Pre-Open market analysis

The Emini spend most of yesterday in a trading range around last week’s low. Yet, it rallied into the close and the day became a buy signal bar on the daily chart.

Last week was a doji bar on the weekly chart and therefore a weak buy and sell signal bar. Monday traded below last week’s low after it traded above its high. Hence, both the weekly buy and sell signals triggered. But, since the signal bar on the weekly chart is weak, the bears need a strong bear bar for their entry bar this week.

The daily chart is still in its month-long trading range. Hence, the bears need to do more to convince traders that a bear breakout will succeed. Yesterday’s late rally made yesterday a buy signal bar on the daily chart. Despite that, the bears can still get their needed follow-through selling today.

Overnight Emini Globex trading

The Emini is down 10 points in the Globex market, and it will therefore open around last week’s low. The bears want this week to close below last week’s low. That would therefore create an outside down bar on the weekly chart. Since that is a sign of strong bears, traders would then begin to think that a correction might be starting on the daily chart. If so, day traders will start looking for more bear swing trades. This is because an early trend often has big moves.

Because the Emini’s higher time frames are in buy climaxes, there is an increased risk of a correction on the daily chart. The big swings of the past 2 days increase the chances for the correction. They also are very good for day traders who prefer to swing trade. The odds are that today will again have at least one swing. Since tomorrow is Friday and its close determines the appearance of the weekly chart, today might again oscillate around last week’s low.

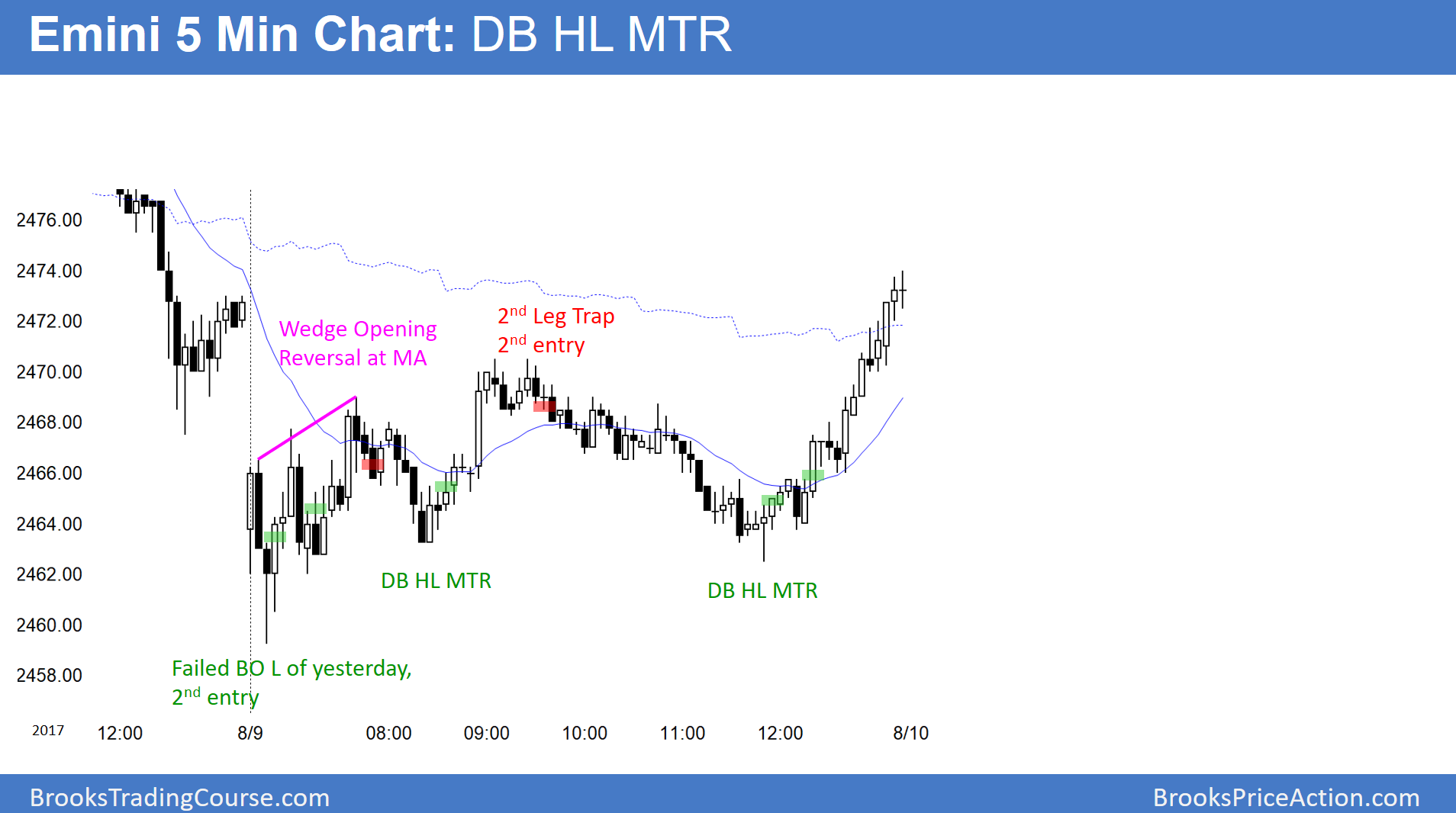

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars