Emini Buy Climax Pausing Before Trump’s Tax-Cut Vote

I will update around 6:55 a.m.

Pre-Open Market Analysis

Five of the past 6 days gapped down, but all reversed up. It is unusual for a bull trend to gap down on 5 of 6 days. Therefore, the bull trend is weakening. Everyone is aware of how extreme the buy climaxes are on the daily, weekly, and monthly charts. Yet, bulls keep buying every selloff. They correctly assume that most reversals will fail and this is a profitable strategy. Even if they finally lose on one of their buys, they will have made so much money on all of their other buys to make the strategy profitable.

Yesterday triggered a sell signal on the weekly chart buy falling below last week’s low. However, yesterday was not a big bear trend day. Hence, it was a weak entry bar for the bears. The bears need consecutive big bear bars soon to make traders believe that they have taken control. Without that, the 4-week trading range will continue. In addition, the Emini will probably trade at least a little higher.

Yesterday was the 1st close below the 20-day EMA in 3 months. In addition, the bears could only get a small bear body on the daily chart. In addition, yesterday closed above last week’s low after triggering a weekly sell signal. Finally, the Emini is at the bottom of a 3-week trading range, and most breakout attempts fail. The odds therefore favor a bounce today or soon.

Overnight Emini Globex Trading

The Globex is up 8 points in the Globex session. The bulls want a strong reversal up from below the 3-week trading range and last week’s low. Yet, the trading range is tight. Consequently, both bulls and bears will be disappointed. Therefore, even if the bulls get a rally today, the follow=through will probably be bad.

Since the Emini has been in a tight range for 3 weeks and most days have had at least one leg up and down, today will probably also have at least one leg up and down. When that is the case, there is often a trading range for the 1st hour as the market decides on the direction of the 1st leg.

Buy Signal On Daily Chart

A big trend day up or down can come at any time. However, the context makes continued trading range trading more likely. Since yesterday closed above its open, it is a buy signal bar on the daily chart for a failed breakout below the 3-week range and 20-day EMA. But, it was a bear doji. This is a weak buy signal bar.

The Globex market is just above yesterday’s high on the day session chart. Consequently, today will probably trade above yesterday’s high. This will therefore trigger a buy signal on the daily chart. While this increases the odds of a bull trend today, the weak buy signal and the 3 week trading range make a big bull trend day less likely. In addition, the reversal up from support makes a bear trend day unlikely.

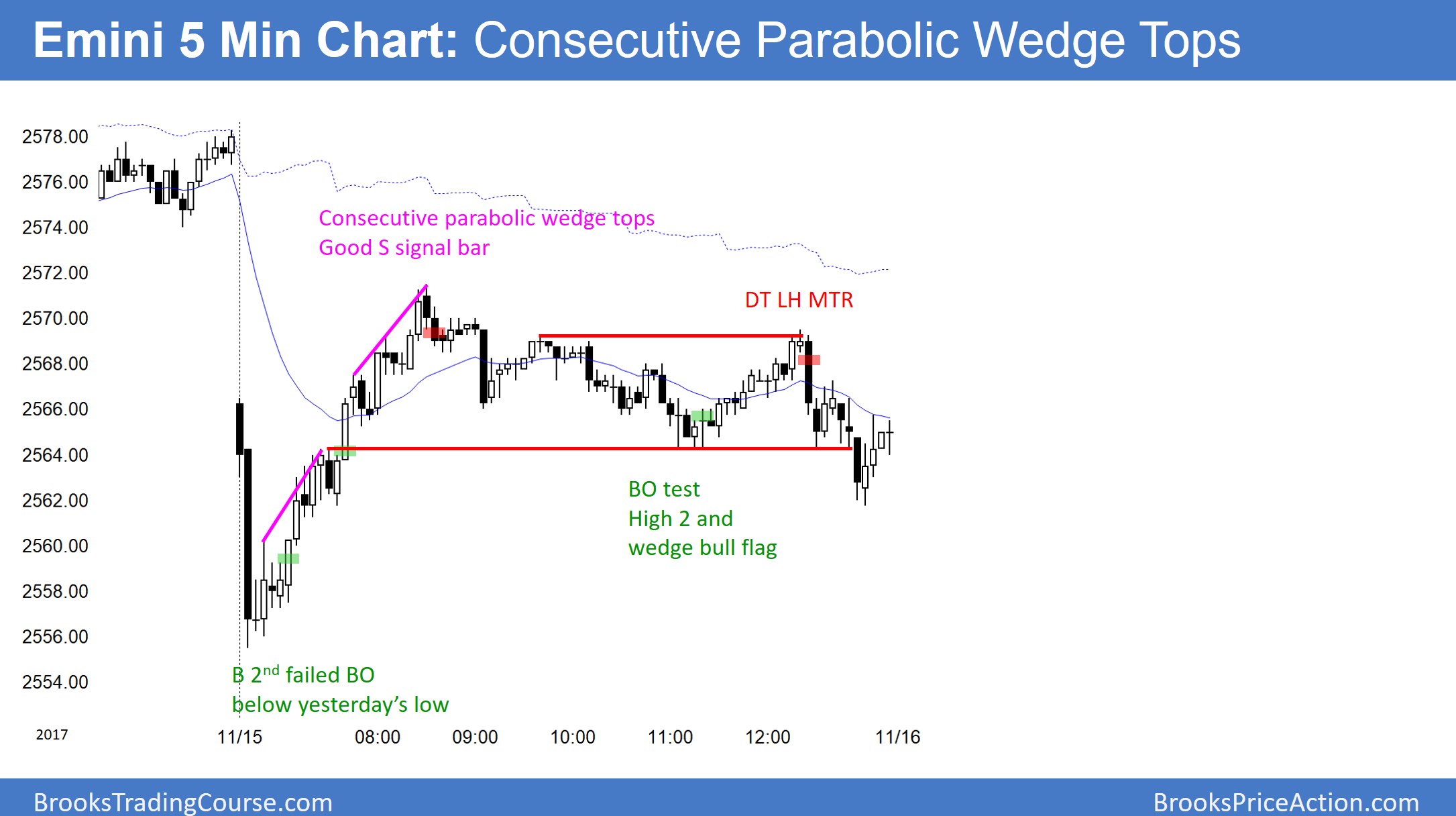

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.