I will update around 6:55 a.m.

Pre-Open Market Analysis

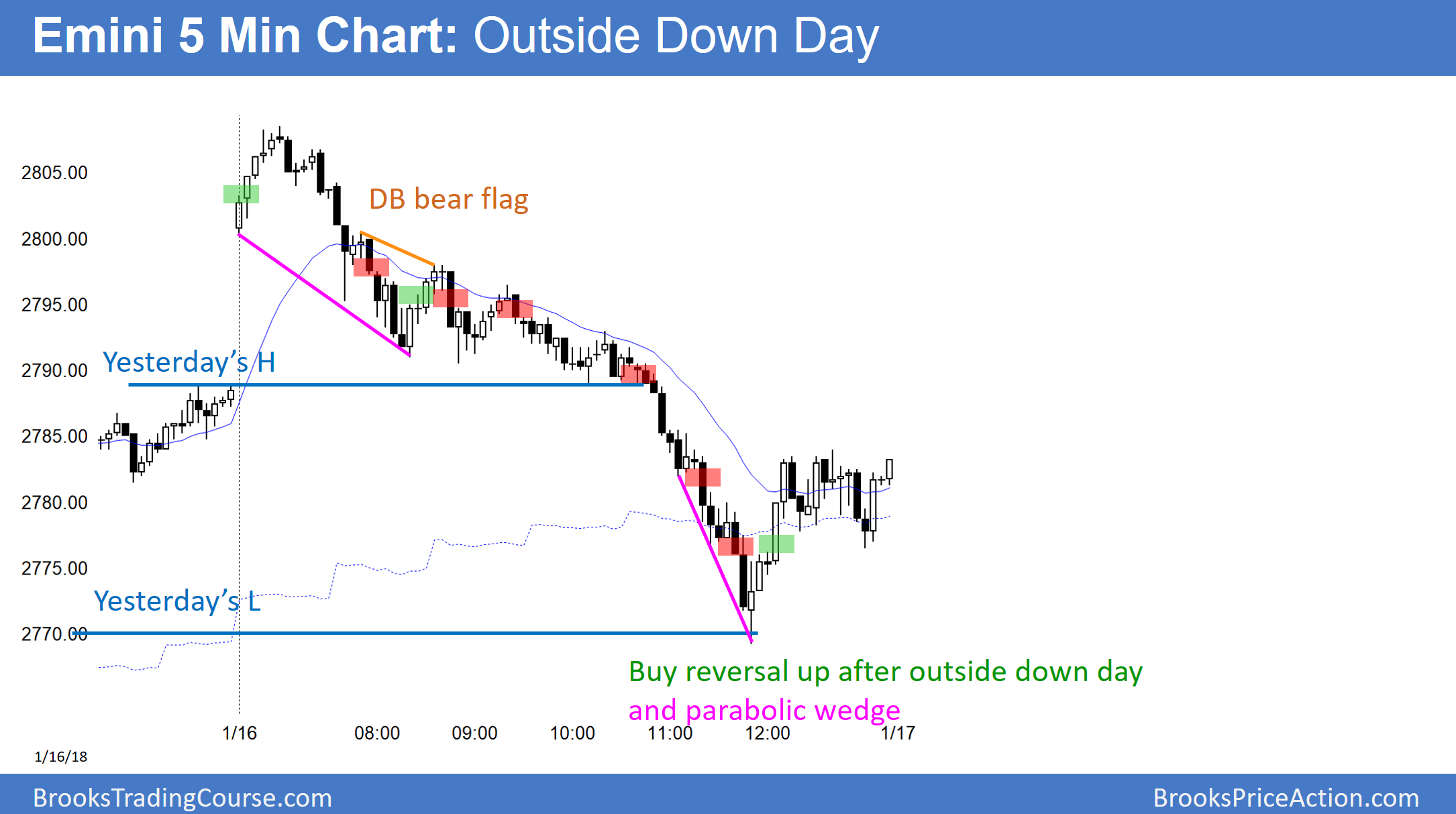

Yesterday, the Emini reversed down from a breakout above 2800 and became an outside down day. This was the 1st bear day in 2 weeks. The odds are that the past 2 weeks on the weekly chart will be an exhaustive buy climax. This means that there will be a reversal to test the bottom of the 2 bars. That is also a test of the open of the year. In addition, it will probably be a 5% correction down to the 20-week exponential moving average.

The two bears bars on the weekly chart are strong enough so that there might be one more leg up before a pullback. In addition, the reversal will be minor. This means that the bulls will buy the selloff, even if it is surprisingly big or lasts 2 – 3 months.

Has the selloff begun? The bears need a couple big bear bars on the daily chart or 3 – 4 smaller bear bars. Without that, the odds continue to favor higher prices. Furthermore, after 10 bull days, the odds favor a trading range before Friday’s vote on a government shutdown.

Overnight Emini Globex Trading

The Emini is up 10 points in the Globex market. Look at any big bear bar on the daily chart over the past year. Most were followed by sideways to up prices over the next 1 – 3 days. Consequently, the odds are against a consecutive big bear trend day today. More likely, the Emini will spend a lot of time in the middle of yesterday’s big range. It probably will form an inside bar on the daily chart, and be mostly a trading range day.

However, whenever something is likely, traders always have to be ready for what is unlikely. The biggest trends up or down come from days that were likely to be trading range days.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.