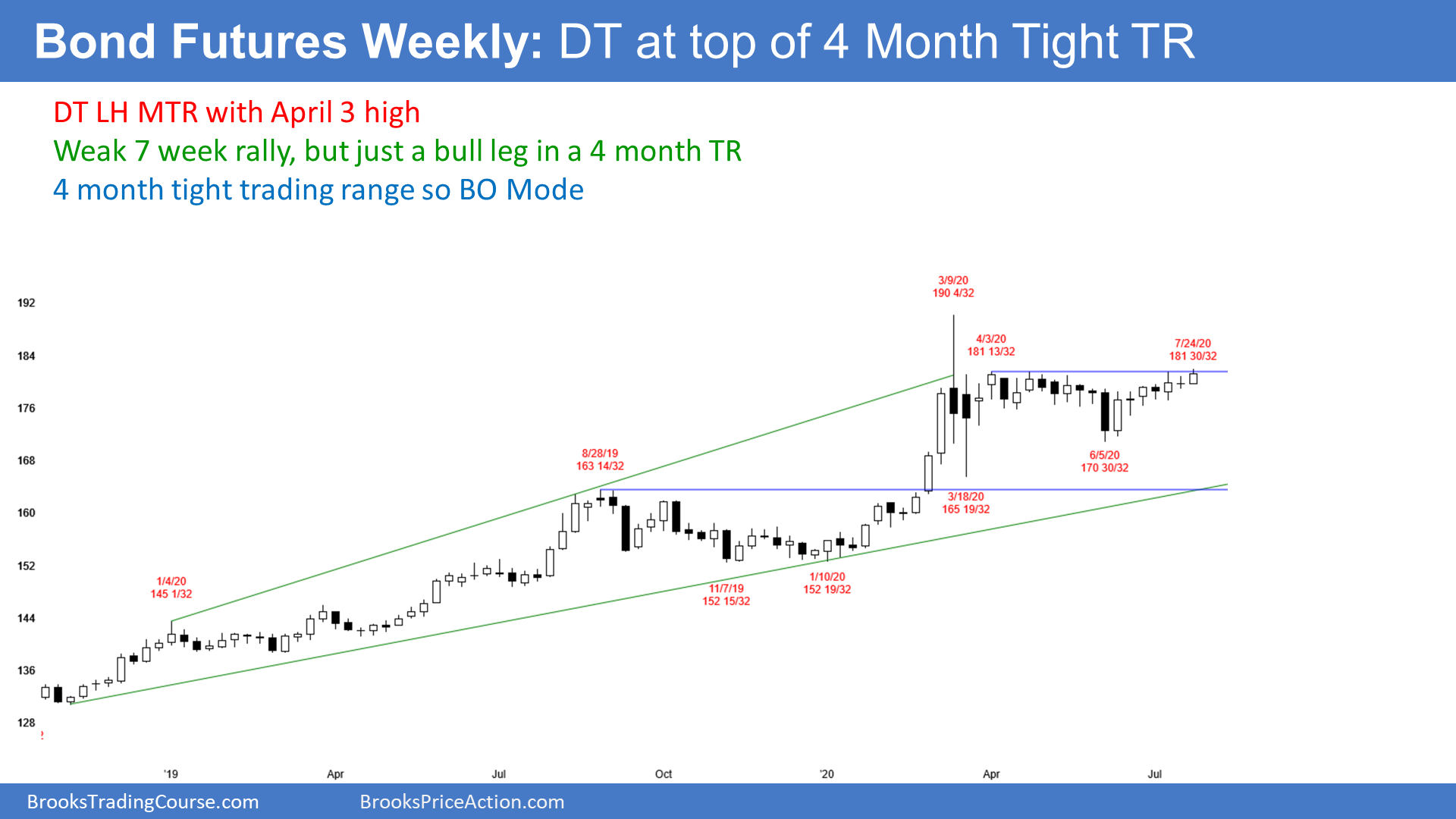

30 year Treasury Bond futures weekly chart:

8 bar bull micro channel

This week’s low on the 30 year Treasury bond futures weekly chart was above last week’s low. This is the 7th consecutive week with rising lows. There is now an 8 week bull micro channel on the weekly chart.

