Pre-Open Market Analysis

I have been saying throughout February that the rally was probably not a resumption of the 5 month bull trend. Instead, it looked more like a bull leg in a trading range that began at Christmas. That is why I have been saying that traders should expect a test of the bottom of the range. That is the January 31 low.

I also said that the Emini might bounce from there and rally back to around 3300. If it reversed down again from there, there would be a head and shoulders top on the daily chart with the January 22 high as the right shoulder. Traders would then wonder if the correction will test the 3000 top of the 2 year trading range. That would be about 10% down from the high.

Yesterday got to within a few ticks of my target of the January low and then reversed up strongly. The rally failed and the day closed just below the open. It was a doji bar on the daily chart. The selling has been extreme and the Emini is at support. The Emini might be sideways to up for 2 – 3 days. But after 3 strong days down, the 1st reversal up will probably be minor.

The Importance Of The Monthly Chart

There are 4 trading days left to the month. The Emini might still trade below the January low in February. It would then be an outside down month. Furthermore, if February closes near its low, it will form a micro double top with January on the monthly chart. That would make lower prices likely in March.Even if February does not go outside down, it will probably close below the midpoint of the month. That increases the chance of lower prices in March.Is this the start of a bear trend? It is too early to tell. But if the bears continue to get bear bars, traders will expect a 10% correction.I have been saying since Christmas that 2021 will be in a trading range between 2900 and 3500. Also, I said that the high of the year would probably be in the 1st quarter. Both are still likely.

Overnight Emini Globex Trading

The Emini is up 13 points in the Globex session. The bulls are hoping that yesterday’s 2 legs down will form a double bottom. Since that double bottom would be 40 points tall, a measured move up from a break above the neck line would test 3300.

However, the monthly chart is very important this week. There is now a micro double top on the monthly chart. The bears retraced a month-long rally in just a few days. They are therefore strong and traders expect the month to close near its low.

Consequently, traders should not look for a strong rally far above yesterday’s neck line today. More likely, February will close around its low and the January low. Therefore, the Emini will probably be sideways for the rest of the week. That means a trading range.

The intraday ranges over the past few days have been huge. Therefore, even if the Emini goes sideways, the legs up and down will be big enough for day traders to swing trade. The bulls will look to buy reversals up from selloffs and then take profits around prior highs. The bears will sell around prior highs and take profits around prior lows. If a leg up or down is particularly strong, trades will wait for a 2nd signal before entering on the reversal.

Yesterday’s Setups

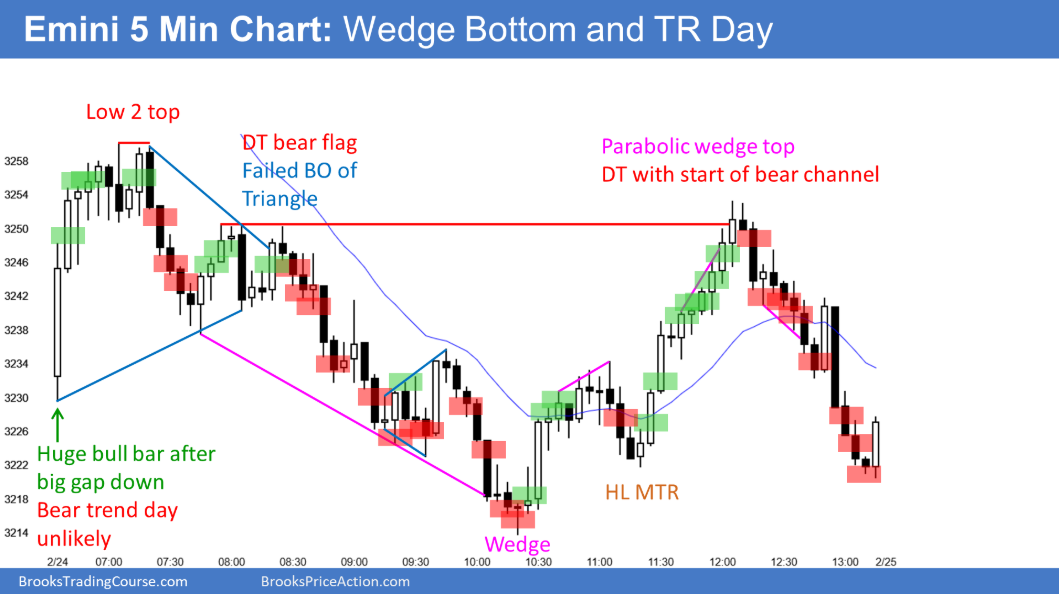

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.