Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Pre-Open Market Analysis

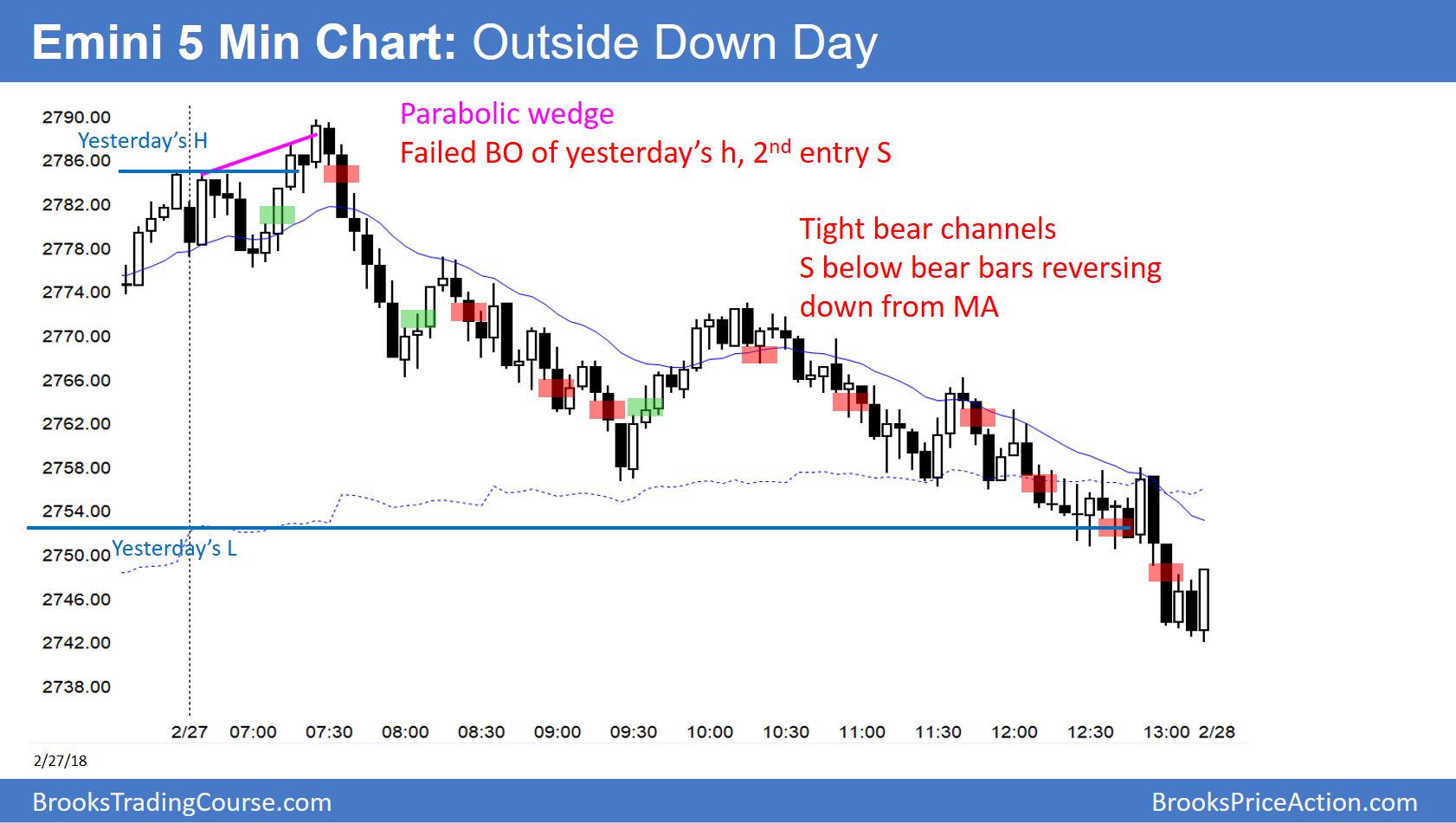

The daily chart is still in bull trend, or at least a bull leg in a trading range. The rally, though, has had 3 legs up in a tight bull channel. That makes it a parabolic wedge buy climax. In addition, the Emini sold off yesterday from a wedge lower high major trend reversal on the daily chart. Finally, the selloff closed the gap up on the daily and weekly charts. Consequently, the Emini might trade down for a couple small legs over the next week.

The bears want a gap down today. That would create a 2-day island top on the daily chart. Hence, it would be a sign of bear strength.

The rally has been strong enough so that the bears will probably need at least a micro double top over the next few days before they can create a strong swing down. Even if they succeed, the odds are that the selloff would form a higher low on the daily chart. In addition, there are probably buyers below the February low.

Yesterday provided useful information. Because the Emini reversed down strongly from resistance, the odds of the rally going straight up to a new high are less. The odds now favor a continued trading range over the next month.

Last Day Of The Month

Today is the last day of the month. The open of the month is too far above for the bulls to get there today. January’s low is too far below. The odds are that the month will close today with a small bear body and a big tail below.

Overnight Emini Globex Trading

The Emini is up 4 points in the Globex market. Because yesterday was a sell climax day, there is a 75% chance of at least 2 hours of sideways to up trading that begins by the end of the 2nd hour.

Furthermore, the 3-week rally has been strong. As strong as the bear trend was yesterday, it is still more likely a pullback in the 3-week rally than the start of a reversal down. Therefore, the odds favor the start of another leg up beginning this week.

Yet, if today is another strong bear trend day, traders will conclude that there will be a couple legs down over the next couple of weeks.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.