Emini and Forex Trading Update: Tuesday, November 26, 2019

Pre-Open market analysis

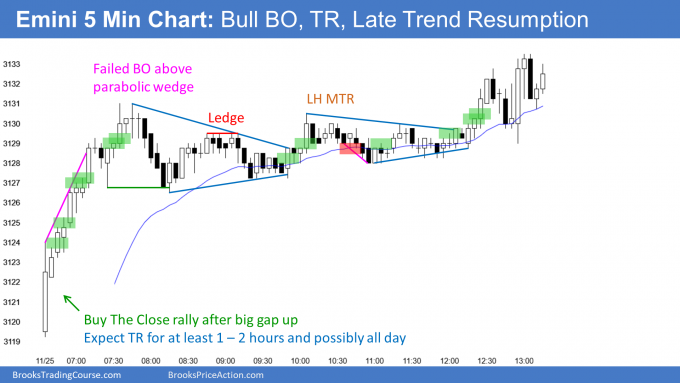

After a big gap up and strong bull trend on the open yesterday, the Emini entered a trading range. It broke above last week’s high and to a new all-time high.

But last week had a bear body on the weekly chart and there is a buy climax on the weekly chart. This rally will probably only last a week or two before the Emini pulls back 50 – 100 points.

However, the bull trend is strong. Until there is a clear top or a big reversal down, the odds continue to favor higher prices. Since this is a holiday week, the Emini will probably spend a lot of time in trading ranges.

Overnight Emini Globex trading

After a big rally early in the Globex session, the Emini reversed down and is unchanged. With last week being a bear doji bar on the weekly chart in a buy climax, its close will probably be a magnet this week. Also, the holiday week will likely result in a lot of trading range price action. This is true even if there is a strong trend for an hour or two like yesterday.

This has been a great year for the bulls. Many will be quick to take some profits before the end of the year. Also, the buy climaxes on the daily and weekly charts increase the chance of profit-taking soon. Consequently, there is an increased chance of a couple of big bear days within the next few weeks.

But the tops of the monthly and daily bull channels are not far above. The 8-week rally could end with a blow-off top. That increases the chance of a surprisingly big bull day as well.

However, despite the strong bull trend on the daily chart, most days have spent most of their time within trading ranges. Day traders will trade the breakouts up or down with they come, but they expect them to evolve into trading range within an hour or so.

Yesterday’s setups