It’s not perfect because the low 3 weeks ago was 3/32 below the low of the week before. But on the monthly chart, that is minimal. Most things in trading are less than perfect. But the closer they are to perfect, the more traders expect the market to behave like the perfect pattern. The rally is close enough to a micro channel to use that term.

While the price has not been rising quickly, the bulls have been persistent. It is important to remember that the chart is not just a price chart. It is 2 dimensional and time is the 2nd variable. Sometimes time is more important than price. Time can occasionally tell traders that a trend is beginning before price makes it clear. This could be an example.

Possible short covering rally soon

When there is a bull micro channel with very little gain in price, the bears short what they think is a weak bull trend. But it is not weak. What often happens is that the shorts get squeezed and the bull trend accelerates up.

The bears see that there is a lot of room to the March high and they do not want a huge loss. They become concerned by the persistent drift upward and buy back their losing shorts.

A bull micro channel often leads to an acceleration up due to short covering. Consequently, there is an increased chance of a near-term bull breakout above the 8 week bull channel.

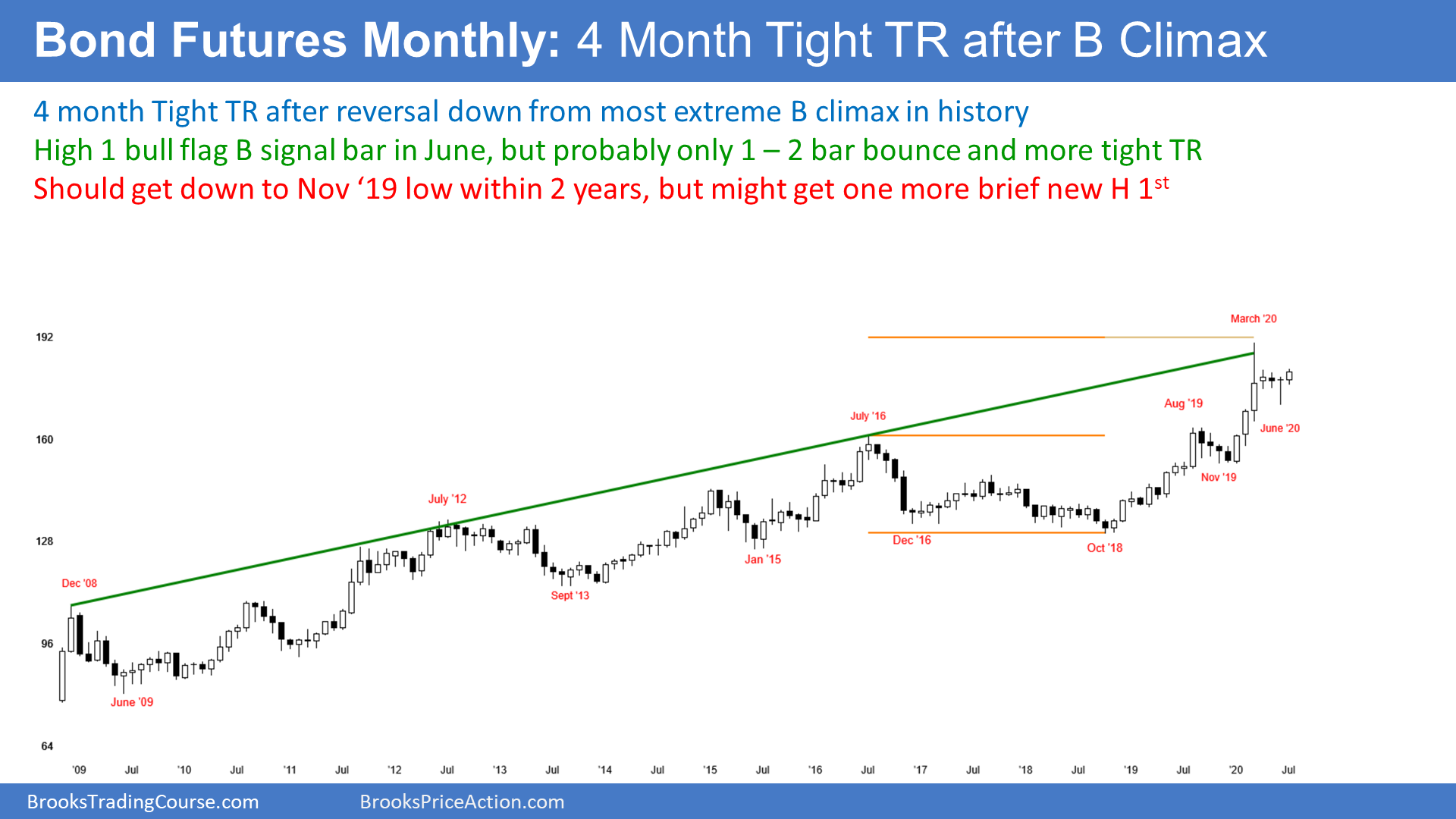

Monthly chart has High 1 bull flag

I talked about June being a pullback from the rally to the March high. That made it a High 1 bull flag buy signal bar. July triggered the buy by going above the June high. July is therefore the entry bar.

With one week remaining to the month, July is a bull bar closing above its midpoint. While is is not a big bull bar, if it looks like this when the month closes on Friday, traders will expect at least slightly higher prices in August.

As climactic as the January to March rally was, it was still only a 2nd leg up. Buy climaxes often end as wedge tops, which means a 3rd leg up. The bulls are hoping that June was the start of the 3rd leg up to above the March high.

But unless either July or August is a big bull bar closing near its high, the 2 month rally will more likely form a lower high. The odds are that the March buy climax was extreme enough to lead to a yearlong trading range and not just a 3 month pullback.

ii was a sell signal, but it is now a buy signal

June broke below an ii pattern on the monthly chart after the reversal down from the March buy climax. April and May were consecutive inside bars (inside-inside, or ii), which is a Breakout Mode pattern. The sell signal triggered when June traded below the May low.

The bond futures this week broke above that ii. When an ii sell signal fails like this, the breakout above the ii is then a buy signal. In addition to the High 1 bull flag in June, there is now an ii buy signal in July.

That could be what the bulls need to accelerate up above the weekly bull micro channel. But if instead the bonds turn down next week, there would be a micro double top with the April high. This would be 2nd sell signal (the ii was the first). Traders should find out within the next 2 weeks.

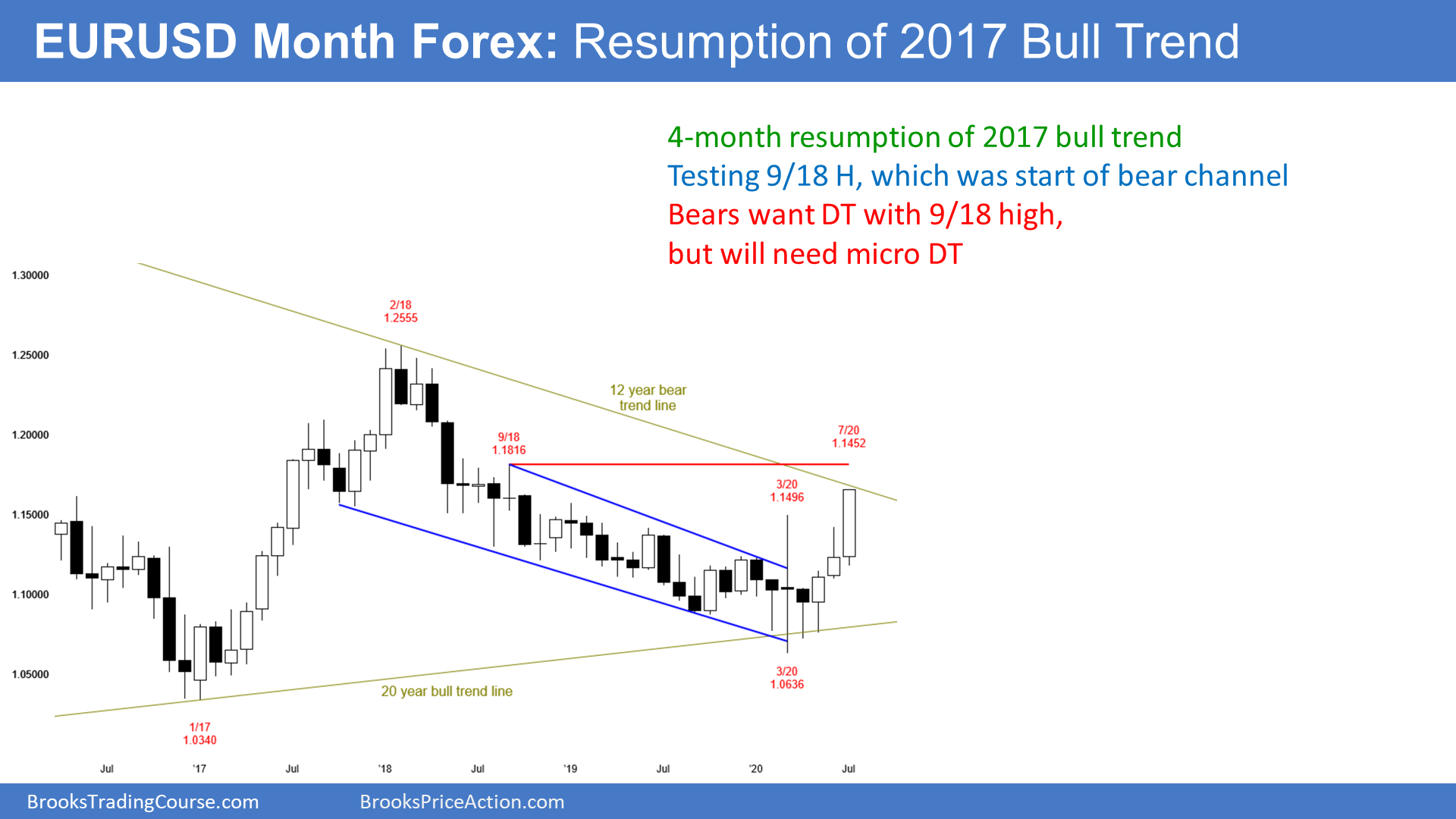

EUR/USD Forex weekly chart:

Strong breakout to new 52 week high

The EUR/USD Forex weekly chart has had consecutive big bull bars closing near their highs. In addition, this week closed far above the March high. That high was a 52 week high. More importantly, it was the final major lower high in the 2 year bear channel. Traders now believe that the 2 year bear trend has ended.

When a bear trend ends, a market is either in a bull trend or a trading range. It often is in both. At the moment, the rally is strong and traders see it as a bull trend.

The next target is the September 2018 high. That was the 1st pullback after the strong reversal down (bear spike) from the February 2018 high. It was therefore the start of the 2 year bear channel. The selloff from the February 2018 high was a Spike and Channel Bear Trend.

Spike and Channel Bear Trend typically evolves into a trading range

The monthly chart is reversing up from a higher low major trend reversal. The bulls want the rally to continue to far above the February 2018 high.

But when a market reverses up from a bear channel, the 1st target is the start of the channel. Here, on the monthly chart, that is the September 2018 high of 1.1816. Once the rally reaches the target, the bulls often take profits.

Also, the bears know that a bear channel began at that price 2 years ago. They expect that traders will sell there again.

So there are bears selling into shorts as well as bulls selling out of longs. That typically results in at least a minor reversal down. It also generates confusion.

Consequently, what usually happens is that the rally stalls and the chart turns sideways. The rally becomes a leg in a big trading range, and traders look back at the 2 year bear channel as a bear leg in the trading range.

If the EUR/USD Forex market stalls around 1.18, it will probably be in a trading range for at least another year. The top of the range should be around 1.18, but it might be back at the February 2018 high at around 1.25. The bottom is just about 1.06, but the odds are against a test of that level for at least a year.

Monthly S&P500 Emini futures chart:

Bull bar breaking above June high

The monthly S&P500 Emini futures chart in July so far is a bull bar closing near its high with one week remaining. It broke above the June high, but pulled back below that high at the end of the week.

It is important to note that June had a big tail on top. That represents profit-taking, which means that the bulls were less aggressive.

Also, May had a smaller body than April and June had a smaller body than May. Shrinking bodies is a sign of loss of momentum.

This is taking place near the top of a 3 year trading range, which is resistance. The bulls can reestablish the momentum by having July close on its high and far above the June high. If the Emini simply goes sideways for the final week of July, the monthly bar will be strong. Traders will expect higher prices in August.

