Emini Breakout Before Senate Tax Vote

I will update around 6:55 a.m.

Pre-Open Market Analysis

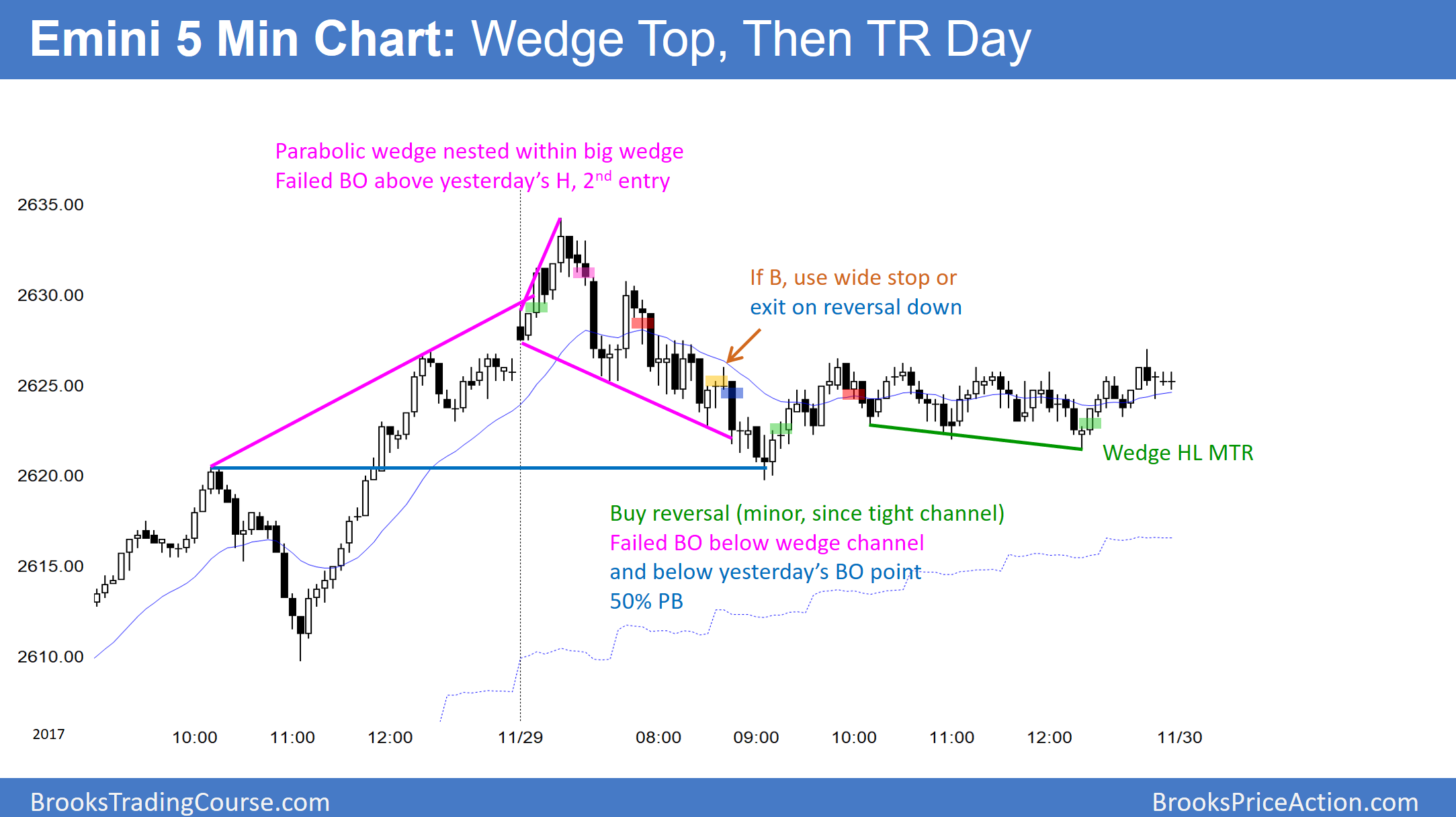

Yesterday was a trading range day after Tuesday’s strong bull breakout. The bulls hope that it is just a pause in a new leg up. However, because it was not a strong follow-through day, there is only a 50% chance of much follow-through over the next week.

The bears stopped the momentum of the bulls by creating a small bear bar yesterday. They therefore see yesterday as a sell signal bar for the failed breakout above a wedge top on the daily chart. Yet, Tuesday’s rally was so strong that the odds favor buyers below yesterday’s low. There is only a 40% chance of a reversal down and a failed breakout.

Since yesterday was a sell signal bar, today will probably trade below yesterday’s low. The market usually tests important support or resistance when it is close, and then decides on the breakout or the reversal. However, Tuesday was so climactic that the market might need to go sideways for several days before deciding whether to resume up or reverse down.

Last Day Of The Month

Since today is the last day of the month, it affects the appearance of the monthly chart. At the moment, this month is a bull trend bar closing near its high. If today is sideways or up, that will be how the monthly bar will look once it closes.

However, if the bears get a 20 point selloff today, the monthly chart will have a conspicuous tail on the top of this month’s bar. That would indicate some loss of momentum. If today was a huge bear day and closed below the open of the month, the month would be a bear reversal bar. That would require more than a 40 point selloff, which is extremely unlikely.

Overnight Emini Globex Trading

The Emini is up 8 points in the Globex market. Tuesday’s rally was so strong that the odds favored follow-through buying at some point over the next week. The bulls are trying to begin it today. Since yesterday was a tight trading range, there is an increased chance of more trading range trading today.

Tuesday’s breakout was so strong that it might be exhaustive. Consequently, there is an increased chance of a double top with Tuesday’s high. That would create a micro double top on the daily chart. Yet, the odds would favor simple more sideways bars instead of a reversal down on the daily chart. Therefore, the downside risk over the next few days is small. If the bears get a strong bear day, it will probably have bad follow-through selling. At least slightly higher prices are more likely than a reversal down.

Because today will test Tuesday’s buy climax high, traders will be ready for either a strong rally far above, or a reversal down. However, Tuesday was so extreme that today will probably be another rest day. This means that a trading range is most likely.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.