Pre-Open Market Analysis

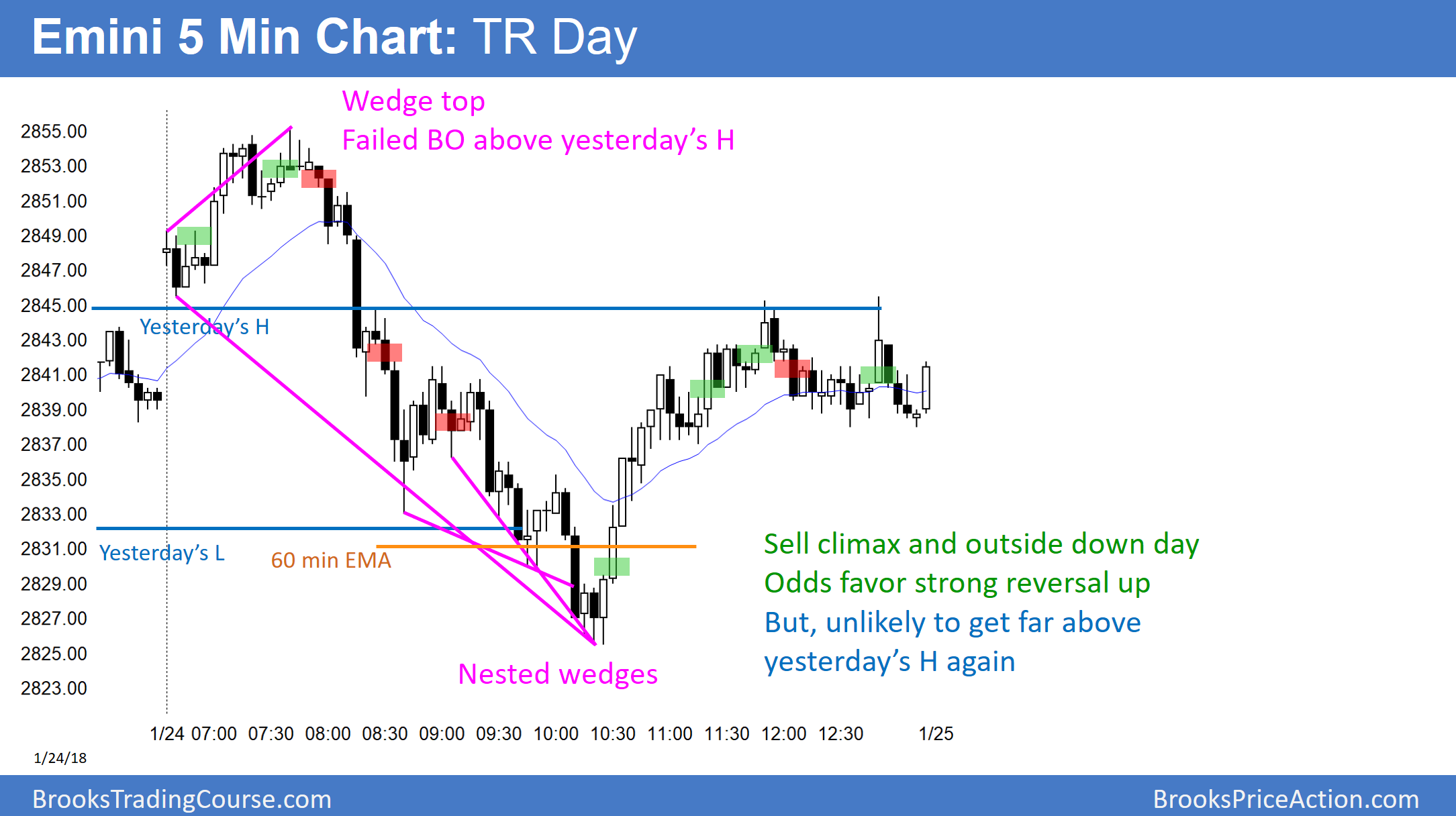

Yesterday was an outside down day, but it closed in the middle and therefore was mostly neutral. However, the buy climax on the daily chart is extreme. Yesterday is a sign that a trading range might begin soon.

There are 2 days left to the week, and the week’s range is not big. This means that the week could still close near its open. That would put a tail on top of the bar on the weekly chart. Since last week had a tail below, there is an increased chance of another doji bar this week.

Overnight Emini Globex Trading

The Emini is up 8 points in the Globex session. There is a measured move target at 2860 based on a breakout above a wedge top on the 60 minute chart. This is therefore resistance and a magnet above.

Today has an increased chance of being an inside day. If it breaks above yesterday’s high, it would probably stall. This is because a big reversal usually results in a trading range and not a strong bull trend. In addition, the breakout above yesterday’s high would create a 3 day expanding triangle top because yesterday was an outside day.

Yesterday’s reversal up was strong enough to reduce the odds of a big bear trend today. Since today will open near yesterday’s high, the best the bears can probably get today is a test of yesterday’s low. Even that is unlikely after yesterday’s strong reversal up.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.