Investing.com’s stocks of the week

Emini and Forex Trading Update: Monday November 25, 2019

Friday triggered a High 1 bull flag buy signal on the daily chart. But Thursday was a bear bar and the 3rd consecutive bear bar. This was a low probability buy setup and there probably will be more sellers than buyers above Thursday’s high and above the all-time high.

Furthermore, the Emini broke below the 7 week bull channel last week. Traders should expect at least a small 2nd leg down.

Finally, last week was the 1st bear bar in 7 weeks on the weekly chart. While last week is not a strong sell signal bar, it probably will lead to at least one more week of sideways to down trading. If there is a new high, it will probably be brief and lead to a 2 week pullback shortly thereafter.

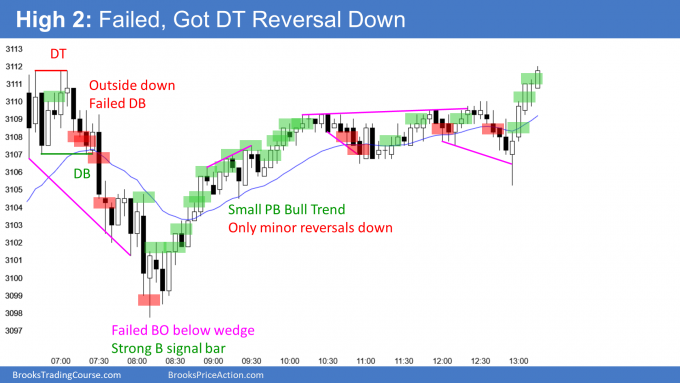

Most of the days for several weeks have had at least one reversal. Day traders will expect that again today. Because of the buy climaxes on the daily and weekly charts, there is a slightly increased chance of a strong bear trend day this week. However, since it is a holiday week, there is a greater chance of lots of tight trading range price action.

Overnight Emini Globex trading

The Emini is up 7 points in the Globex session. It will therefore probably gap above Friday’s high. Traders are deciding if there will be a 2nd leg down after the bears broke below the bull trend line last week. Since the 7 week rally has been so strong, there is a 50% chance of a 1 – 2 week new high before a 100 point pullback.

Today is the 1st day of a holiday week. Also, the past 6 days had small ranges and were trading range days. Day traders expect another trading range day today.

But whenever something is especially likely, there is always an increased chance of the opposite. Consequently, if a Small Pullback Trend up or down begins to form, day traders will swing trade.

Friday’s setups