Next week is important

There is always a bear case. What happens if the tail on the top of June and the shrinking bodies are still important?

One sign of that would be if July closed far below the June high and had a big tail on top, like June. Traders would then see a micro double top with the June high and a big double top with the February high. They would suspect that August might trade down.

Consequently, this coming week is important because it can affect what August does. If the bears can get a strong reversal down, it could lead to further selling in August. But if the bulls can keep the Emini where it currently is, traders will look for a new all-time high in August.

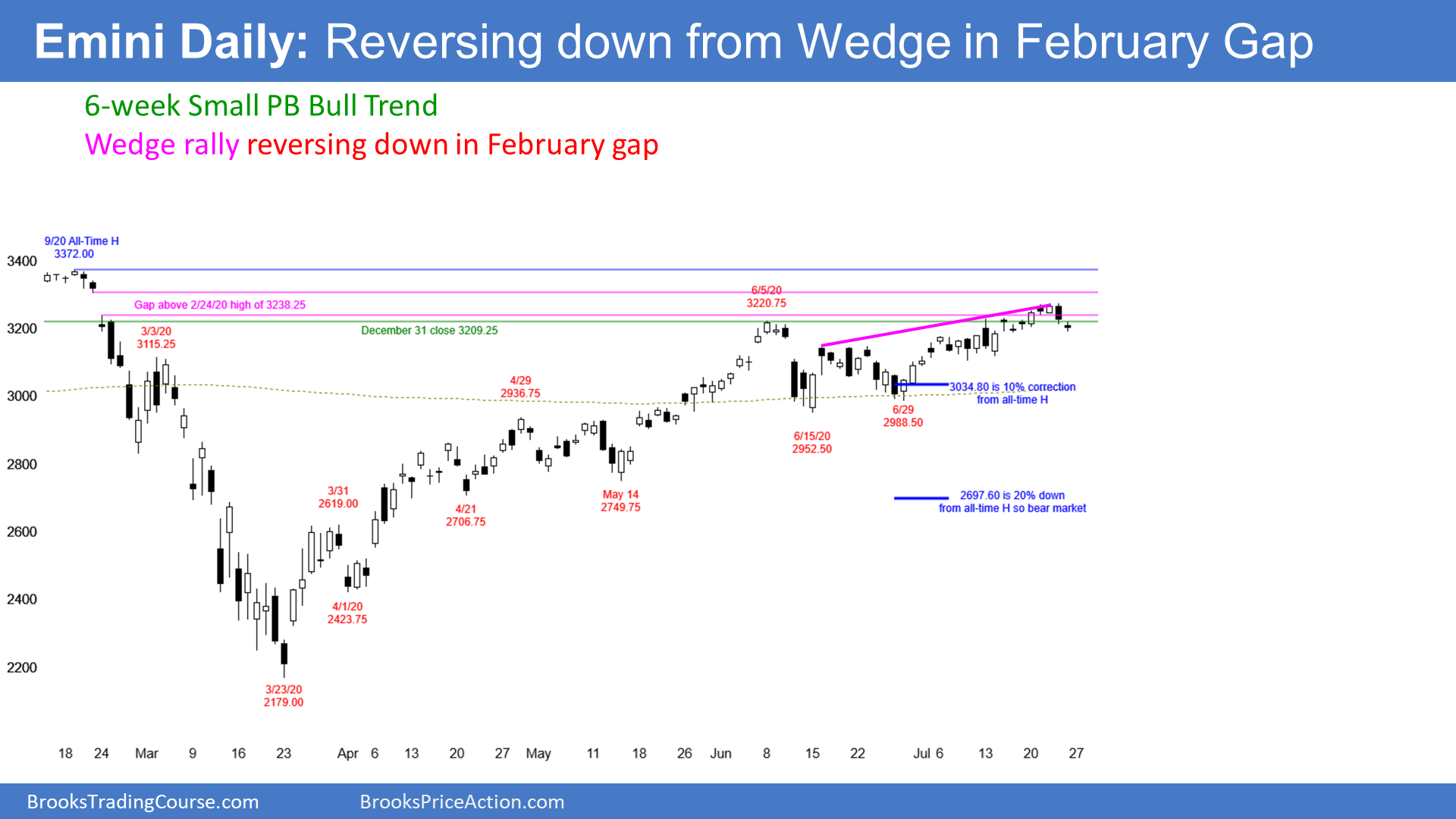

Weekly S&P500 Emini futures chart:

Reversing down from within February gap

The weekly S&P500 Emini futures chart formed a bear doji bar this week. The bears hope that the bulls will finally take profits now that the rally entered the February gap.

