Investing.com’s stocks of the week

Pre-Open market analysis

Yesterday reversed up from a test of Monday’s low. Because it had a bull body, it is a buy signal bar for today. It was also an outside up day. The bulls now have a micro double bottom, which is bullish.

However, the 4 day sell climax was surprisingly strong. Consequently, the bulls might need a week or more of stopping the selling before there will be a reversal up to a new high. Therefore, traders will look for reversals every few days until the bulls get either a very big bull bar (Surprise Bar) or 3 or more consecutive ordinary bull bars.

The bulls are hoping that yesterday will be similar to the December 26 reversal and lead to a Buy The Close rally on the daily chart. It will more likely be like the many reversals up in early 2018 and again in late 2018. They all became legs in a trading range.

The importance of this week’s open

The most important price for the rest of the week is 2885.00. That is the open of the week. If the week closes above open, there will be a bull reversal bar on the weekly chart. This week would then be a buy signal bar for next week. Traders will suspect that the correction is over.

But if this week has a bear body, it will be a weaker buy signal bar. There might be sellers above.

Since the selling has been exceptionally strong, even if the bulls get their buy signal bar, the 1st reversal up will probably be minor. The odds favor a trading range for at least a couple weeks.

Overnight Emini Globex trading

The Eminiis up 11 points in the Globex session. Today might, therefore, gap up. But small gaps typically close within the 1st 2 hours.

Also, while yesterday was an outside up day, it had a prominent tail on top. That makes it a weaker buy signal bar on the daily chart. Additionally, as I wrote above, a relentless bull trend like the one after Christmas is less likely than a trading range after a sell climax like we had over the past week.

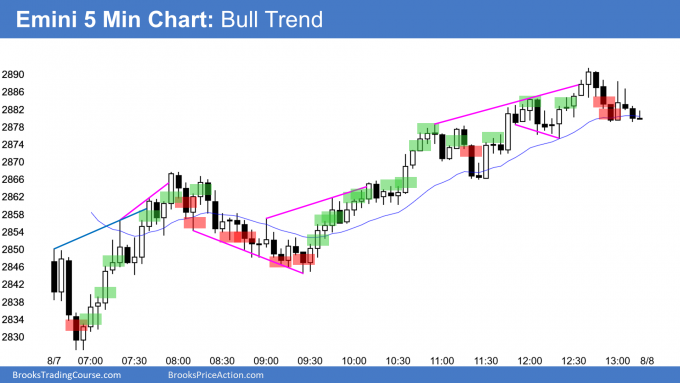

Finally, yesterday’s rally on the 5 minute chart was unsustainable and therefore climactic. It will begin to attract profit-takers. Traders should understand that there is only a 25% chance of another relentless bull trend again today. They should expect at least a couple hours of sideways to down trading that starts by the end of the 2nd hour today.

Yesterday’s setups