Pre-Open market analysis

The Emini rallied for a couple of days after last week’s big bear breakout. However, the rally stalled yesterday and the bears got a bear body on the daily chart. Last week’s bear breakout was strong enough to make a test back down to last week’s low likely. Since the reversal up erased more than 50% of the selloff, the bulls might get one more new all-time high before the bears get their 2nd leg down.

Since the weekly chart is so extremely climactic, the odds are against much higher prices. Instead, the Emini will probably test to below the weekly moving average before going much higher. What traders do not know yet is whether the reversal down has begun. At the moment, it is more likely than not that it has. However, it could take a couple of months to get its 2nd leg down. That is what happened after the September 2016 strong bear breakout.

If instead the Emini rallies to a new high, there will probably be sellers up there. The odds are that the new high will fail and the bears will again create another reversal attempt.

The Emini has been mostly sideways for 2 days. This is because it is deciding between a lower high and one more new high. The odds slightly favor a lower high. However, the breakout from this current lower high can be up or down, and the probability is only slightly higher for the bears.

Overnight Emini Globex trading

The Emini is up 5 points in the Globex market. Since the August 9 2474.50 high was the top of last week’s selloff, it is a major lower high. Hence, it is a magnet. The Emini is close enough so that it probably cannot resist the magnetic pull of that resistance level. Consequently, it will probably test that high today or tomorrow.

The bears want a reversal down from that high. They would see that as a double top lower high major trend reversal on the 240 minute chart. In addition, it would be a double top with yesterday’s high. The bulls want a strong break above the high. That would make a test of the all-time high likely.

Because the past 2 days have been in a trading range, the odds favor either a continuation of the range, or a failed breakout of the range. The rally on the daily over the past 2 days was strong enough so that the bears will need at least a micro double top. This means that the chance of a big bear trend day is probably small today. In addition, because last week’s low will probably be tested within a week or two, the odds of a strong bull trend day are also less.

Yesterday’s setups

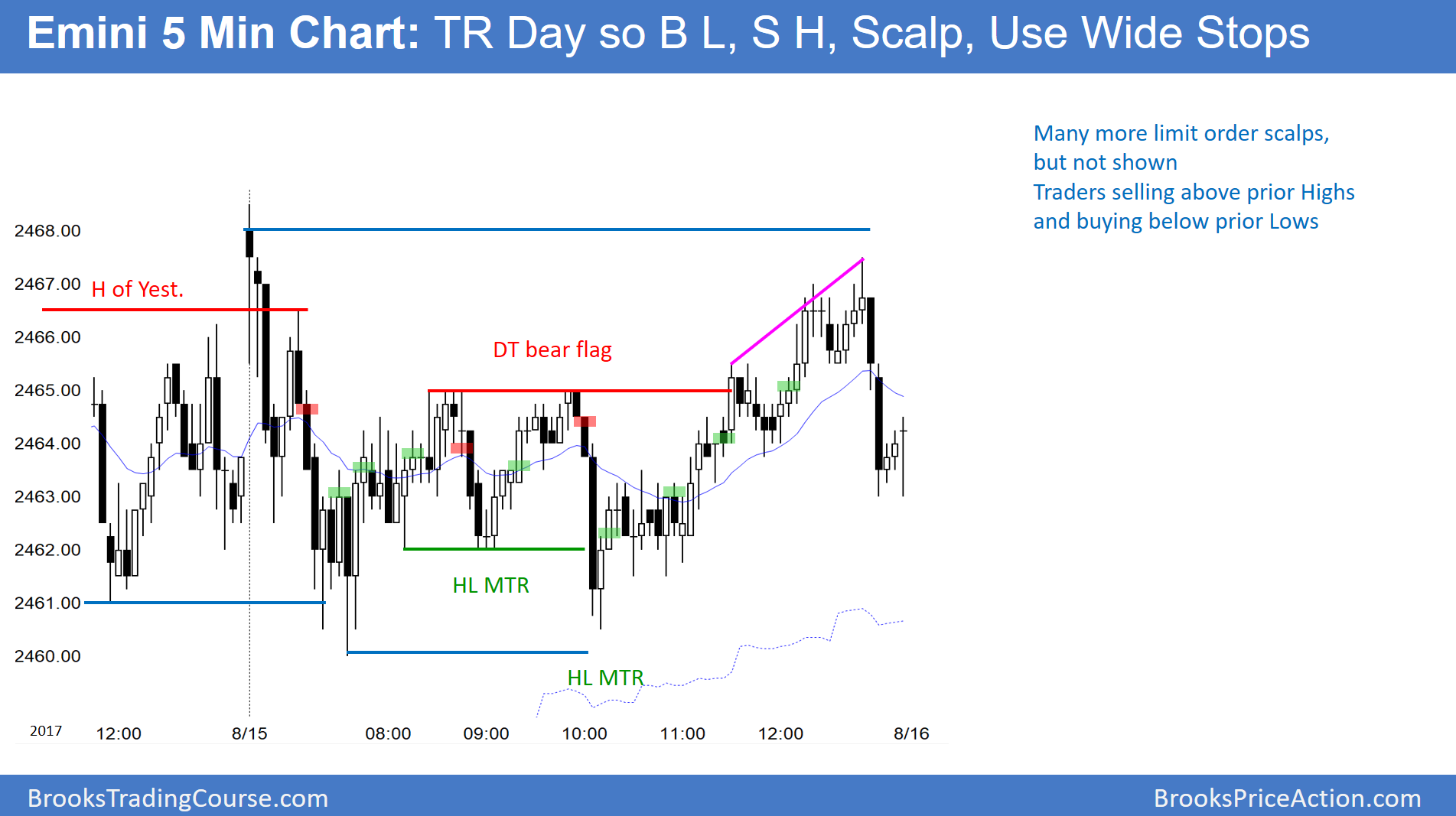

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.