This week is a sell signal bar for next week. But because it only had a small bear body, it is not a high probably sell signal. This is especially true since the 4-month rally is a Small Pullback Bull Trend. That is a strong bull trend and it resists reversing. The bulls still have a 50% chance that the rally will make a new high before there is more than a 2 bar pullback.

The importance of the February gap

Ever since the gap down on February 24, I have said that the gap would be an important price. It was a big gap down and the start of the coronavirus crash.

For the past 2 months, the Emini was close to the gap. I, therefore, said that the Emini would probably have to enter the gap before there would be a pullback that lasts more than a few days. The Emini this week entered the gap. That will catch the interest of bears who were waiting for the Emini to get there.

We do not yet know that there will be enough selling to create a reversal. But we should find out within a week or two.

A big gap at the start of a trend is a strong magnet

Because it was a big down, we knew traders were very eager to sell. All of the bulls who bought in February were instantly holding losing positions. Many held trough the crash and the V bottom reversal up.

Since the gap was so unusually big and it led to a crash, traders see it as very important. Once the Emini began to get near it in June, many traders decided not to sell until after the Emini entered the gap. That relative lack of sellers meant the market had to go higher to find sellers. How much higher? Well, into the gap. Many traders are interested in selling there.

Who is going to sell in the gap? Maybe everyone!

The Emini finally entered the gap this week. Now we will find out what the bulls are thinking. Will the February bulls thank the heavens for allowing them to get out around breakeven? The 4-month rally has made them whole again. Will they be so exhausted by the collapse and sharp rally that they will choose to exit and wait to see what happens?

Traders know that there were a lot of sellers at this price in February. Markets have memory. Will many bears think this is still priced to sell?

Finally, the smart bulls who bought at the March low need to take profits at some point. Will they conclude that a 40% gain in 4 months is so exceptional that it is unlikely to grow much more in the coming months? Many will not want to give back their windfall profits. Those bulls will sell out of their hugely profitable longs.

Will there be enough these 3 types of sellers to reverse the 4-month bull trend? We might find out over the next few weeks.

How big will a pullback be?

If the Emini repeatedly dips back below the February 24 high (the bottom of the gap), or reverses down strongly, traders will look for a pullback. The 1st reversal down in a strong bull trend is typically a pullback and not the start of a bear trend. When there is a pullback in a bull trend, a good rule of thumb is to expect it to retrace about half of the rally and about last half as long.

A 50% pullback is around 2700. Half of a 4-month rally is 2 months. Consequently, you can estimate what to expect if the Emini is going to reverse soon.

Using my simple guide, the initial estimate for a possible end of a selloff would be a month or two down to 2700. It could last 3 weeks or 3 months, and the bottom might be at 2800 or 2600. No one knows, but this is a good starting point when looking for a pullback.

Another generalization is that a pullback from a buy climax retraces approximately half of the rally about half of the time. In 25% of cases, the pullback is more like 1/3rd and in the other 25% of cases, it’s around 2/3rds. That is why I said 2600 – 2800.

Over the past month, I have given many other reasons to expect a pullback to around 2700. I will not repeat them today.

Daily S&P500 Emini futures chart:

Wedge rally reversing down in February gap

The daily S&P500 Emini futures chart had 3 consecutive closes this week above the February 24 high. That means that they were in the gap.

However, Thursday reversed down from within the gap. Since the 6-week rally has had 3 pushes up, it is a wedge and a buy climax. If the bears can get follow-through selling next week, they will probably get a reversal down to the middle of the 3-year trading range.

But since the rally is still in a Small Pullback Bull Trend, the bulls still have a 50% chance of a new all-time high before there is more than a few days down.

I have been saying that once the Emini entered the gap, there would be a 50% chance of a new high before there is a pullback lasting more than a few days. That is still true.

