Pre-Open Market Analysis

The Emini rallied for a 2nd day yesterday. The high got to within 7 points of the 3300 Big Round Number. I talked about how that was an important price in mid-January and therefore a magnet. I also said that the 1st reversal up might last only 2 days.

Yesterday is a Low 1 sell signal bar for the bears who are hoping that a bear trend began last week. It is a sell setup, but many traders expect a better test of 3300 before the 2nd leg down begins.

The 2-day reversal up was big enough to create confusion. Since the chart is not clear, the Emini might have to go sideways for a week or more before the 2nd leg down begins. The odds are that this selloff will fall to below 3200 within a few weeks. A 5% correction down to 3177 is a reasonable minimum target.

I mentioned several times recently that January might close around its open when the month ends on Friday. That is still a reasonable possibility. There will probably be a big gap down today to around the open of the month.

Overnight Emini Globex Trading

The Emini is down 18 points in the Globex session. There will therefore be a big gap down.When there is a big gap down, the Emini is far below the EMA. Traders do not like to sell far below the average price. That reduces the likelihood of a big selloff on the open after a gap down. They prefer to sell near the average price.The result is that the Emini often goes sideways for an hour or two until it gets closer to the EMA. That trading range usually has both a buy and a sell setup.The chart is then in breakout mode. The bulls look for a double bottom or wedge bottom and then a swing up. However, the bears want a double top or wedge top near the EMA and then a swing down.If there is a trading range open, it is a sign of a balanced market. It reduces the chance of a relentless trend up or down. If there is a swing up or down after the initial trading range, it typically leads to a 2 – 4 hour swing. Then, traders look for either a trading range or an opposite swing.The Emini is back to around the open of the month. I have been saying that the open would be a magnet this week and that the Emini might end the month around the open. Today’s gap down makes that likely. Traders should expect it to be a magnet for today and tomorrow. That reduces the chance of a big move out of this area before tomorrow’s close.

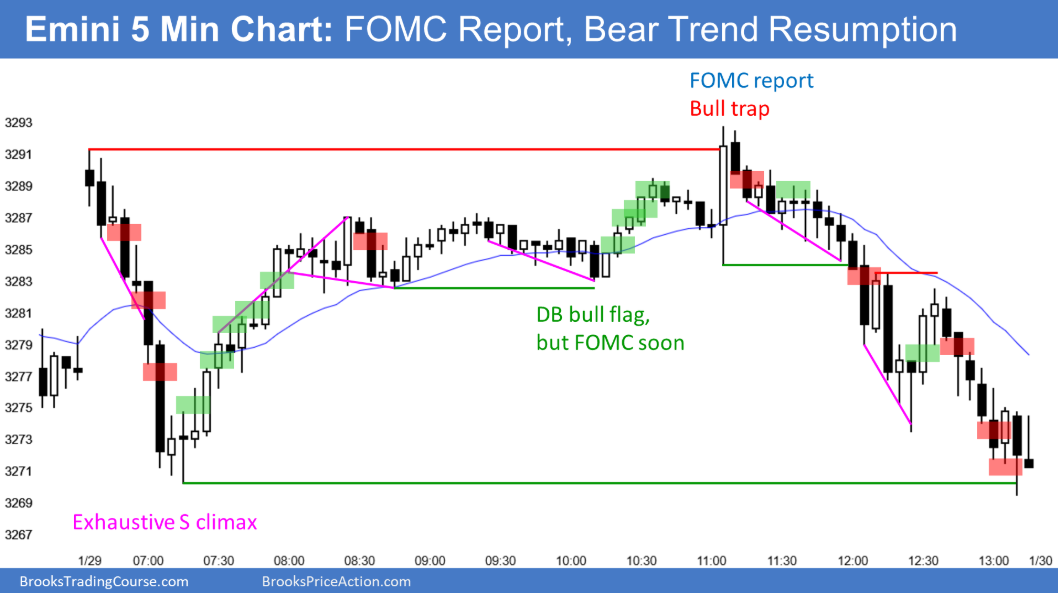

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.