Pre-Open Market Analysis

Last week was an outside down week on the weekly chart. It turned down from the 2800 Big Round Number and the October-November-December triple top. The odds favor at least a 2 – 3 week pullback.

It was the 1st pullback in 10 weeks on the weekly chart. The bulls are finally getting an opportunity to buy below the low of the prior bar. Many will take that opportunity. That will reduce the chance of a big selloff lasting more than a few weeks.

Possible ioi Breakout Mode Pattern

An inside bar often follows an outside bar. There is therefore an increased chance that this week will open within last week’s range and not break below last week’s low. That is especially true after Friday’s strong, late rally. Friday is a good by signal bar for today.

If this week is an inside bar on the weekly chart, there would be a ioi (inside-outside-inside) pattern. That is a breakout mode setup.

But, the 2-month buy climax reduces the chance of a big move up from here without more of a pullback. The strong momentum up on the weekly chart minimizes the chance of a big sell. Consequently, the Emini might simply go a little sideways to down for a couple of weeks. Then, the bulls will try again to get above the triple top.

Overnight Emini Globex Trading

The Emini is up 7 points in the Globex session. It might therefore gap above Friday’s high. Friday’s late rally was strong enough to make traders believe that there will be at least some follow-through buying today or tomorrow.

Friday broke above the wedge bear channel on the 60 minute chart. That channel began on March 5 from just above 2800. When a wedge reverses, the rally typically tries to test the start of the channel. At that point, the chart usually enters a trading range and is again in Breakout Mode.

The wedge sell climax likely exhausted the bears. Also, that magnet is strong. Consequently, the Emini will probably try to work higher over the next few days.

Friday’s Setups

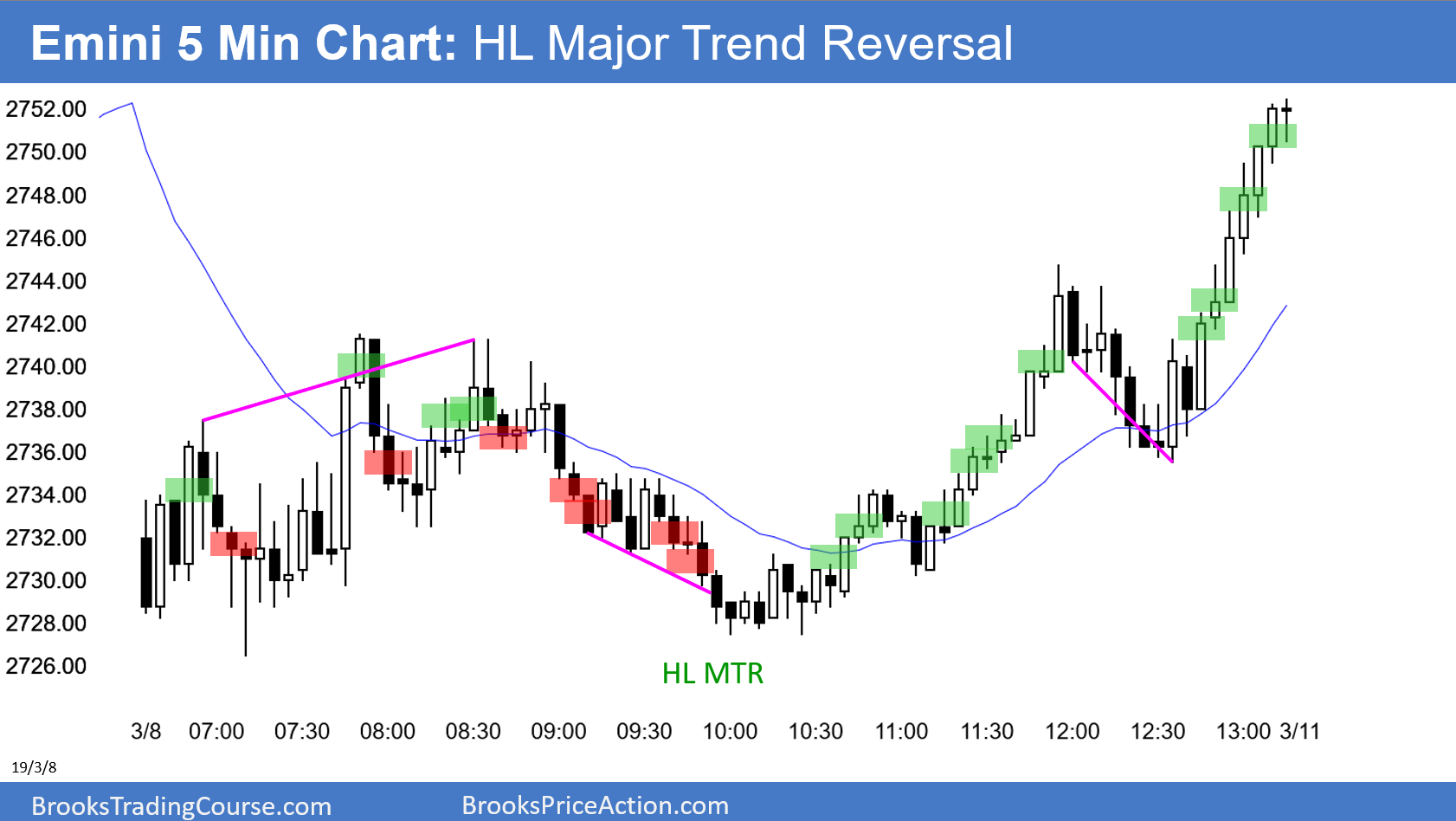

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.