You often hear that all gaps close. However, the bulls have not yet closed the gap. Remember, for 2 months I have carefully said that the Emini should go above the February 24 high. That means I was expecting it to enter the gap. I never said it should go above the February 21 low, which would close the gap.

My thought was that traders thinking of selling in the gap did not care if it closed the gap. Besides, the top of the gap is very near the all-time high, which is a much more important price.

That is why I have only mentioned the bottom of the gap and the all-time high as major targets. If the Emini were to close the gap, it would probably quickly continue up to a new high, and that is a more important achievement.

Do all gaps close?

There is an adage on Wall St. that says “all gaps close.” It is important to understand that traders who have traded for decades (I have traded for 35 years) never use superlatives like always, never, all, or none.

Well, except one. I sometimes say, “Never say never or always.” That is because black swans exist and unimaginable things happen. They happen rarely, but they happen. One of the tenets of quantum physics is that there is a real possibility for everything imaginable, even if it is so small that it is realistically impossible.

Back to gaps. Every bear gap in history has closed, and the February gap will close as well. How can I say that? The world’s population and the world’s wealth have increased forever. That means the value of the market has continued up, even after an 89% loss in the Great Depression. There always has been a new high. Therefore every gap down gets closed.

But what about a gap up? The market has been in a bull trend forever. That means there have been many higher lows. If the market gapped up early in the rally from a low, that gap does not have to close.

How often do gaps close?

If you look back at daily and weekly charts over the past 100 years, you will see that every gap down eventually closed (the February gap will close at some point). And you would also find many gaps up that never closed and they never will close. If you just look at recent gaps up and down, about 70% will close within 3 years.

Gaps on the Emini chart have become less important in recent years because so many institutions use 24-hour charts. They don’t see the gaps on the day session chart.

Also, there are far fewer gaps on continuation charts because the market is open almost without stop from Sunday night through Friday night. When there are gaps, they are more likely to come on Mondays after the market has been closed for a couple of days. News can happen during the closure and it can result in a gap up or down. That means that Monday gaps can have more significance. For example, February 24 was a Monday, and the gap down is present on both the daily and weekly charts.

How low can a pullback go?

It is important to note that the Emini dipped back below the February 24 high on Thursday. That is a sign of sellers in the gap. We do not know yet if the selling will be persistent and severe. We should find out within the next 2 weeks.

If it is, the 1st downside target is the bottom of the June trading range. A trading range is an area of agreement. Both the bulls and bears think the price is fair.

The Emini is now above what everyone thought was a fair price. If enough traders think it belongs back within that trading range, the Emini will probably test down to the bottom of that range, just below the 3000 big round number. At that point, traders will conclude that the July rally was just an extension of the June/July range instead of a resumption of the bull trend.

Possible head and shoulder top within 2 months

If there is a selloff to 3000 and then a bounce, traders will begin to talk about the possibility of a lower high and then a 2nd leg down. The trading range at that point would contain a lower high major trend reversal sell signal. Also, it would be a head and shoulders top.

If that top were to develop, there would be a 40% chance of a break below the June low and then a measured move down. That would take the Emini down to around 2600.

That is just below the March 31 high, which was a breakout point. Pullbacks often test breakout points. This is especially true when the market is in a trading range. The Emini has been sideways for almost 3 years.

If the Emini were to fall that far, that would probably be the end of the pullback. There is only a 30% chance that a reversal down would go below the March low during the initial selloff.

Why 30% and not 10%? Because markets are always more balanced than you might think. The probability for everything that is reasonably possible hovers between 40 and 60%. Betting on a test of the bottom of the 3-year range is not crazy. Therefore the probability has to be at least 30%.

