Pre-Open market analysis

The Emini pulled back for 2 days after a strong bull breakout. Furthermore, yesterday reversed up from the 60 minute moving average. While the odds still favor higher prices, the Emini might go sideways for a few more days. Less likely, the pullback to the weekly moving average is underway.

Overnight Emini Globex trading

The Emini is up 2 points in the Globex market. After 8 consecutive bull days on the daily chart, the odds are that today will close below its open and create a bear day. Furthermore, yesterday was a Spike and Channel bull trend. Since bull channels usually have bear breaks and evolve into trading ranges, that is likely today. There was no top yesterday. Therefore, yesterday’s rally could continue for a couple of hours on the open. Yet, the odds are that today will have at least a couple hours of sideways to down trading. In addition, it will probably begin by the end of the 2nd hour.

However, the 60 minute chart went sideways for 9 hours at that high on Monday. In addition, yesterday’s rally put the market back into that tight trading range. Since the market went sideways there last week, it will probably go sideways there again today.

The bulls want the rally to continue to a new all-time high. While yesterday is a buy signal bar on the daily chart, it was big. When a buy signal bar is big, the stop is far below. This makes traders hesitant to buy above the signal bar high. therefore increases the chances that there will be many sellers above yesterday’s high. Consequently, this is another force in favor a trading range trading today.

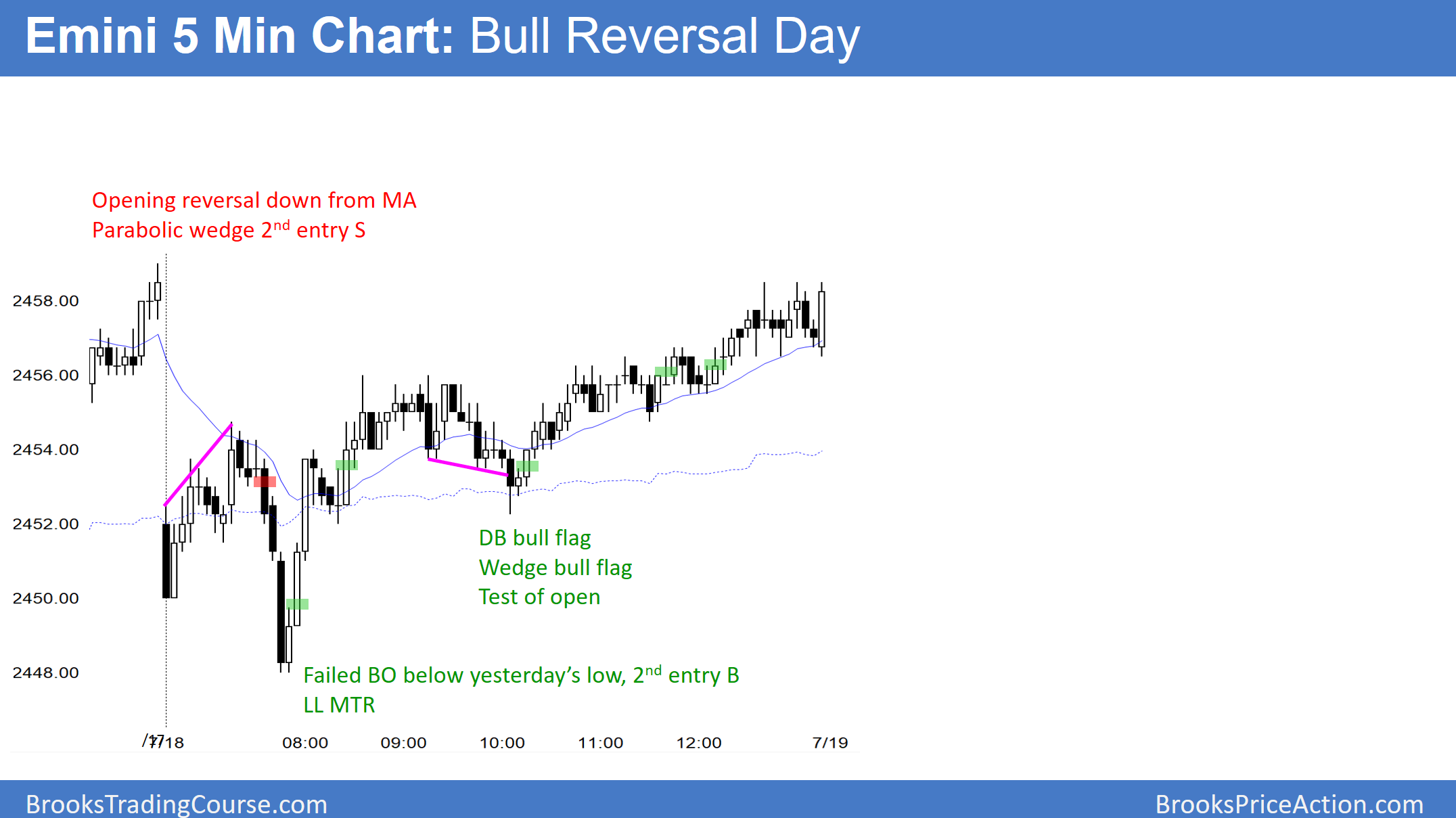

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.