Pre-Open market analysis

The Emini yesterday reversed much of Thursday’s selloff. The rally tested a 50% pullback and the daily moving average. In addition, last week was an outside down week and a sell entry bar. The signal bar was therefore the week before. Yesterday tested back above that low. Yet, the bulls need more. Unless they break strongly to a new all-time high, the bears still have a 50% chance of a swing down for the next 2 – 3 months.

The next week is important. If the bulls can get 3 – 5 consecutive bull bars, they will then have taken control again. Consequently, the odds would favor a new high. However, if the rally fails around Thursday’s high, the bears will look for a swing down.

Because the weekly chart is in a tight bull channel, the best the bears will probably get is a minor reversal on the weekly chart. However, that could still be a 150 points correction and a bear trend on the daily chart.

Overnight Emini Globex trading

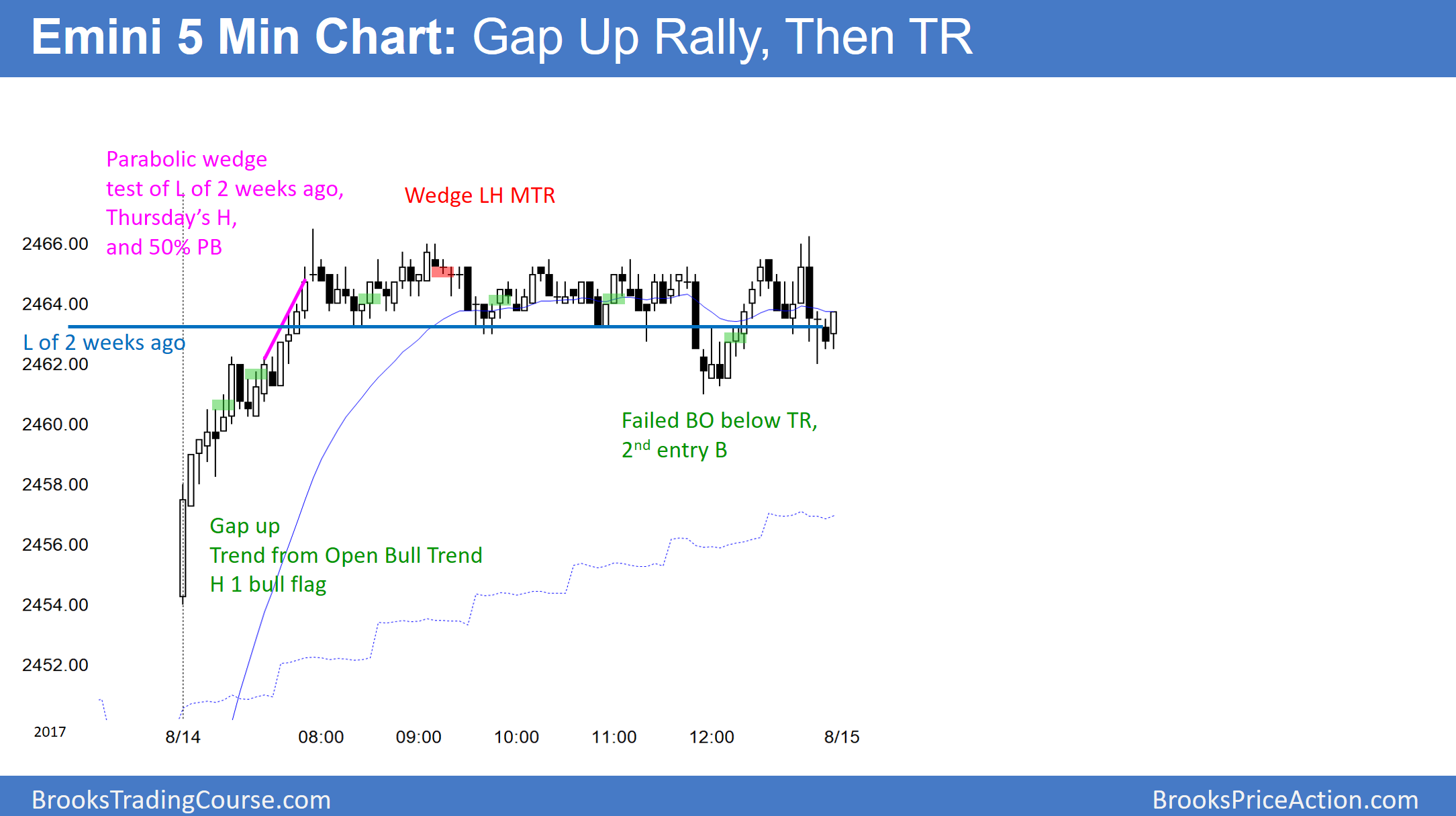

The Emini is up 5 points in the Globex market. It is now in the upper half of its 5 week trading range. Yet, the bulls need at least one more big bull trend day before traders will believe they have regained control. The odds still favor a 2nd leg down after last week’s strong bear breakout. Therefore, traders will look to sell this rally, betting on a lower high.

Today will probably open with a gap up. The bulls hope that this reversal up will be like the one from the May 17 failed bear breakout. The bulls need more or bigger bull trend bars before that becomes likely.

More likely, this reversal up will be similar to the one after the September 9, 2016 bear breakout. That rally stalled, and the bears got their 2nd leg down after 2 months in a trading range. The 2nd leg down from the current reversal up will probably be sooner, and it could begin at any time.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.