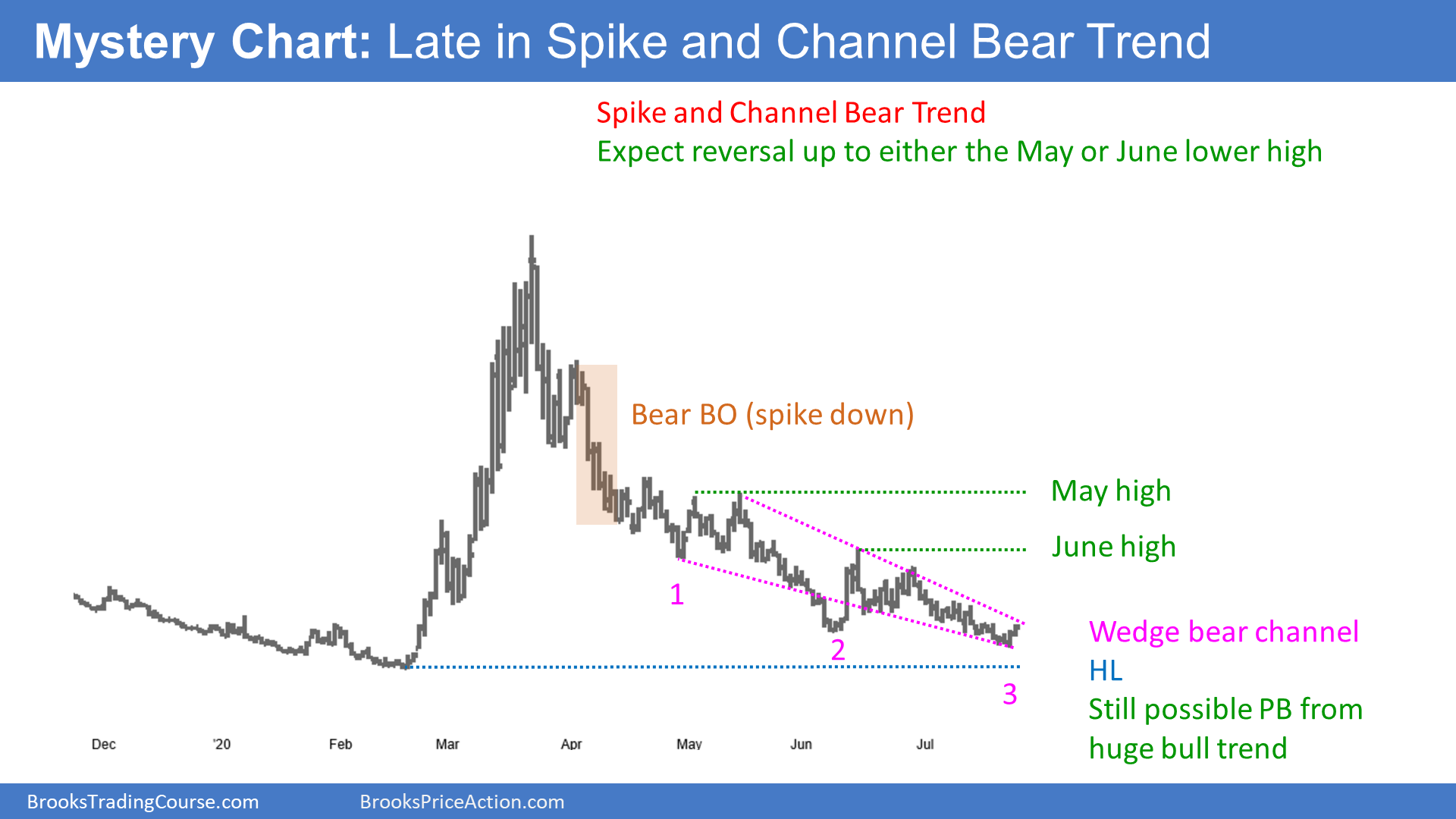

Mystery chart

The above chart had a huge bull trend that ended in March. It broke strongly to the downside in early April. After a pullback that formed a double top bear flag, it sold off in a wedge bear channel. The 3rd leg down also has 3 small legs so the selloff is a nested wedge. This has a higher probability of a reversal up.

Bear channels usually have bull breakouts. Therefore, traders should expect a rally soon.

When a Spike and Channel Bear Trend reverses up, it usually tests either or both lower highs. Here, those are the May and June highs. It then typically evolves into a trading range.

It is important to note that the strong bear trend so far is holding above the February bottom of the bull trend. While it retraced almost the entire rally, it still could be just a deep pullback in a bull trend.

So what market is this? It is the Emini, but I plotted it upside down. If you flip it over, you would see that the rally to the March high on this chart is the selloff to the March low on the Emini chart.

Sometimes its easier to see what might be going on if you can look at the market from a different perspective.